- United States

- /

- Medical Equipment

- /

- NasdaqCM:ESTA

Establishment Labs Holdings (ESTA): Assessing Valuation Following Strong Mia Femtech Results and Improved Credit Terms

Reviewed by Simply Wall St

Establishment Labs Holdings stock hit a 52-week high recently, following the release of promising 3-year clinical results for its Mia Femtech product and an amended credit agreement that improves its financing flexibility.

See our latest analysis for Establishment Labs Holdings.

The buzz around Establishment Labs Holdings is not just about impressive clinical results; the latest credit line news adds to the growing sense of momentum. After surging nearly 30% over the past month, the stock now stands at $50.81, and its one-year total shareholder return of 13.5% outpaces broader indices. However, its three-year total return remains negative. Recent gains suggest renewed optimism about both the company's growth prospects and its financial stability.

If you’re watching ESTAs momentum and want to see what else could be gaining steam, take the next step and discover fast growing stocks with high insider ownership

With shares soaring and analyst targets still above current levels, the question becomes clear: is ESTA undervalued, or is recent momentum merely a sign that the market has already priced in future growth?

Most Popular Narrative: 8.4% Undervalued

The narrative sets a fair value of $55.44 for Establishment Labs Holdings, about 8% above its last close at $50.81. This puts current optimism in the spotlight and raises an important question: what is driving this valuation premium?

Accelerating surgeon adoption and utilization curve in the U.S., combined with further account additions and growing patient demand (amplified by patient-driven requests and social media engagement), positions the company for continued strong revenue growth and sustainable market share gains in a large, culturally receptive, and increasingly affluent market.

Want to know why the narrative expects so much future upside? The secret sauce is extraordinary growth forecasts and ambitious margin targets that reward believers. Curious about the exact leaps in revenue, profits, and multiples embedded in this price? The full narrative breaks down the big bets that make or break the valuation.

Result: Fair Value of $55.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high expenses or slower-than-expected commercial growth in China could quickly challenge analysts’ optimism about Establishment Labs Holdings’ future performance.

Find out about the key risks to this Establishment Labs Holdings narrative.

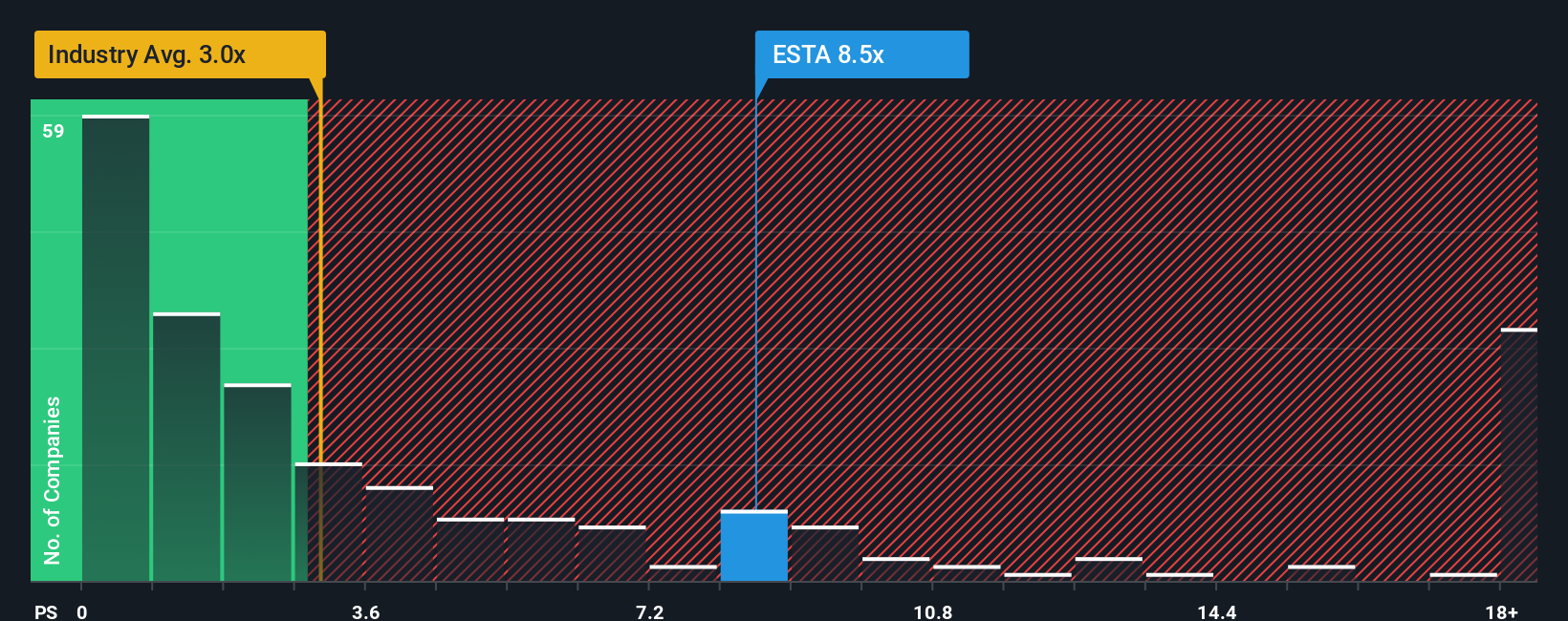

Another View: Multiples Show a Lofty Valuation

While many see upside in ESTA, its current price-to-sales ratio of 8.3x is well above both the peer average (2.7x) and the US Medical Equipment industry (3x). Even the fair ratio is just 4.9x, suggesting the market may be pricing in a lot of future success already. Does this premium signal risk or opportunity ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Establishment Labs Holdings Narrative

If you want to interpret the numbers differently or prefer your own approach, you can easily shape your own outlook in just a few minutes. Do it your way

A great starting point for your Establishment Labs Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let your next big investment opportunity pass you by. More unique stock ideas are just a click away inside Simply Wall Street’s powerful screener tools.

- Boost your portfolio’s income potential by checking out these 19 dividend stocks with yields > 3% offering high yields that consistently outperform low-interest alternatives.

- Take advantage of pricing gaps in the market and unlock hidden value with these 870 undervalued stocks based on cash flows that trade for less than their true worth.

- Catch the next technological boom by scanning these 27 AI penny stocks for opportunities capturing rapid growth and innovation driven by artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Establishment Labs Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ESTA

Establishment Labs Holdings

A medical technology company, manufactures and markets medical devices for aesthetic and reconstructive plastic surgeries.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives