- United States

- /

- Medical Equipment

- /

- NasdaqGS:CVRX

The Price Is Right For CVRx, Inc. (NASDAQ:CVRX) Even After Diving 47%

To the annoyance of some shareholders, CVRx, Inc. (NASDAQ:CVRX) shares are down a considerable 47% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 27% share price drop.

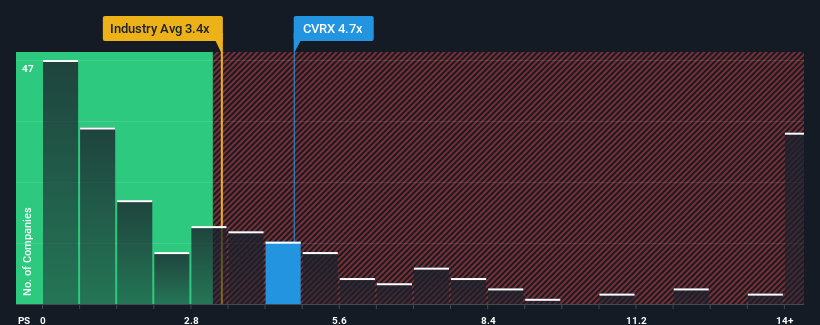

In spite of the heavy fall in price, CVRx may still be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 4.7x, since almost half of all companies in the Medical Equipment in the United States have P/S ratios under 3.4x and even P/S lower than 1.2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for CVRx

What Does CVRx's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, CVRx has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think CVRx's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, CVRx would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 60%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 33% per year over the next three years. With the industry only predicted to deliver 10% each year, the company is positioned for a stronger revenue result.

With this information, we can see why CVRx is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On CVRx's P/S

CVRx's P/S remain high even after its stock plunged. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into CVRx shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - CVRx has 3 warning signs we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CVRX

CVRx

A commercial-stage medical device company, engages in developing, manufacturing, and commercializing neuromodulation solutions for patients with cardiovascular diseases in the United States, Germany, and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives