- United States

- /

- Medical Equipment

- /

- NasdaqGS:IART

Integra LifeSciences (IART): Deep Valuation Discount Tests Profitability Timeline, Spotlights Risk-Reward Divide

Reviewed by Simply Wall St

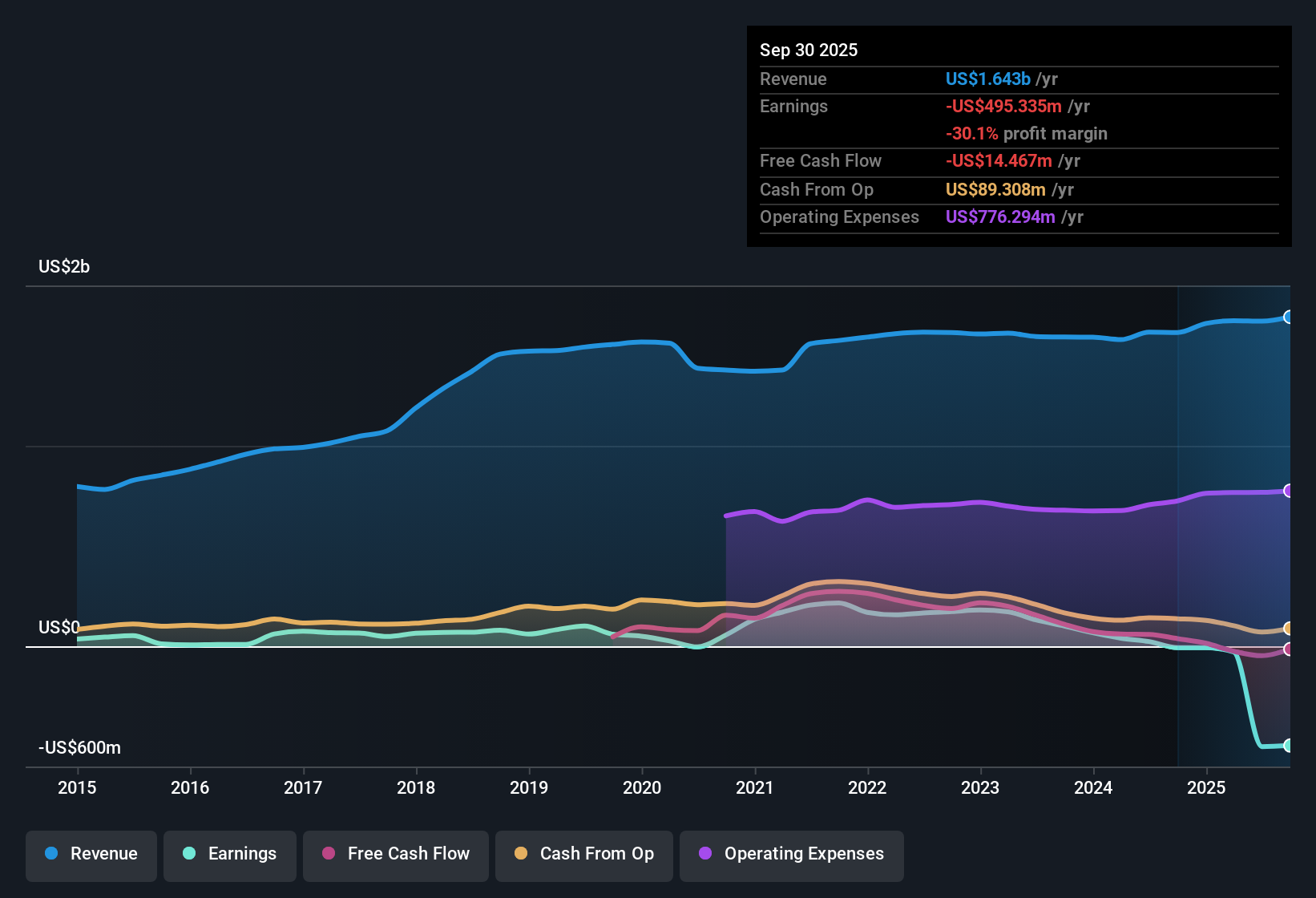

Integra LifeSciences Holdings (IART) is currently unprofitable, with losses having widened over the past five years at a rate of 51.4% per year. Despite negative earnings and stagnant net profit margins in the most recent year, the company is projected to return to profitability within the next three years. This forecast is supported by a substantial expected earnings growth rate of 166.84% per year. In this context, investors are paying attention to IART’s discounted valuation relative to both its peers and the industry, as well as the company’s modest 3.4% annual revenue growth forecast.

See our full analysis for Integra LifeSciences Holdings.The next section compares these headline numbers with the dominant narratives in the market, exploring both the consensus and where the new results might provoke a rethink.

See what the community is saying about Integra LifeSciences Holdings

Margin Recovery Hinges on Cost Control

- Gross margin compressed by 450 basis points and adjusted EBITDA margin dropped by 290 basis points, reflecting persistent operational and shiphold costs that continue to pressure profitability.

- Analysts' consensus view spotlights management’s efforts to repair margins, citing supply chain improvements, progress on the Compliance Master Plan, and targeted annualized savings of $25 to $30 million as critical to future operational efficiency.

- Analysts expect profit margins to rise from -30.9% today to 4.9% within three years; if successful, this would mark a significant turnaround supporting the consensus thesis.

- However, ongoing product recalls and delays in relaunching high-margin products are meaningful headwinds, and if unresolved, could undercut margin momentum and prolong the recovery timeline.

- There's a sharp focus on sustainable margin gains since previous cost-saving programs have not translated to durable net margin expansion. Investors are closely monitoring the next quarters for evidence that fixed cost reductions actually stick.

- Consensus narrative notes that strategic investments and operational improvements offer a path to sustained margin expansion. These benefits will be realized only if disruptions subside and management executes on efficiency targets.

- The narrative highlights that subdued revenue growth of 4.5% annually still requires improvements in cost management to transform the company’s current loss-making status into a profitable one.

- Reimbursement changes favoring evidence-based, cost-effective wound care could give Integra’s portfolio a boost, though market timing remains uncertain.

Financial Leverage Tests Earnings Durability

- Net debt stands at $1.59 billion, resulting in a leverage multiple of 4.5x EBITDA, which poses limitations on the company’s flexibility to invest or withstand unexpected shocks.

- Consensus narrative stresses that this high leverage exposes Integra to interest rate and refinancing risks that could weigh on long-term earnings growth.

- The company is targeting $25 to $30 million in annualized savings, which management argues will help mitigate some leverage-related pressures. However, persistent operational disruptions may prevent these savings from flowing through to genuine debt reduction.

- Bears also highlight that increased reliance on short-term savings compounds financial risk, amplifying the need for successful execution on cost and growth plans before future debt maturities.

Deep Discount to DCF Fair Value Draws Attention

- Shares currently trade at $11.81, far below both the DCF fair value of $69.07 and the peer average price-to-sales ratio (0.6x for IART versus 6.6x for peers and 2.8x for the industry), flagging substantial potential upside if forecasted improvements materialize.

- Consensus narrative flags that while the analyst price target sits at $15.75 (just 2.8% above the current share price), the sizeable DCF fair value gap stands out, making valuation a central debate point for investors weighing risks against the low entry price.

- The discount reflects both skepticism about growth and margin delivery, and cautious optimism that even modest operational execution could unlock substantial upside relative to sector norms.

- Industry peers are priced much higher relative to sales despite similar growth headwinds, intensifying the view that Integra’s valuation sets the stage for outsized returns if execution improves.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Integra LifeSciences Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

View the data from a new angle? In just a few minutes, you can capture your interpretation and contribute your own narrative: Do it your way

A great starting point for your Integra LifeSciences Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Integra LifeSciences Holdings' high net debt, compressed margins, and exposure to refinancing risks raise major questions about its financial durability and earnings recovery.

If you want to focus on companies with lower debt and stronger financial health, check out solid balance sheet and fundamentals stocks screener (1984 results) built to weather exactly these kinds of challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IART

Integra LifeSciences Holdings

Manufactures and sells surgical instrument, neurosurgical, ear, nose, throat, and wound care products for use in neurosurgery, neurocritical care, and otolaryngology.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives