- United States

- /

- Medical Equipment

- /

- NasdaqGS:GEHC

How GE HealthCare's (GEHC) Expanded AI Alliance with DeepHealth Could Reshape Imaging Innovation and Access

Reviewed by Sasha Jovanovic

- On November 12, 2025, DeepHealth, Inc. and GE HealthCare announced an expanded strategic collaboration to accelerate AI innovation in imaging, aiming to enhance breast cancer care and ultrasound diagnostic efficiency across global markets.

- This initiative highlights how validated AI-driven tools can streamline clinical workflows, standardize reporting, and broaden access to expert imaging in diverse care environments.

- To understand what this means for GE HealthCare, we'll examine how their expanded global AI partnership could shape the company's broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

GE HealthCare Technologies Investment Narrative Recap

For investors to consider GE HealthCare Technologies, they need to believe in the company’s ability to leverage innovation in AI and partnerships to stay ahead in global medical imaging and diagnostics. The expanded alliance with DeepHealth, Inc. strengthens GE HealthCare’s digital offering, but it may not move the needle on the biggest short-term catalyst: accelerating recurring revenue from digital solutions. However, competitive risk from rival product pipelines remains, as advancing AI could quickly become an industry standard rather than a differentiator.

Of the company’s recent announcements, the October 2025 collaborations with The Queen’s Health Systems and Duke Health, focused on AI hospital operations software, align closely with this theme. These projects showcase GE HealthCare’s emphasis on digital health partnerships, which are seen as crucial for driving longer-term gains in recurring revenue and maintaining a leading position in clinical workflow automation. Yet, while partnerships multiply opportunities, they don’t fully shield the company from competitors’ innovation cycles...

Read the full narrative on GE HealthCare Technologies (it's free!)

GE HealthCare Technologies is expected to reach $22.7 billion in revenue and $2.5 billion in earnings by 2028. This outlook assumes a 4.3% annual revenue growth rate and a $0.3 billion increase in earnings from the current level of $2.2 billion.

Uncover how GE HealthCare Technologies' forecasts yield a $86.96 fair value, a 16% upside to its current price.

Exploring Other Perspectives

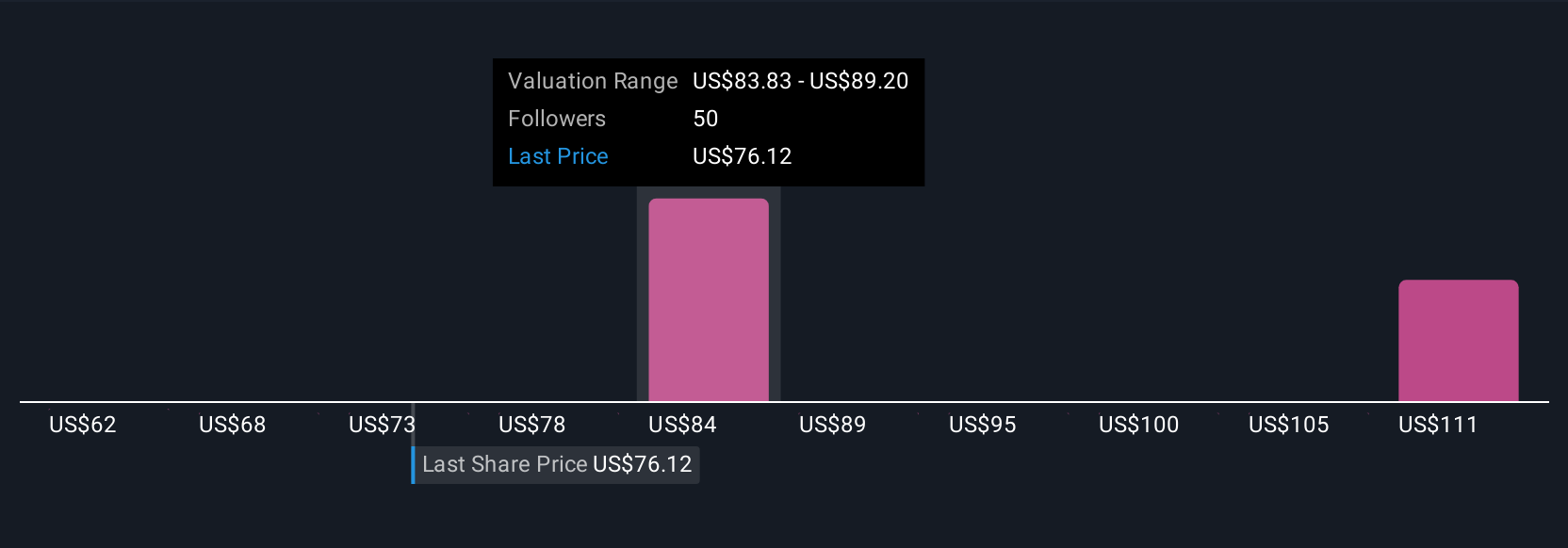

In the Simply Wall St Community, four independent fair value estimates for GE HealthCare Technologies range from US$62.11 to US$123.59 per share. While these diverse views shape investment decisions, persistent risk from competitor advancements may influence future performance, so it pays to review others’ analyses before making up your mind.

Explore 4 other fair value estimates on GE HealthCare Technologies - why the stock might be worth 17% less than the current price!

Build Your Own GE HealthCare Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GE HealthCare Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free GE HealthCare Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GE HealthCare Technologies' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GEHC

GE HealthCare Technologies

Engages in the development, manufacture, and marketing of products, services, and complementary digital solutions used in the diagnosis, treatment, and monitoring of patients in the United States, Canada, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives