- United States

- /

- Medical Equipment

- /

- NasdaqGS:HOLX

Hologic (HOLX) Profit Margin Drops on $277.8M One-Off Loss, Undercutting Bullish Recovery Narratives

Reviewed by Simply Wall St

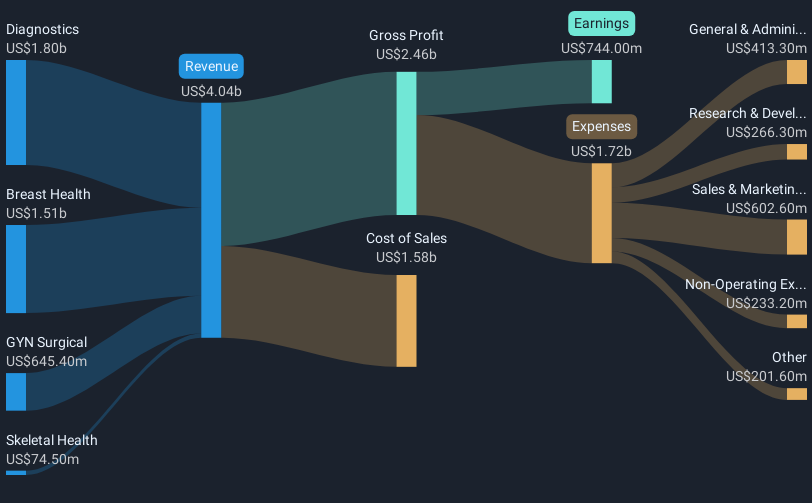

Hologic (HOLX) reported a net profit margin of 13.8%, down from 19.6% last year, reflecting a continued decline in earnings that have averaged a 26.7% decrease per year over the past five years. While a significant one-off loss of $277.8 million weighed on profits in the last twelve months to September 27, 2025, investors are now watching for a turnaround, as revenue is forecast to grow at 4.7% per year and earnings are expected to rise at 14.8% per year, although still trailing the broader US market. With shares trading at $74.11, notably below the estimated fair value of $105.96, the market appears cautiously optimistic that future growth may offset recent setbacks.

See our full analysis for Hologic.The next section puts these headline results side by side with prevailing narratives, revealing where the data aligns with market expectations and where surprises may lie ahead.

See what the community is saying about Hologic

Margins Projected to Rebound Strongly

- Analysts expect Hologic’s profit margin to increase from 13.8% today to 21.2% in three years, pointing to a significant operational recovery on the horizon.

- The analysts' consensus view highlights that this margin recovery hinges on innovation in diagnostic and screening technology, especially through premium product upgrades and next-generation AI integration.

- Gains in recurring revenue from expanding product offerings and international growth are expected to provide the foundation for this margin lift.

- However, the path relies on the successful rollout of higher-margin innovations such as 3D mammography and the new Envision system. If these are not executed as planned, persistent international and product mix pressures could keep margins below target.

To see how analysts frame the risks and potential of this recovery, don't miss the consensus narrative outlining Hologic's evolving growth story. 📊 Read the full Hologic Consensus Narrative.

Tariff and China Pressures Remain

- Hologic faces ongoing tariff expenses of $10-12 million per quarter, and China revenue has dropped more than 50% year-over-year to now less than $10 million per quarter, both major drag factors on near-term results.

- According to the analysts' consensus view, these headwinds may keep a lid on consolidated revenue and earnings momentum into fiscal 2026.

- While operational improvements and product upgrades could help offset challenges, continued international and supply chain weakness risk undercutting expected growth if not resolved.

- Bears argue this environment may slow Hologic’s ability to deliver the forecast earnings growth if macro or regulatory pressures persist in key markets like China.

DCF Fair Value: Wide Upside Gap

- Shares currently trade at $74.11, sitting well below the DCF fair value estimate of $105.96, which implies a potential upside of over 40% if targets are met.

- The analysts' consensus view acknowledges that this discount reflects ongoing margin pressure and recent one-off losses. There is also an expectation that if Hologic executes on innovation, market expansion, and cost control, current pricing could prove attractive.

- The projected PE ratio of 19.5x in 2028 would represent a discount compared to the current US Medical Equipment industry average, suggesting further room for rerating if growth materializes.

- Still, for value to close the gap, investors will want to see evidence of margin improvement and a stabilization of international operations, not just forecasts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hologic on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the data tells a different story? Take a few minutes and shape your own perspective. Do it your way

A great starting point for your Hologic research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite forecasts for margin recovery, Hologic continues to face inconsistent profits and international headwinds. These challenges threaten steady earnings momentum.

If you value predictable performance, use stable growth stocks screener (2083 results) to discover companies with proven records of stable revenue and earnings growth across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hologic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOLX

Hologic

Engages in the development, manufacture, and supply of diagnostics products, medical imaging systems, and surgical products for women's health through early detection and treatment worldwide.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives