- United States

- /

- Healthcare Services

- /

- NasdaqGS:GH

How Investors May Respond To Guardant Health (GH) Winning FDA Approval for Breast Cancer Companion Diagnostic

Reviewed by Sasha Jovanovic

- Guardant Health announced that the U.S. Food and Drug Administration (FDA) has approved its Guardant360 CDx as a companion diagnostic to identify advanced breast cancer patients with ESR1 mutations who may benefit from Eli Lilly’s Inluriyo (imlunestrant).

- This approval marks the sixth companion diagnostic claim for Guardant360 CDx and further expands its clinical utility in breast cancer, a leading cause of cancer death among women in the United States.

- We’ll explore how FDA approval of Guardant360 CDx for advanced breast cancer could influence Guardant Health’s long-term growth narrative.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Guardant Health Investment Narrative Recap

To be a shareholder in Guardant Health, you need to believe in the continued adoption of non-invasive, blood-based cancer diagnostics and the company's expanding utility in precision oncology. The recent FDA approval of Guardant360 CDx as a companion diagnostic in advanced breast cancer is a tangible milestone, which could help reinforce near-term revenue catalysts through broader clinical acceptance. However, this approval does not materially reduce the company's biggest risk: sustained high cash burn and the challenge of reaching profitability. Among recent announcements, the strategic partnership with Quest Diagnostics to offer the Shield blood test for colorectal cancer screening stands out. This move directly supports commercial expansion, a key near-term catalyst for revenue growth, by increasing Shield's reach in the U.S. screening market, especially as reimbursement and payer coverage remain crucial for widespread adoption. In contrast, investors should also be aware of the persistent risk that high R&D spending and continued net losses could...

Read the full narrative on Guardant Health (it's free!)

Guardant Health's outlook anticipates $1.5 billion in revenue and $82.1 million in earnings by 2028. This is based on a 22.5% annual revenue growth rate and a $495.9 million increase in earnings from current earnings of -$413.8 million.

Uncover how Guardant Health's forecasts yield a $68.23 fair value, a 6% upside to its current price.

Exploring Other Perspectives

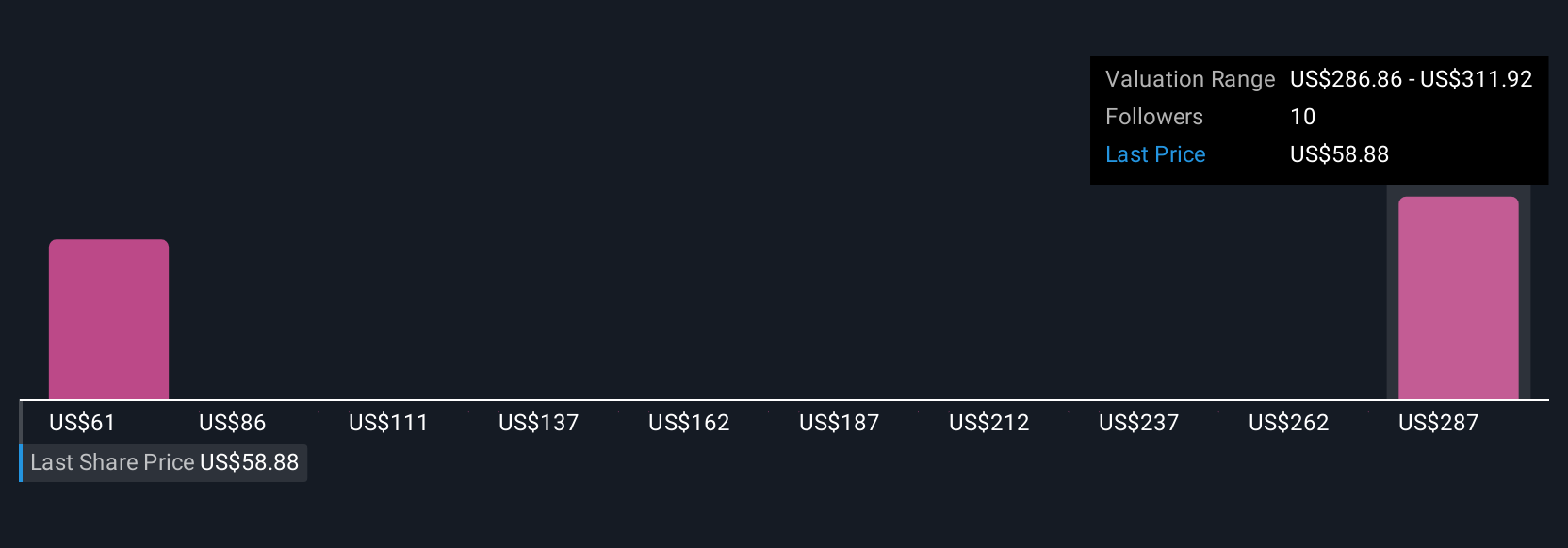

Simply Wall St Community members have submitted 3 fair value estimates for Guardant Health, stretching from US$68.10 to US$195.52 per share. While optimism centers on revenue growth from expanding diagnostics, ongoing high cash burn continues to influence market confidence and projected outcomes.

Explore 3 other fair value estimates on Guardant Health - why the stock might be worth just $68.10!

Build Your Own Guardant Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Guardant Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Guardant Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Guardant Health's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GH

Guardant Health

A precision oncology company, provides blood and tissue tests, and data sets in the United States and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives