- United States

- /

- Medical Equipment

- /

- NasdaqGS:GEHC

How Investors Are Reacting To GE HealthCare's (GEHC) Alzheimer's Diagnostics FDA Approval

- GE HealthCare received FDA approval for an updated label on its Vizamyl PET imaging agent, expanding its use for Alzheimer's disease detection, enabling quantitative scan analysis, and removing key limitations for diagnostics and patient monitoring.

- This regulatory update positions GE HealthCare at the forefront of Alzheimer's diagnostics, as clinicians can now use Vizamyl for both patient selection and ongoing therapy assessment, reflecting significant progress in molecular imaging.

- With these advancements in Alzheimer's imaging and broader PET/CT capabilities, we'll assess how GE HealthCare's innovation pipeline could influence its investment narrative moving forward.

GE HealthCare Technologies Investment Narrative Recap

Being a shareholder in GE HealthCare Technologies means believing in the company’s ability to lead innovation in medical imaging and diagnostics, particularly with its expanded PET and CT capabilities. The recently approved FDA label for Vizamyl, enabling quantitative Alzheimer’s diagnostics and broader clinical use, directly supports a key catalyst: the pipeline of new high-impact imaging products. However, the company still faces immediate challenges from tariffs and regulatory uncertainties in China, which could weigh on margins or disrupt revenue, limiting near-term upside if not managed effectively.

The renewed research collaboration with Stanford Medicine, focused on advancing total body PET/CT technology, stands out for its direct relevance to GE HealthCare’s innovation track record. This partnership could further strengthen the company’s position in precision molecular imaging, building on the momentum of recent regulatory wins like the Vizamyl label expansion, and underpinning future efforts to drive clinical adoption and recurring revenue beneath ongoing macro and competitive pressures.

Yet, despite the positive innovations, investors should remain mindful of impacts from shifting global trade policies, especially if ...

Read the full narrative on GE HealthCare Technologies (it's free!)

Exploring Other Perspectives

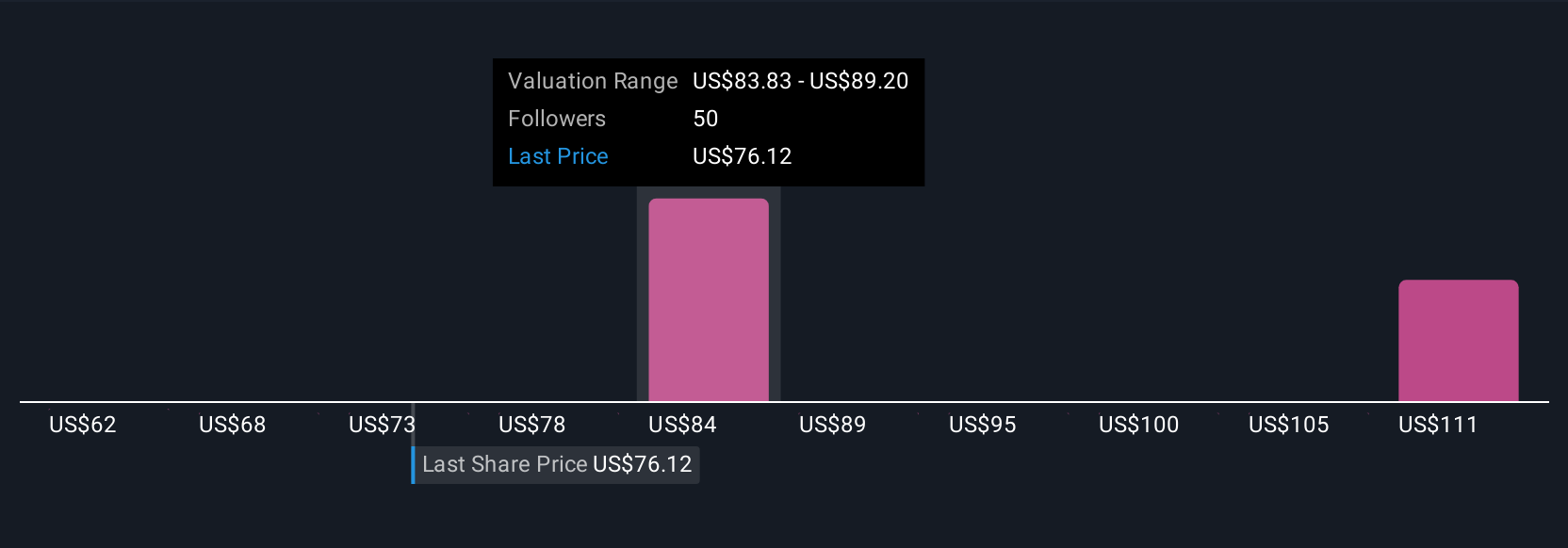

Four individual fair value estimates from the Simply Wall St Community place GE HealthCare’s shares between US$62 and US$109. Ongoing challenges from tariffs remain critical, and your outlook will depend on how you weigh innovation versus these risks.

Build Your Own GE HealthCare Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GE HealthCare Technologies research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free GE HealthCare Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GE HealthCare Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover 18 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GEHC

GE HealthCare Technologies

Engages in the development, manufacture, and marketing of products, services, and complementary digital solutions used in the diagnosis, treatment, and monitoring of patients in the United States, Canada, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives