- United States

- /

- Healthcare Services

- /

- NasdaqGS:HSIC

Can Margin Pressures Reshape Henry Schein's Competitive Edge in Dental Distribution (HSIC)?

Reviewed by Simply Wall St

- In the most recent quarter, Henry Schein reported year-over-year revenue growth of 3.3% but missed analysts' earnings expectations due to lower margins driven by reduced glove pricing and targeted sales initiatives.

- This result differed from some dental industry peers, whose stronger performances highlighted Henry Schein's margin pressures and operational challenges.

- We'll examine how margin pressure from competitive glove pricing could influence Henry Schein's longer-term growth and profitability outlook.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

Henry Schein Investment Narrative Recap

Owning Henry Schein means believing in its ability to grow profitably despite industry pressures, particularly in dental supplies, through expansion in higher-margin segments and operational efficiencies. The recent revenue growth accompanied by missed earnings reflects margin pressure from lower glove pricing, a risk that remains front and center and could weigh on short-term profit visibility, potentially moderating the catalyst from digital and specialty growth in the near term.

Among the most relevant recent announcements is the reaffirmation of management’s full-year sales growth guidance (2% to 4%), provided alongside Q2 results. This steady guidance, despite margin pressure, is meaningful for investors tracking near-term catalysts such as benefits from technology and private-label expansion, hinting that management remains focused on underlying structural improvements while navigating pricing compressions.

By contrast, the risk of ongoing margin pressure from competitive glove pricing is something investors should be aware of if...

Read the full narrative on Henry Schein (it's free!)

Henry Schein's outlook projects $14.4 billion in revenue and $614.4 million in earnings by 2028. This requires 4.0% annual revenue growth and a $225.4 million increase in earnings from the current level of $389.0 million.

Uncover how Henry Schein's forecasts yield a $73.23 fair value, a 5% upside to its current price.

Exploring Other Perspectives

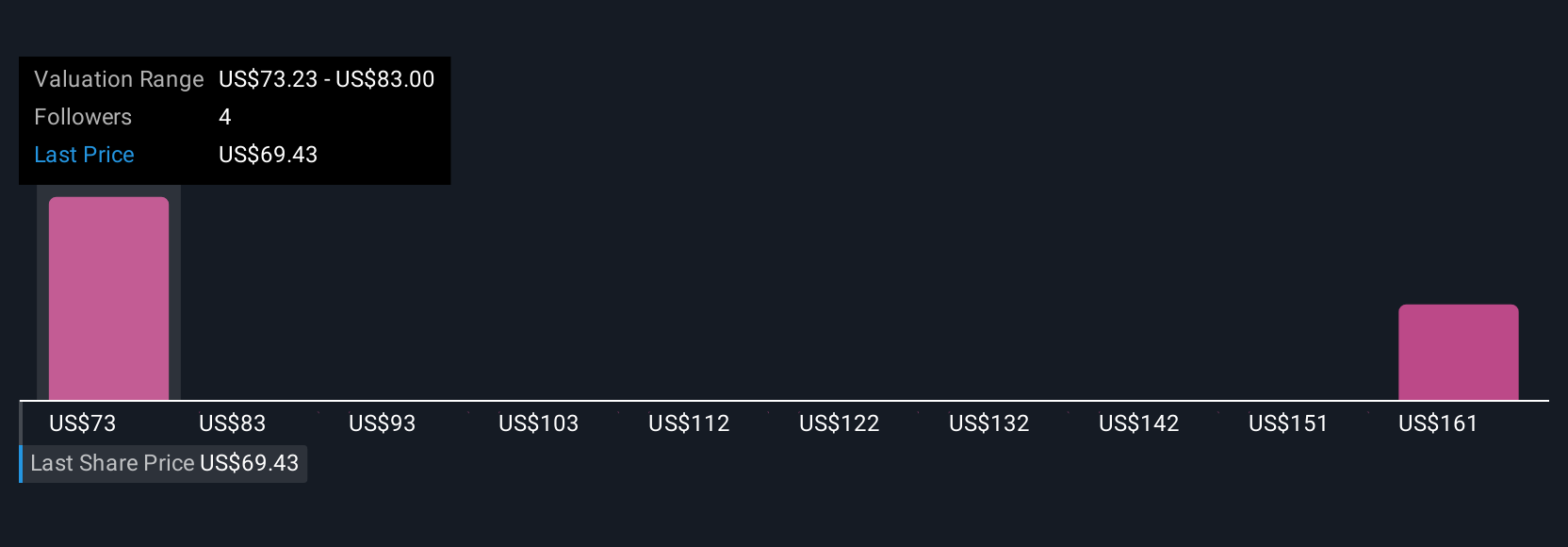

Simply Wall St Community members produced two fair value estimates ranging from US$73 to US$171 per share. While many focus on Henry Schein's growth in digital and specialty products, persistent margin pressure from competitive pricing highlights the need to weigh these viewpoints carefully, explore multiple opinions before forming your position.

Explore 2 other fair value estimates on Henry Schein - why the stock might be worth just $73.23!

Build Your Own Henry Schein Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Henry Schein research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Henry Schein research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Henry Schein's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henry Schein might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HSIC

Henry Schein

Provides health care products and services to office-based dental and medical practitioners, and alternate sites of care worldwide.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives