- United States

- /

- Medical Equipment

- /

- NasdaqGS:HOLX

Hologic (HOLX): Assessing Valuation After Recent 10% Share Price Gain

Reviewed by Simply Wall St

See our latest analysis for Hologic.

Hologic’s 10% share price gain over the past month has turned a few heads, especially after a tough year that saw its 12-month total shareholder return drop more than 10%. This recent momentum suggests that investors may be re-evaluating the company’s long-term potential, even as the healthcare sector continues its own period of transition.

If Hologic’s upswing has you curious about what else is gaining traction in the sector, it’s an ideal time to discover See the full list for free.

But with shares now near analyst targets and after a stretch of sluggish long-term returns, investors are left wondering: Is Hologic trading at a discount, or has the market already factored in the company’s future growth prospects?

Most Popular Narrative: Fairly Valued

The latest narrative puts Hologic’s fair value at $73.54, almost identical to the last close of $73.91. This close alignment highlights how acquisition news and financial results are driving analysts’ consensus. But what’s fueling these high expectations?

“Innovation in core diagnostic and screening technologies, supported by AI integration, is driving market share gains and expanding margins through premium offerings and product upgrades.

Portfolio expansion, strategic acquisitions, and improved operations are diversifying revenue, supporting resilience, and fueling sustained growth across international markets.”

Curious about which breakthrough products or deals are at the heart of this fair value? One bold forecast stands out, backed by a future profit margin leap and margin expansion plans that could change the company’s trajectory. Discover what’s behind the numbers and how Hologic’s next moves could redefine its valuation.

Result: Fair Value of $73.54 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing revenue in China and ongoing margin pressure could disrupt Hologic’s outlook. These factors may also challenge analyst expectations for steady growth and profitability.

Find out about the key risks to this Hologic narrative.

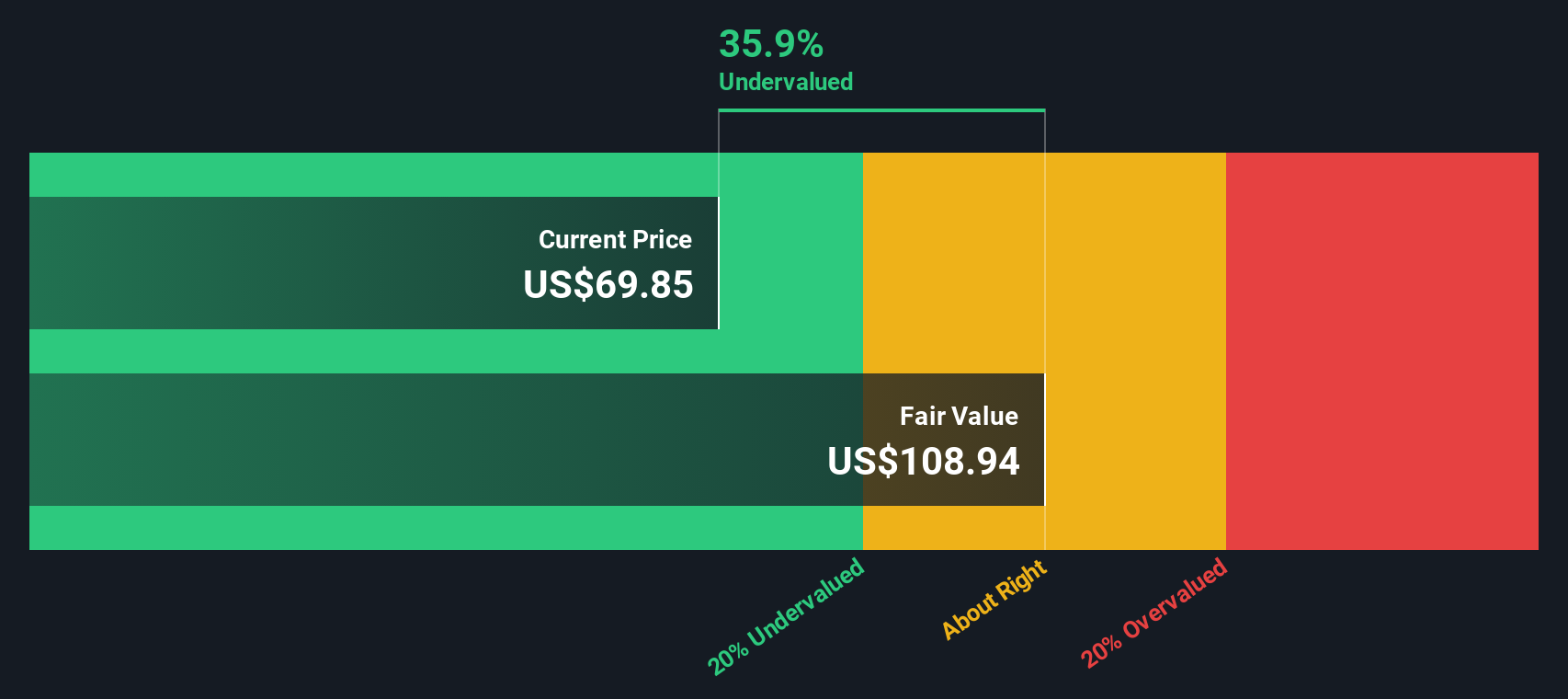

Another View: Discounted Cash Flow Perspective

While analysts find Hologic’s price near fair value, our DCF model suggests a much bigger opportunity. By projecting future cash flows, the SWS DCF model estimates fair value at $107.80. This puts today’s price at a 31% discount. Could the market be underestimating Hologic’s long-term cash generation?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hologic for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 831 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hologic Narrative

If you see things differently or want to analyze the numbers yourself, you can easily craft your own narrative in just a few minutes: Do it your way

A great starting point for your Hologic research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Looking beyond Hologic can unlock opportunities you might regret missing. Let Simply Wall Street’s powerful Screener help you spot your next standout stock today.

- Pinpoint undervalued gems by reviewing these 831 undervalued stocks based on cash flows that the market has not fully recognized yet.

- Tap into next-level growth potential with these 26 AI penny stocks as artificial intelligence transforms entire industries and business models.

- Strengthen your income strategy by searching these 22 dividend stocks with yields > 3% offering reliable yields that can help boost your returns in any market environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hologic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOLX

Hologic

Engages in the development, manufacture, and supply of diagnostics products, medical imaging systems, and surgical products for women's health through early detection and treatment worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives