- United States

- /

- Medical Equipment

- /

- NasdaqGM:HYPR

Here's Why Hyperfine (NASDAQ:HYPR) Must Use Its Cash Wisely

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So should Hyperfine (NASDAQ:HYPR) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

We've discovered 4 warning signs about Hyperfine. View them for free.How Long Is Hyperfine's Cash Runway?

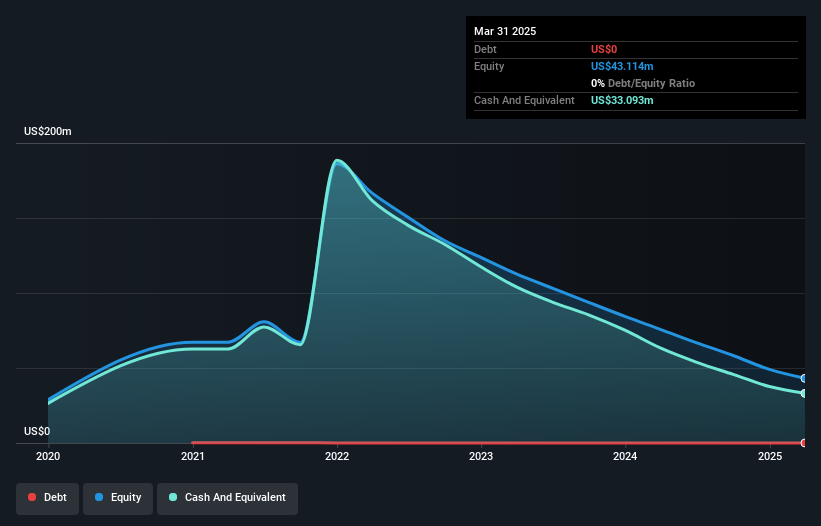

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In March 2025, Hyperfine had US$33m in cash, and was debt-free. Importantly, its cash burn was US$36m over the trailing twelve months. So it had a cash runway of approximately 11 months from March 2025. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. Depicted below, you can see how its cash holdings have changed over time.

See our latest analysis for Hyperfine

How Well Is Hyperfine Growing?

Hyperfine reduced its cash burn by 13% during the last year, which points to some degree of discipline. However, operating revenue was basically flat over that time period. In light of the data above, we're fairly sanguine about the business growth trajectory. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Hyperfine Raise More Cash Easily?

Given Hyperfine's revenue is receding, there's a considerable chance it will eventually need to raise more money to spend on driving growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Hyperfine has a market capitalisation of US$48m and burnt through US$36m last year, which is 76% of the company's market value. Given how large that cash burn is, relative to the market value of the entire company, we'd consider it to be a high risk stock, with the real possibility of extreme dilution.

So, Should We Worry About Hyperfine's Cash Burn?

Even though its cash burn relative to its market cap makes us a little nervous, we are compelled to mention that we thought Hyperfine's cash burn reduction was relatively promising. Considering all the measures mentioned in this report, we reckon that its cash burn is fairly risky, and if we held shares we'd be watching like a hawk for any deterioration. On another note, Hyperfine has 4 warning signs (and 2 which are significant) we think you should know about.

Of course Hyperfine may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Hyperfine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:HYPR

Hyperfine

A health technology company, engages in the production, supply, service, and commercialization of magnetic resonance imaging (MRI) products.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026