- United States

- /

- Healthcare Services

- /

- NasdaqGS:ENSG

Ensign Group (ENSG): Evaluating Valuation After Strong Shareholder Returns and Growth Momentum

Reviewed by Simply Wall St

Ensign Group (ENSG) shares have delivered a strong run over the past year, climbing almost 17%. Investors are increasingly watching its consistent growth in revenue and net income, which continue to set it apart in the healthcare sector.

See our latest analysis for Ensign Group.

Momentum around Ensign Group has clearly been building, with its 30-day share price return of 6.5% and a year-to-date surge of 37.5% catching investor attention. Long-term holders have seen impressive results as well, with a total shareholder return of 17.3% over the last year and more than doubling their money over three years.

If you’re on the lookout for more resilient healthcare stocks showing strong trends, discover new opportunities with our See the full list for free.

But with shares nearing analyst price targets and robust growth already on display, the key question for investors becomes clear: is Ensign Group undervalued at these levels, or is the market already pricing in its future potential?

Price-to-Earnings of 32.4x: Is it justified?

Ensign Group trades at a Price-to-Earnings (PE) ratio of 32.4x, placing it well above both the US Healthcare industry average of 21.7x and the peer average of 15.9x. At a last close of $182.7, this premium hints that investors expect robust future growth or exceptional business quality.

The Price-to-Earnings ratio measures the price investors are willing to pay today for each dollar of earnings generated by the company. In sectors like healthcare, where predictable earnings can command higher multiples, the PE ratio serves as a pulse-check on market sentiment and profit growth expectations.

Ensign's elevated multiple is difficult to overlook. While its recent earnings growth is impressive, the current valuation leaves little room for disappointment. Compared to industry averages, this level sets a high bar and could signal that enthusiasm is running ahead of fundamentals. Notably, the estimated fair PE ratio of 23x suggests a possible reset in expectations should growth slow.

Explore the SWS fair ratio for Ensign Group

Result: Price-to-Earnings of 32.4x (OVERVALUED)

However, slowing revenue growth or any earnings miss could quickly challenge the premium valuation currently enjoyed by Ensign Group shares.

Find out about the key risks to this Ensign Group narrative.

Another View: Discounted Cash Flow Model

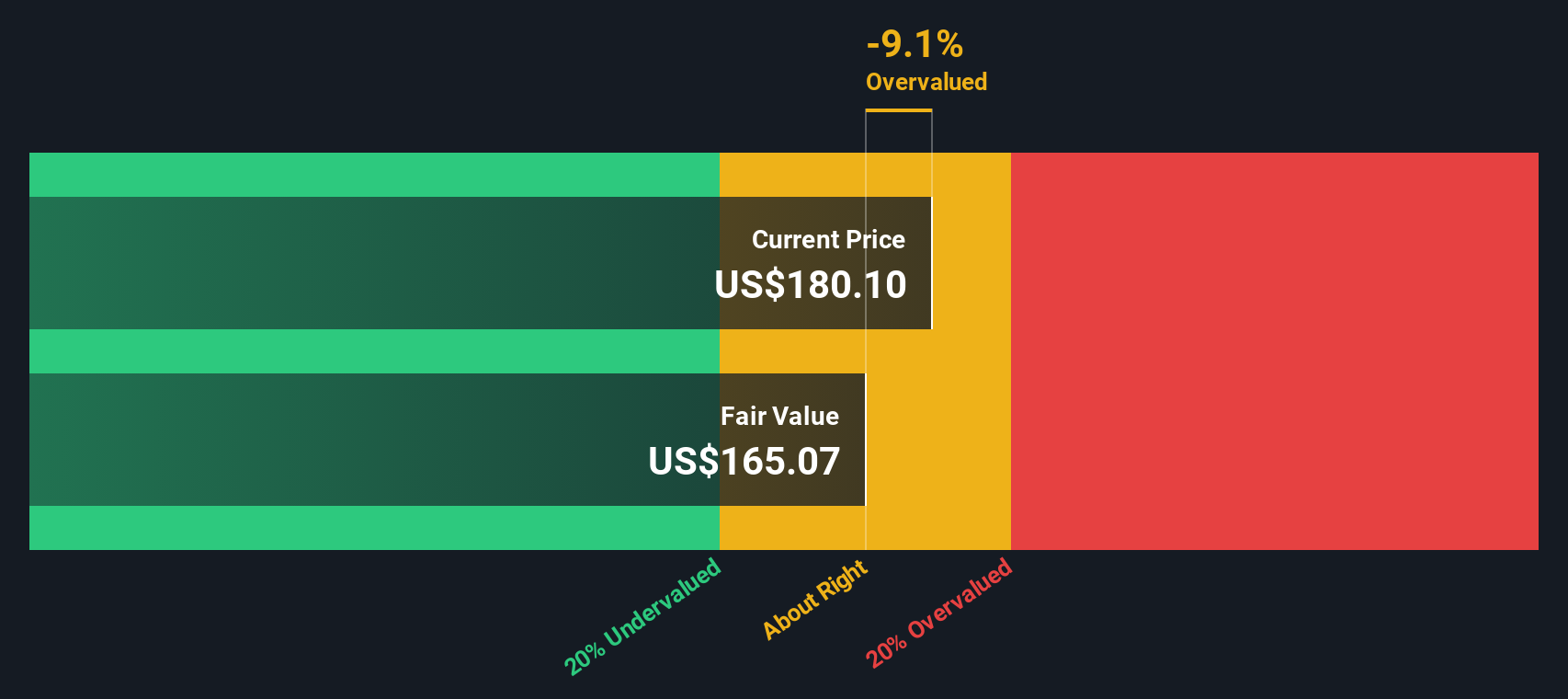

Taking a different approach, our SWS DCF model estimates Ensign Group’s fair value at $165.07. This suggests the shares may be trading above their intrinsic worth. This perspective challenges the premium indicated by the high earnings multiple. Could growth expectations be a step ahead of real value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ensign Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ensign Group Narrative

If our assessment doesn't fit your view, or you want to dig deeper using your own research, you can easily shape your own narrative in just a few minutes with Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Ensign Group.

Looking for More Smart Investment Ideas?

Don't leave your portfolio limited to one opportunity. Broaden your investing horizons and get ahead of the next big trend before everyone else catches on.

- Kickstart your search for untapped potential with these 3579 penny stocks with strong financials. These agile players could unlock strong gains as they break through to new markets.

- Harness the future of healthcare by checking out these 34 healthcare AI stocks, using AI to transform patient outcomes and revolutionize the industry.

- Maximize your income potential and build stability with these 21 dividend stocks with yields > 3%, offering dependable yields greater than 3% for steady, long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ensign Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ENSG

Ensign Group

Provides skilled nursing, senior living, and rehabilitative services.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives