- United States

- /

- Healthcare Services

- /

- NasdaqGS:GH

Guardant Health (GH): Evaluating Valuation After a 123% Year-to-Date Share Price Surge

Reviewed by Simply Wall St

Guardant Health (GH) has seen its stock climb in recent months, gaining steam as a result of growing investor interest and strong momentum in health technology equities. Recent performance trends are catching many investors’ attention as the conversation shifts to valuation.

See our latest analysis for Guardant Health.

Guardant Health's share price has more than doubled year-to-date, delivering a 123% share price return, as excitement builds around its technology and progress in the health diagnostics space. Momentum has been especially strong lately, with a 63.6% gain over the past three months. The one-year total shareholder return stands at a remarkable 219%. This resurgence in value hints at changing market perceptions and optimism about longer-term growth potential following a period of share price underperformance.

If you’re interested in how other healthcare innovators are moving, now’s a good time to explore new opportunities with our See the full list for free.

All eyes are now on valuation, raising a key question for investors: is Guardant Health undervalued based on recent gains and fundamentals, or has the market already factored in all of the company’s potential growth?

Most Popular Narrative: Fairly Valued

The latest fair value calculation from the most popular narrative puts Guardant Health’s fair value at $69.55, almost identical to its last close at $70.85. This near match raises the stakes on the underlying logic driving the narrative’s outlook and sets up a big question: are analysts too cautious or right on target?

Rapid integration of AI-powered clinical analytics and multi-omic profiling into Guardant's "Smart Liquid Biopsy" platform is creating new clinical applications, enhancing product utility and differentiation versus peers, which is leading to higher average selling prices (ASPs), rising margins, and increased potential for broader payer reimbursement and improved net margins.

Want to know what supports this razor-thin gap between price and fair value? The most popular narrative bets big on expanding profit margins, premium product pricing, and future market share. Guess which bullish financial projections push Guardant Health into this unique position? Dive deeper to uncover the quantitative story behind this sophisticated valuation call.

Result: Fair Value of $69.55 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high R&D costs and delays in broadening payer coverage could threaten Guardant Health’s growth assumptions and challenge the company’s current fair value outlook.

Find out about the key risks to this Guardant Health narrative.

Another View: Discounted Cash Flow Puts Price in Perspective

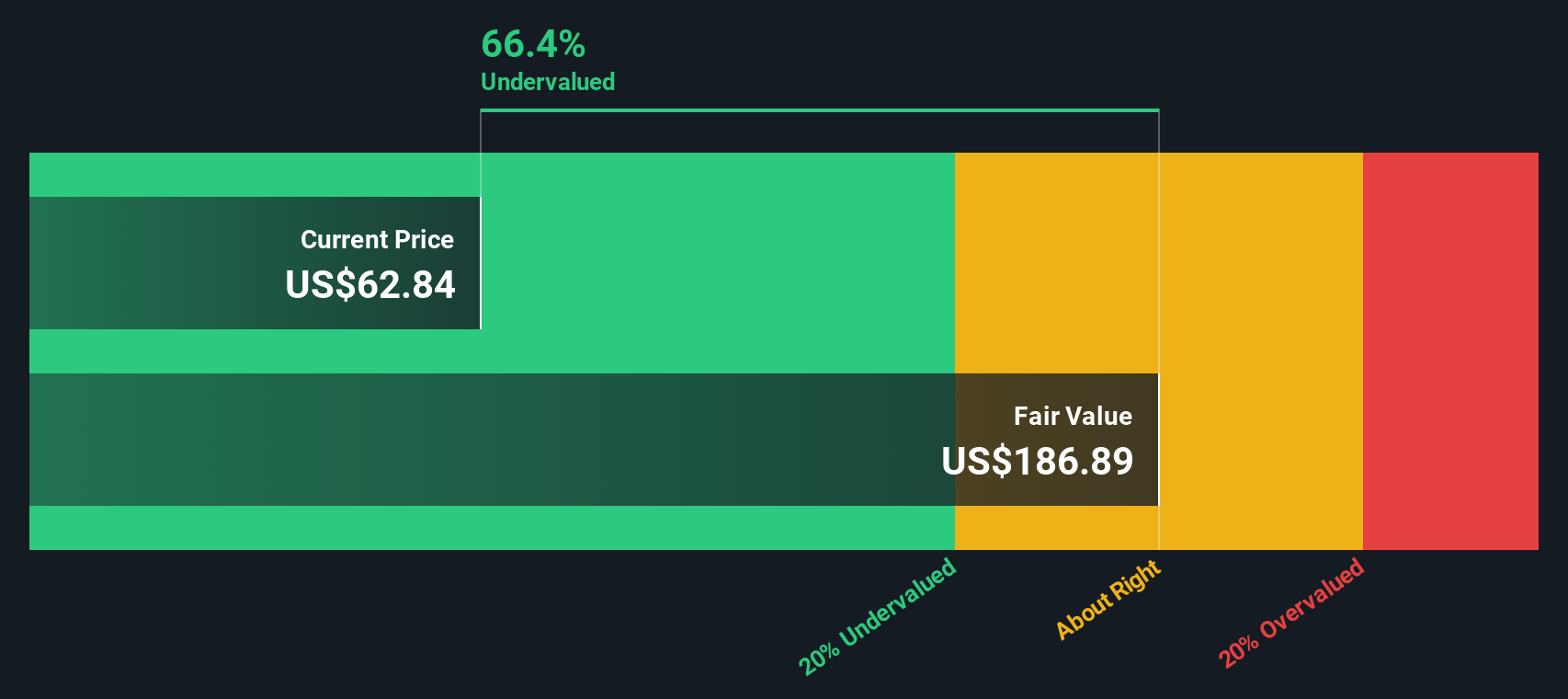

While analyst consensus suggests Guardant Health’s shares are about fairly valued, the SWS DCF model tells a very different story. This alternative approach estimates the company is trading at a remarkable 63.8% discount to its fair value. Could this signal untapped upside, or is the market rightly skeptical until consistent profits are proven?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Guardant Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Guardant Health Narrative

Want to see where your own analysis might differ from the prevailing view? It only takes a few minutes to explore the numbers and craft a narrative that reflects your perspective. Do it your way.

A great starting point for your Guardant Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors broaden their horizons to spot fresh opportunities before the crowd does. Don’t miss out on these powerful stock picks that could energize your portfolio:

- Explore the potential of automation and machine intelligence by tapping into these 27 AI penny stocks, which are poised to transform industries and drive tomorrow’s tech breakthroughs.

- Enhance your income strategy by considering these 19 dividend stocks with yields > 3%, which features reliable yields above 3%.

- Stay ahead of the mainstream by uncovering these 80 cryptocurrency and blockchain stocks, which is pioneering new frontiers in finance and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GH

Guardant Health

A precision oncology company, provides blood and tissue tests, and data sets in the United States and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives