- United States

- /

- Healthtech

- /

- NasdaqGS:GDRX

GoodRx Holdings, Inc.'s (NASDAQ:GDRX) 30% Price Boost Is Out Of Tune With Revenues

GoodRx Holdings, Inc. (NASDAQ:GDRX) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 55% in the last year.

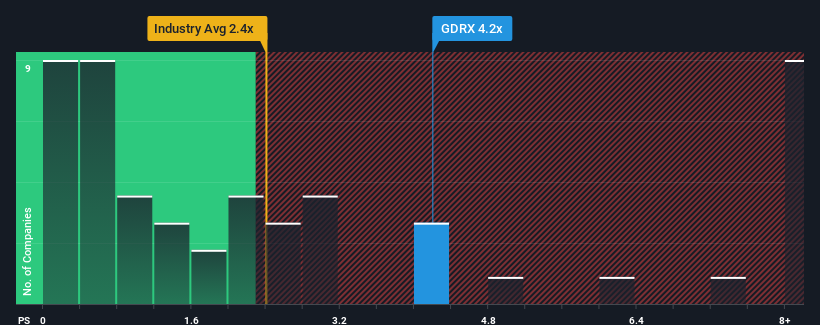

Since its price has surged higher, when almost half of the companies in the United States' Healthcare Services industry have price-to-sales ratios (or "P/S") below 2.4x, you may consider GoodRx Holdings as a stock probably not worth researching with its 4.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for GoodRx Holdings

What Does GoodRx Holdings' P/S Mean For Shareholders?

Recent times haven't been great for GoodRx Holdings as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on GoodRx Holdings will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For GoodRx Holdings?

The only time you'd be truly comfortable seeing a P/S as high as GoodRx Holdings' is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 32% in total over the last three years. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Looking ahead now, revenue is anticipated to climb by 10% per annum during the coming three years according to the analysts following the company. With the industry predicted to deliver 12% growth each year, the company is positioned for a comparable revenue result.

With this information, we find it interesting that GoodRx Holdings is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

The large bounce in GoodRx Holdings' shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given GoodRx Holdings' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for GoodRx Holdings with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GDRX

GoodRx Holdings

Offers information and tools that enable consumers to compare prices and save on their prescription drug purchases in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives