- United States

- /

- Healthtech

- /

- NasdaqGS:GDRX

GoodRx Holdings, Inc.'s (NASDAQ:GDRX) Shares May Have Run Too Fast Too Soon

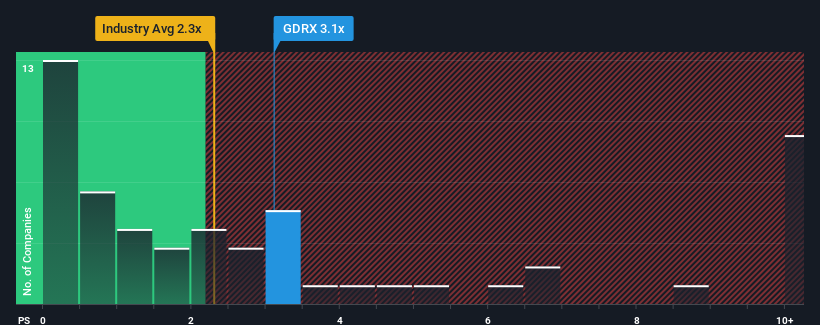

When you see that almost half of the companies in the Healthcare Services industry in the United States have price-to-sales ratios (or "P/S") below 2.3x, GoodRx Holdings, Inc. (NASDAQ:GDRX) looks to be giving off some sell signals with its 3.1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for GoodRx Holdings

How Has GoodRx Holdings Performed Recently?

With revenue growth that's inferior to most other companies of late, GoodRx Holdings has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on GoodRx Holdings.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, GoodRx Holdings would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.0%. Revenue has also lifted 23% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next three years should generate growth of 10% per annum as estimated by the analysts watching the company. With the industry predicted to deliver 11% growth each year, the company is positioned for a comparable revenue result.

In light of this, it's curious that GoodRx Holdings' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Analysts are forecasting GoodRx Holdings' revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 1 warning sign for GoodRx Holdings that you should be aware of.

If these risks are making you reconsider your opinion on GoodRx Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GDRX

GoodRx Holdings

Offers information and tools that enable consumers to compare prices and save on their prescription drug purchases in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives