- United States

- /

- Medical Equipment

- /

- NasdaqCM:DCTH

Delcath Systems (DCTH): Exploring Valuation After Surprise Net Income Turnaround

Reviewed by Simply Wall St

Delcath Systems (DCTH) caught attention after sharing its third quarter and nine-month results, revealing a shift from last year’s net loss to net income for the current period. This turnaround is of interest to many investors.

See our latest analysis for Delcath Systems.

Delcath Systems’ turnaround has certainly made waves, but the optimism has not yet translated into momentum for the share price. While the company’s recent swing to net income signals progress, the 1-year total shareholder return is still down 13.9% and the year-to-date share price return stands at -32%. That said, the company’s three-year total shareholder return of over 210% shows just how quickly sentiment can change when new catalysts take hold.

If this kind of rapid shift in fortunes sparks your interest, now is the perfect moment to broaden your search and discover See the full list for free.

With Delcath’s strong revenue growth and a share price well below analyst targets, the question now is whether the recent turnaround presents a real buying opportunity or if the market has already priced in future gains.

Most Popular Narrative: 64.7% Undervalued

While Delcath Systems last closed at $8.58, the most closely followed narrative sets its fair value much higher. This perspective frames the current price as a deep discount, highlighting the disconnect between near-term volatility and expectations for the years ahead.

Accelerated growth in HEPZATO and CHEMOSAT sales is being driven by increased incidence of liver and metastatic cancers due to demographic shifts, supporting long-term revenue expansion as Delcath addresses a growing clinical need. Integration into the NDRA and 340B programs increases market access, particularly among large academic centers and underserved patient populations. This is likely to drive sustained volume growth and top-line revenue, partially offsetting the per-unit pricing reduction.

Ever wonder what bold, behind-the-scenes growth targets fuel this eye-catching fair value? The forecasts point to giant leaps in market share and profitability. Dive in to see which blockbuster projections analysts are betting on to propel Delcath far beyond today's price.

Result: Fair Value of $24.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on a single therapy and significant pricing pressures could quickly challenge the current growth outlook if adoption or margins weaken.

Find out about the key risks to this Delcath Systems narrative.

Another View: What Do Price Multiples Suggest?

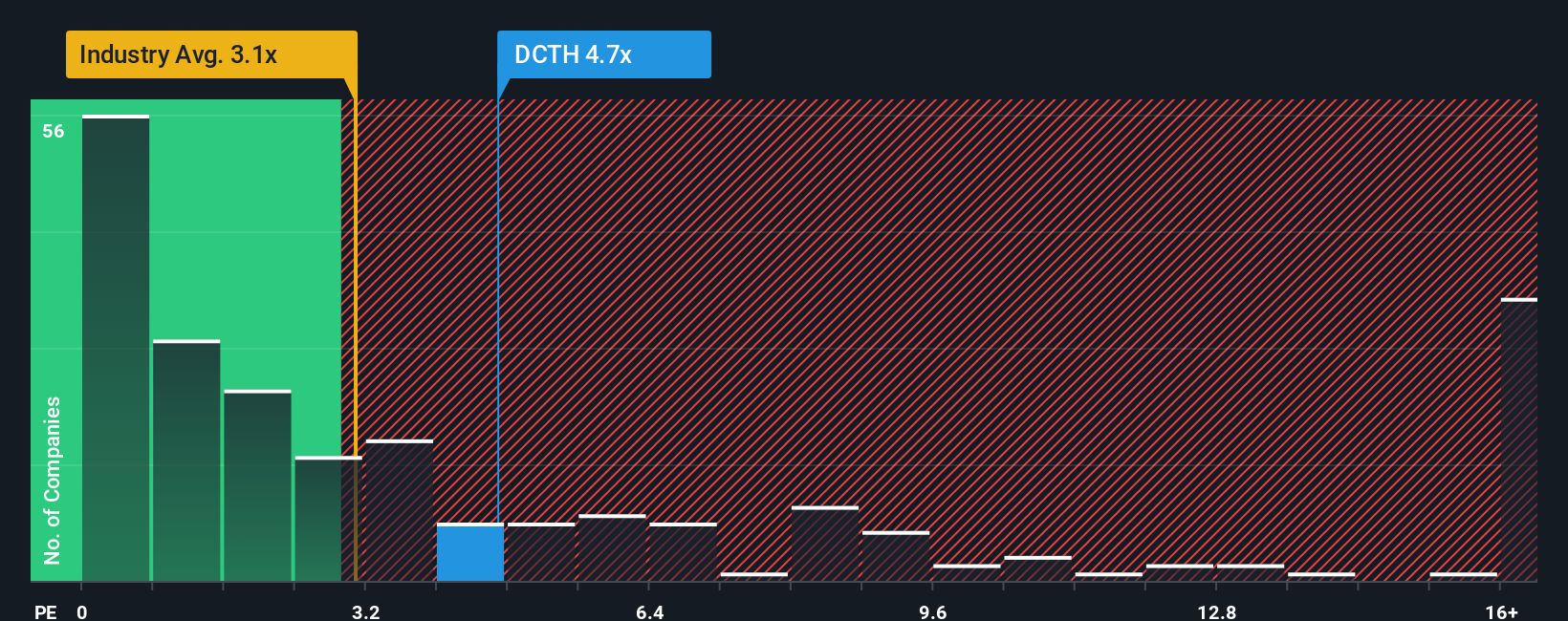

Looking from a different angle, Delcath trades at a price-to-sales ratio of 3.8x. This is higher than the US Medical Equipment industry average of 3.1x, but significantly lower than the peer average of 20.7x. The fair ratio stands at 5.7x, which suggests the market could reconsider how it values the stock. Does this gap point to hidden risk, or a big opportunity if sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Delcath Systems Narrative

If you see things differently or want to dive into the numbers yourself, you can craft your own take on Delcath in just a few minutes, Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Delcath Systems.

Looking for more investment ideas?

Don’t let opportunity pass you by. The Simply Wall Street Screener is powered by fresh data and unique rankings to help you pinpoint the stocks that match your goals.

- Capture rapid gains by targeting these 3575 penny stocks with strong financials poised for breakout growth thanks to strong financials and untapped market potential.

- Collect consistent income by focusing on these 16 dividend stocks with yields > 3% delivering yields over 3% and robust cash flows for the long haul.

- Ride the innovation wave by filtering for these 24 AI penny stocks positioned at the forefront of artificial intelligence and emerging technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DCTH

Delcath Systems

An interventional oncology company, focuses on the treatment of primary and metastatic liver cancers in the United States and Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives