- United States

- /

- Medical Equipment

- /

- NasdaqGS:GEHC

Can GE HealthCare Technologies’ (GEHC) AI Collaborations Reveal an Edge in Digital Health Leadership?

Reviewed by Sasha Jovanovic

- GE HealthCare announced collaborations with The Queen’s Health Systems and Duke Health to help develop its new AI-driven hospital operations software, aiming to bring predictive analytics and real-time insights to hospital leaders through its CareIntellect applications.

- This move highlights how GE HealthCare is integrating frontline clinical expertise into its digital health solutions, creating faster, workflow-friendly deployment for hospitals facing complex workforce and operational demands.

- We’ll assess how the company’s partnerships to advance AI-powered hospital operations software could influence its long-term investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

GE HealthCare Technologies Investment Narrative Recap

To be a shareholder in GE HealthCare Technologies, you need to believe in the company's ability to drive growth by leveraging digital healthcare solutions, clinical partnerships, and AI to help hospitals increase efficiency and quality of care. The recent announcement of collaborations with leading health systems to advance AI-driven operations software could support longer-term revenue stability and strengthen recurring digital revenue, yet the impact on near-term results or on the most pressing risk, exposure to tariffs and related earnings volatility, is not likely to be material at this stage.

The recent launch of CareIntellect for Perinatal stands out in context, representing a concrete product integrating frontline clinician feedback to improve workflow and potentially deepen recurring revenue streams. This aligns closely with the company’s broader digital and AI-driven catalysts but highlights the gap between new digital deployments and immediate financial impact, particularly against the backdrop of cost pressures and competitive risk.

However, while product innovation can fuel optimism, investors should also be mindful of risks that...

Read the full narrative on GE HealthCare Technologies (it's free!)

GE HealthCare Technologies' narrative projects $22.7 billion revenue and $2.5 billion earnings by 2028. This requires 4.3% yearly revenue growth and a $0.3 billion earnings increase from $2.2 billion today.

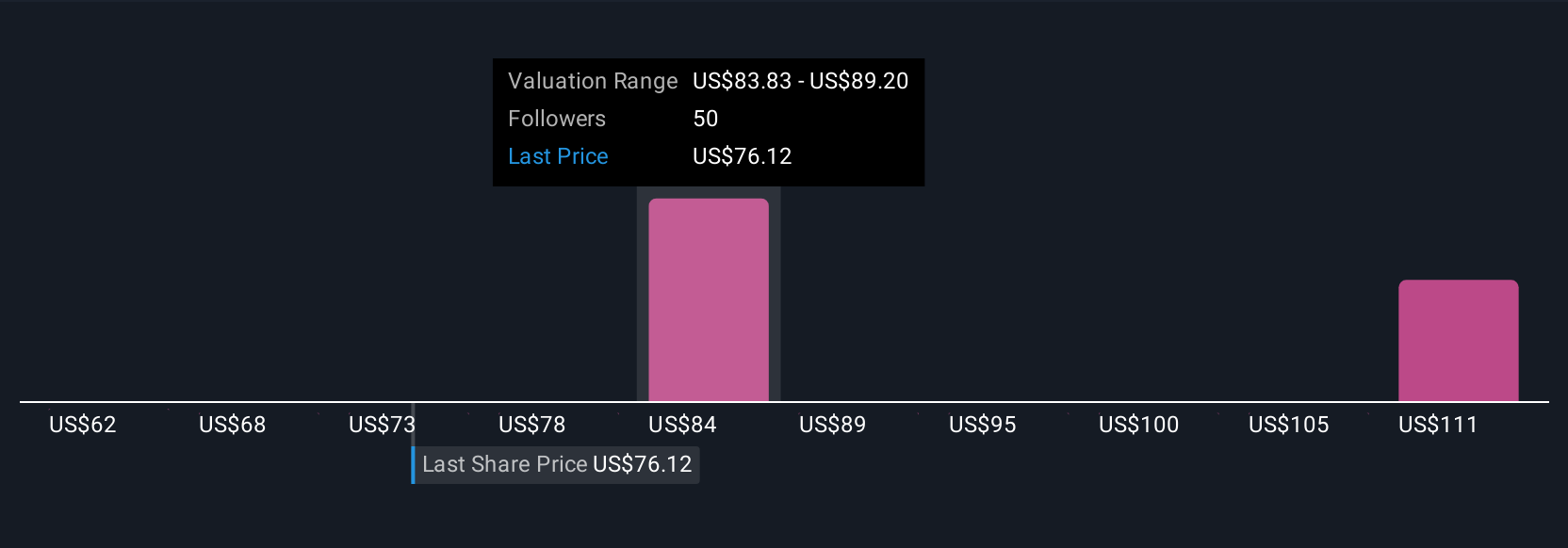

Uncover how GE HealthCare Technologies' forecasts yield a $86.96 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Four individual fair value estimates from the Simply Wall St Community range from US$62.11 to US$122.13 per share. As GE HealthCare focuses on expanding digital solutions, opinions on its valuation and earnings growth potential remain divided, encouraging you to explore multiple viewpoints on what supports future performance.

Explore 4 other fair value estimates on GE HealthCare Technologies - why the stock might be worth 21% less than the current price!

Build Your Own GE HealthCare Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GE HealthCare Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free GE HealthCare Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GE HealthCare Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GEHC

GE HealthCare Technologies

Engages in the development, manufacture, and marketing of products, services, and complementary digital solutions used in the diagnosis, treatment, and monitoring of patients in the United States, Canada, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives