- United States

- /

- Medical Equipment

- /

- NasdaqGS:DXCM

DexCom (DXCM): Evaluating Valuation in Light of Analyst Upgrades and Progress on Next-Gen 15-Day Sensor

Reviewed by Simply Wall St

DexCom (DXCM) is back in the spotlight after recent analyst updates highlighted an evolving product lineup and the rollout of a next-generation 15-day sensor. These moves further support expectations for steady growth and ongoing innovation.

See our latest analysis for DexCom.

Recent momentum has been mixed for DexCom, with a 1-day share price return of 1.93% and a 7-day gain of 5.35% that hint at renewed optimism. However, longer-term returns reflect challenges, as the 1-year total shareholder return is down 4.6% and multi-year performance remains in the red. Still, robust innovation and upbeat sentiment around new products keep the stock’s growth story very much in play.

If you’re actively watching developments in medtech, the next logical step is to discover opportunities from our curated See the full list for free..

With recent analyst upgrades, a next-generation sensor launch, and shares trading well below consensus price targets, the question arises: is DexCom an overlooked value play, or has the market already accounted for its future growth prospects?

Most Popular Narrative: 29.5% Undervalued

DexCom’s most widely followed narrative points to a fair value that is substantially above the recent closing price, with bullish assumptions included in the analysis. The basis for this optimism is not just headline growth; instead, it is a thesis that combines market expansion, technology adoption, and new patient reach.

The recent expansion of insurance reimbursement for type 2 non-insulin diabetes patients, now covering nearly 6 million lives across the three largest U.S. PBMs, opens a large, previously untapped segment of DexCom's addressable market. This development is driving new patient growth and supporting robust multi-year revenue expansion.

Want to know why the consensus sees so much upside? The real story lies in bold expectations for patient growth and a profit surge that outpaces typical medtech forecasts. Wondering which forecasts drive such a confident target? Dig deeper to uncover the critical targets powering this punchy valuation.

Result: Fair Value of $98.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks remain. Industry competition and potential changes in reimbursement trends could still disrupt DexCom’s upbeat growth narrative.

Find out about the key risks to this DexCom narrative.

Another View: Market Multiples Tell a Different Story

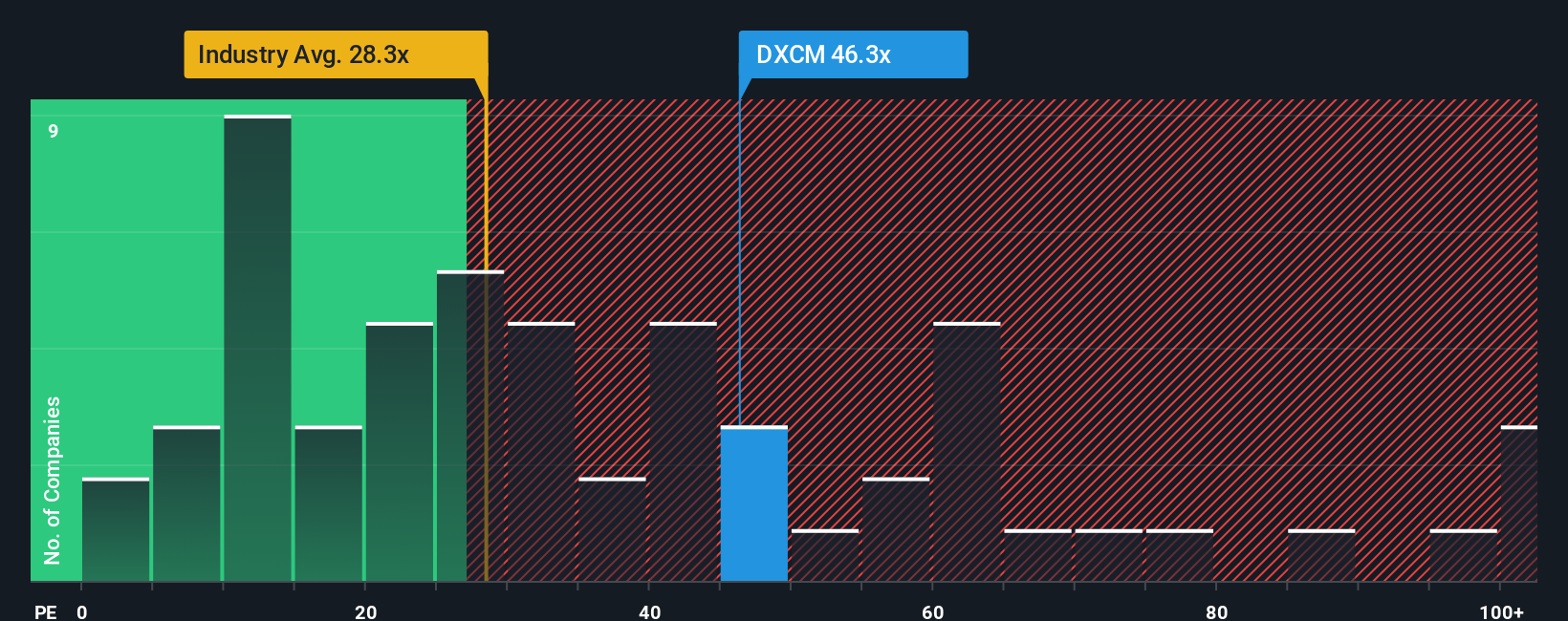

While the fair value estimate paints DexCom as undervalued, a glance at the price-to-earnings ratio signals caution. DexCom trades at 47.9x earnings, which is well above both the industry average of 29.8x and its peer average of 44.6x. It is also significantly higher than the fair ratio of 37.9x. This premium reflects big expectations, but how long can the stock justify such a high bar?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DexCom Narrative

If you see the numbers differently or want a fresh perspective, it takes less than three minutes to build your own view on DexCom. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding DexCom.

Looking for More Smart Investment Ideas?

Step up your investment game with handpicked opportunities most investors overlook. Your next big winner might be waiting, so don’t miss out on these expert-curated lists.

- Seize the chance for growth by tracking these 3581 penny stocks with strong financials, which have strong financials but often fly beneath the radar of large funds and media attention.

- Tap into the high-yield potential of income investments by reviewing these 17 dividend stocks with yields > 3%, offering reliable payments that can help boost your portfolio returns year after year.

- Ride the momentum in tomorrow’s tech by following these 24 AI penny stocks, leading advancements in artificial intelligence across industries such as healthcare, finance, and manufacturing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DXCM

DexCom

A medical device company, focuses on the design, development, and commercialization of continuous glucose monitoring (CGM) systems in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives