- United States

- /

- Medical Equipment

- /

- NasdaqCM:ECOR

electroCore, Inc. (NASDAQ:ECOR) Soars 34% But It's A Story Of Risk Vs Reward

electroCore, Inc. (NASDAQ:ECOR) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 40%.

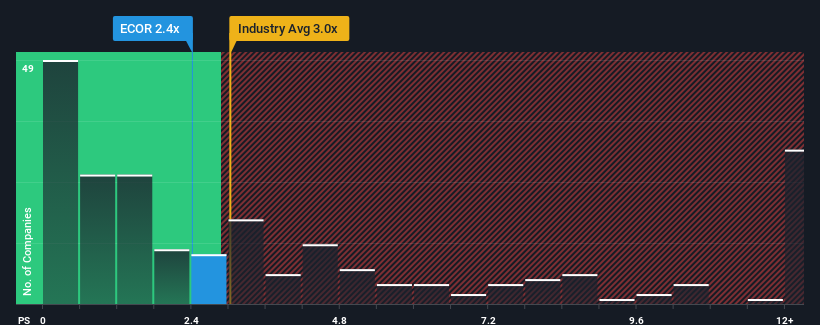

In spite of the firm bounce in price, electroCore may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 2.4x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3x and even P/S higher than 7x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for electroCore

What Does electroCore's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, electroCore has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think electroCore's future stacks up against the industry? In that case, our free report is a great place to start.How Is electroCore's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as electroCore's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 96%. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 40% per annum during the coming three years according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 9.2% per annum, which is noticeably less attractive.

In light of this, it's peculiar that electroCore's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

electroCore's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at electroCore's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for electroCore that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ECOR

electroCore

A bioelectronic medicine and general wellness company, provides non-invasive vagus nerve stimulation (“nVNS”) technology platform in the United States, the United Kingdom, and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success