- United States

- /

- Healthcare Services

- /

- NasdaqGS:HSIC

Is There Opportunity in Henry Schein After 18% Rally and Digital Dentistry Expansion?

Reviewed by Bailey Pemberton

- Wondering whether Henry Schein is a great value buy or if the price has already run ahead of the fundamentals? You are not alone. Many investors are eyeing this healthcare stock for clues.

- In just the last month, Henry Schein's stock rallied an impressive 18%, reversing some previous declines and sparking fresh debates over its future growth and risk profile.

- Recent headlines have spotlighted Henry Schein’s strategic expansion efforts, including partnerships in digital dentistry and investments in supply chain technologies. These moves are seen by many as directly influencing the renewed optimism and the surge in share price.

- As it stands, the company scores a 5 out of 6 on our valuation checks, placing it well above many peers. In a moment, we will dig into the details of how this score is calculated, as well as discuss a more insightful way to assess Henry Schein’s true worth. Stay tuned.

Approach 1: Henry Schein Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by forecasting its future cash flows and then discounting those amounts back to today’s value. This method helps investors determine what a business is really worth based on how much cash it is expected to generate.

For Henry Schein, current Free Cash Flow stands at $342.18 million. According to analyst estimates and extrapolations, this number is projected to grow steadily, reaching approximately $1.03 billion ($1,030.09 million) by 2035. Only the next few years have direct analyst input; longer-term forecasts are extended estimates by Simply Wall St’s model. All projections are published in USD.

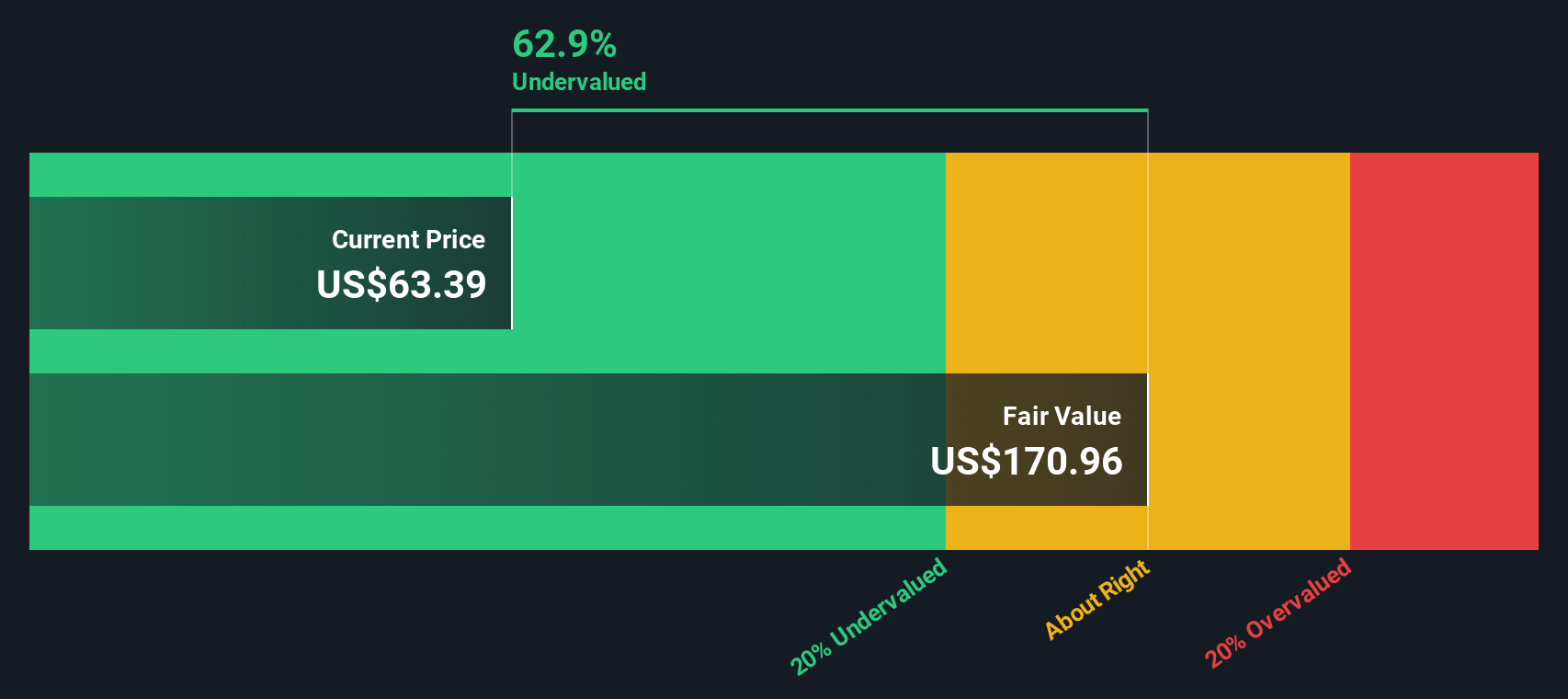

The DCF model estimates Henry Schein’s fair intrinsic value at $174.11 per share. With the current stock price sitting 57.2% below this fair value estimate, the DCF suggests Henry Schein is significantly undervalued at today’s prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Henry Schein is undervalued by 57.2%. Track this in your watchlist or portfolio, or discover 915 more undervalued stocks based on cash flows.

Approach 2: Henry Schein Price vs Earnings

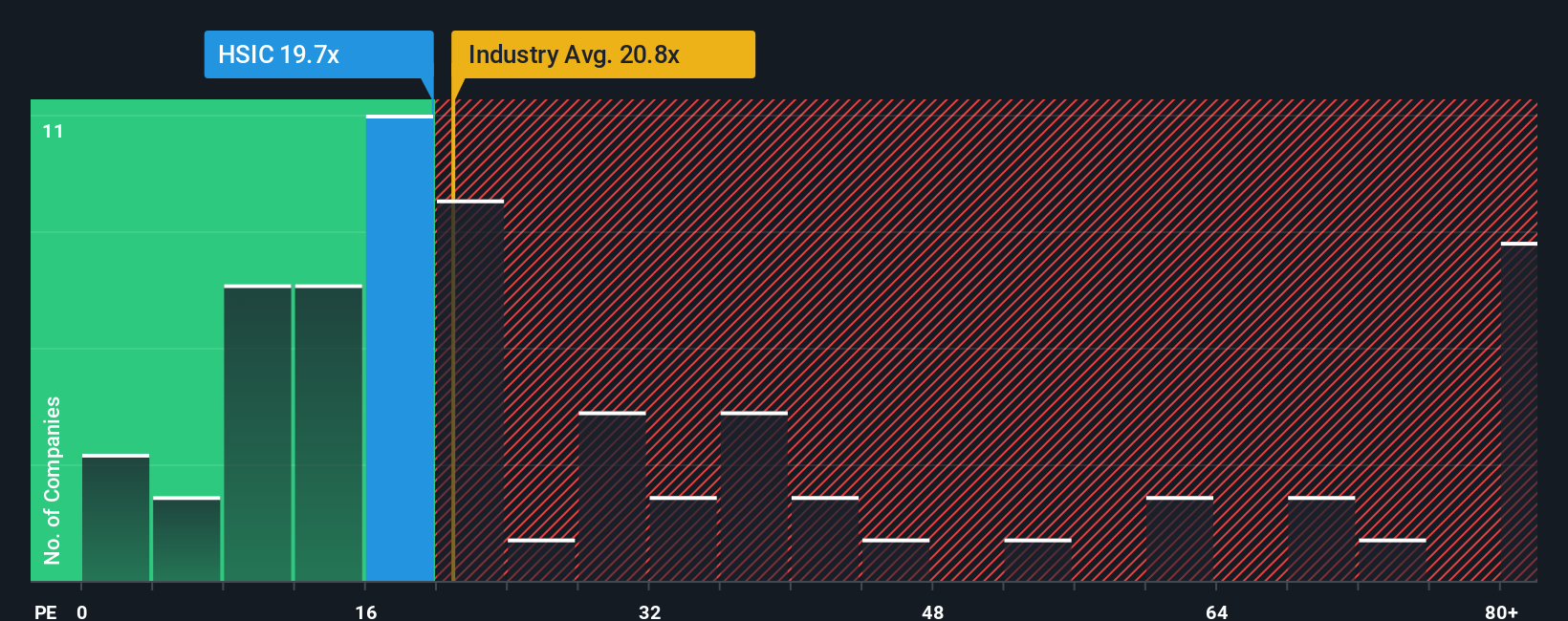

The Price-to-Earnings (PE) ratio is often the go-to valuation metric for profitable companies because it reflects how much investors are willing to pay today for each dollar of future earnings. For established businesses like Henry Schein, the PE ratio effectively captures investor expectations regarding the company’s earnings growth and risk profile.

It is important to remember that fair PE ratios can vary widely between companies and industries. A higher PE typically signals optimism about future earnings growth or lower perceived risk, while a lower PE can indicate market caution. Comparing Henry Schein’s PE gives us insight into how the market views its prospects relative to competitors.

Currently, Henry Schein trades at a PE ratio of 22.45x. This is just below the healthcare industry average of 22.67x, and notably under the peer group average of 30.41x. However, these simple comparisons do not take into account company-specific factors like earnings growth potential or risk profile. That is where Simply Wall St’s “Fair Ratio” comes in, set at 24.99x for Henry Schein. This metric is tailored to the company’s own growth prospects, margins, industry, and size, making it a more precise benchmark than broad averages alone.

By weighing all these elements, the Fair Ratio suggests Henry Schein is trading slightly below its intrinsic multiple, indicating the stock is about fairly valued compared to its long-term outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Henry Schein Narrative

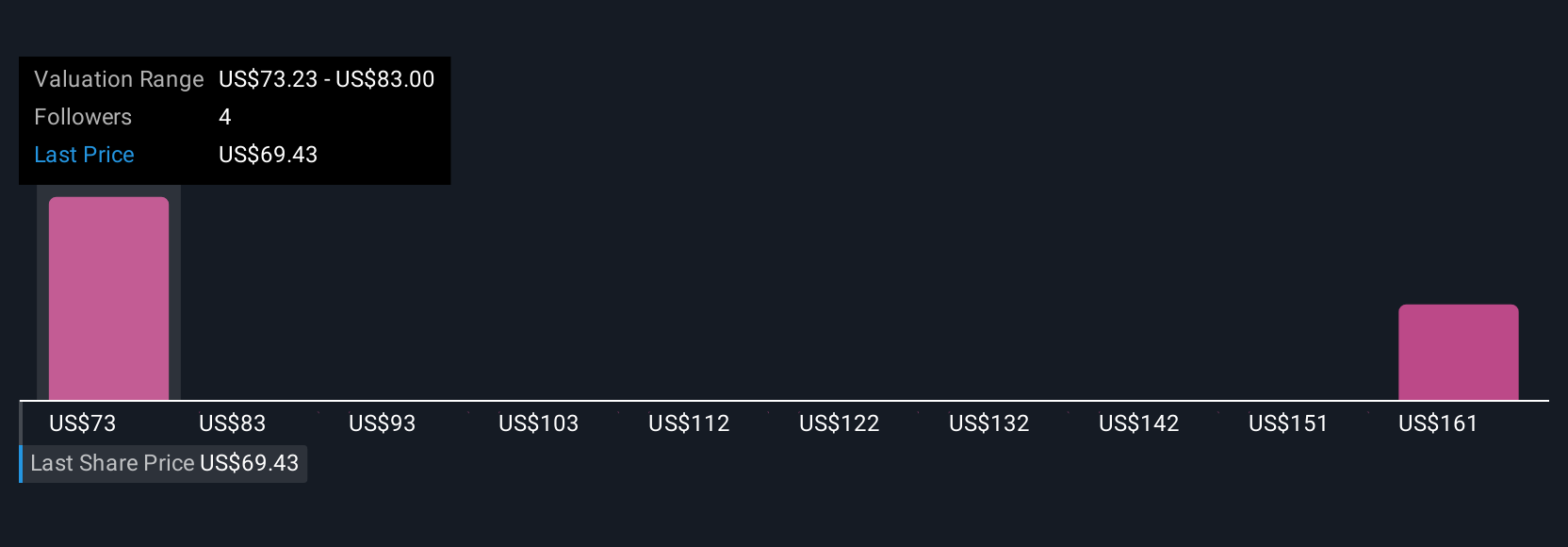

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a powerful tool on Simply Wall St that allows you to connect your personal view of Henry Schein with the numbers behind the stock.

A Narrative is more than just data or a price target; it is your tailored story about the company’s future, combining your expectations about revenue, profit margins, growth, and risk into a financial forecast and an estimated fair value.

This approach links what you believe is happening in Henry Schein’s business with industry trends or company initiatives, then converts that perspective into tangible numbers. This gives you a customized fair value you can easily compare with the current market price to decide if the stock is a buy, hold, or sell.

Narratives are simple to use, available for every user within Simply Wall St’s Community page, and update automatically when new news, earnings, or forecasts come in. This ensures your personal thesis stays relevant as the facts evolve.

For Henry Schein, you will find Narratives from investors who are bullish (setting fair values as high as $83.00, believing in margin expansion from digital initiatives and operational improvements) and those who are more cautious (with fair values as low as $55.00, highlighting competitive and regulatory risks), demonstrating that everyone can create a perspective based on what matters most to them.

Do you think there's more to the story for Henry Schein? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henry Schein might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HSIC

Henry Schein

Provides health care products and services to office-based dental and medical practitioners, and alternate sites of care worldwide.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026