- United States

- /

- Healthcare Services

- /

- NasdaqGS:GH

Could Guardant Health's (GH) Expansive ESMO 2025 Data Redefine Its Long-Term Innovation Edge?

Reviewed by Sasha Jovanovic

- Guardant Health announced that it recently presented new data from 15 oncology studies spanning multiple cancer types at the European Society for Medical Oncology (ESMO) Congress 2025 in Berlin.

- Key highlights included novel applications for tumor profiling and minimal residual disease detection, offering insights into early cancer recurrence monitoring and addressing critical gaps in cancer diagnosis.

- We'll explore how the breadth of new clinical data presented at ESMO 2025 could influence Guardant Health's investment outlook.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Guardant Health Investment Narrative Recap

To be a shareholder in Guardant Health, you need to believe that rapid advancements in liquid biopsy, early cancer detection, and broadening clinical utility will outweigh the company's ongoing high R&D spend and net losses. While the latest ESMO data presentation showcases continued innovation, it is unlikely to materially alter the biggest short-term catalyst: commercial adoption, reimbursement coverage, and revenue acceleration for the Shield test. However, the risk of ongoing cash burn and delayed profitability continues to be front and center for investors.

The most relevant recent announcement is Guardant Health's new collaboration with Quest Diagnostics to make the Shield blood-based colorectal cancer screening test available nationally in 2026. This partnership directly ties to the short-term catalyst of expanding Shield's adoption and payer coverage, which remains vital to driving near-term revenue growth and addressing key business risks identified by analysts.

But against this momentum, investors should be aware that Guardant’s high cash burn could signal future dilution or debt if profitability remains elusive...

Read the full narrative on Guardant Health (it's free!)

Guardant Health's narrative projects $1.5 billion in revenue and $82.1 million in earnings by 2028. This requires 22.5% yearly revenue growth and a $495.9 million earnings increase from the current earnings of -$413.8 million.

Uncover how Guardant Health's forecasts yield a $69.55 fair value, a 4% downside to its current price.

Exploring Other Perspectives

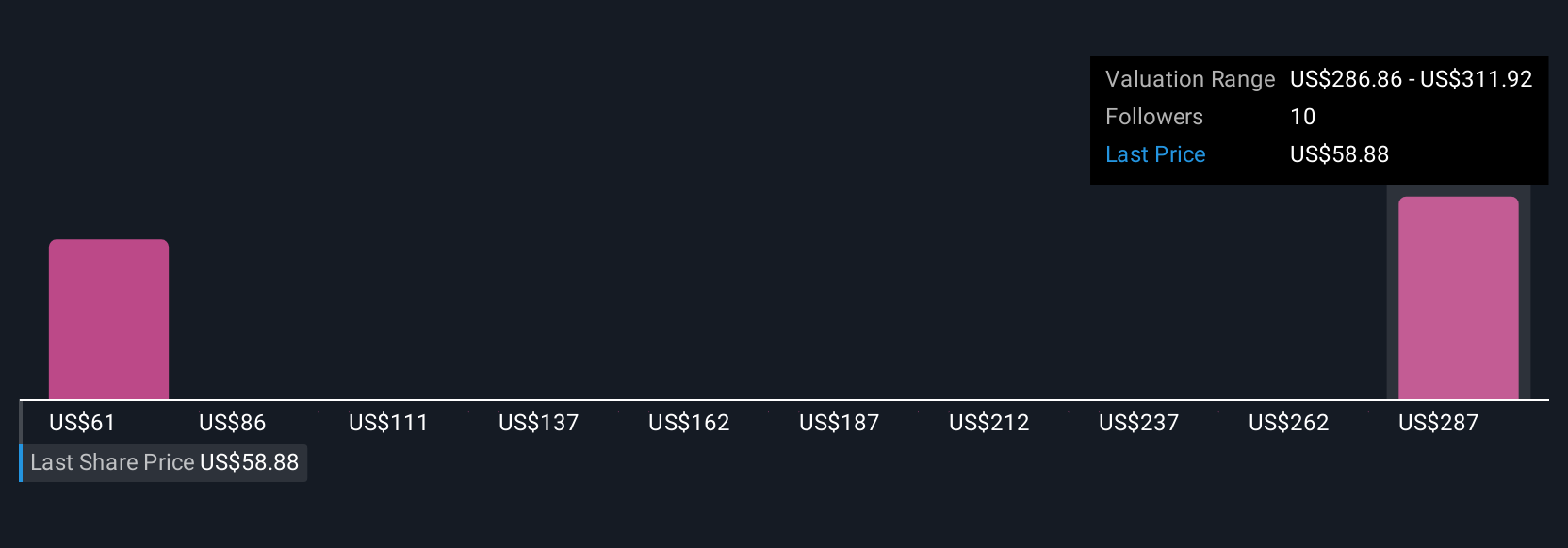

Simply Wall St Community members provided three fair value estimates for Guardant Health ranging from US$68.10 up to US$195.52 per share. These wide-ranging opinions reflect how sharply views can differ, especially given the company’s high R&D investment and continued pursuit of commercial payer adoption.

Explore 3 other fair value estimates on Guardant Health - why the stock might be worth 6% less than the current price!

Build Your Own Guardant Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Guardant Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Guardant Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Guardant Health's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GH

Guardant Health

A precision oncology company, provides blood and tissue tests, and data sets in the United States and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives