- United States

- /

- Healthcare Services

- /

- NasdaqGM:CSTL

Upgrade: Analysts Just Made A Meaningful Increase To Their Castle Biosciences, Inc. (NASDAQ:CSTL) Forecasts

Celebrations may be in order for Castle Biosciences, Inc. (NASDAQ:CSTL) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects. The market may be pricing in some blue sky too, with the share price gaining 20% to US$26.83 in the last 7 days. It will be interesting to see if today's upgrade is enough to propel the stock even higher.

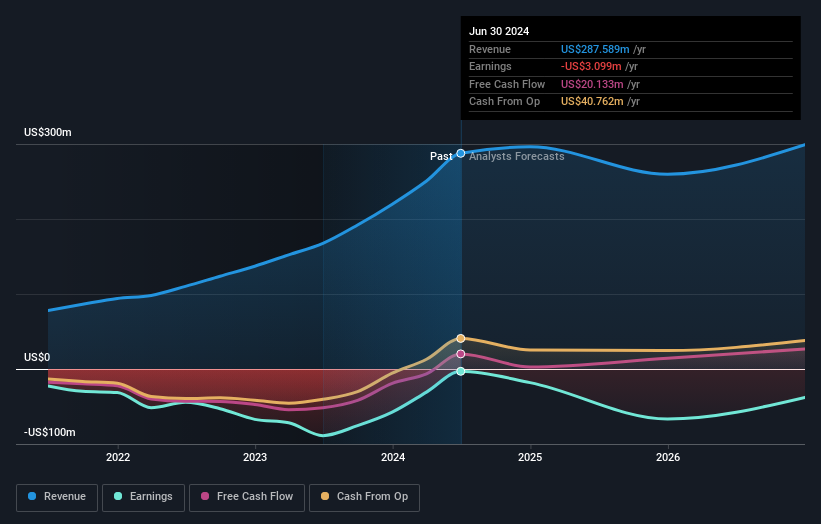

After the upgrade, the eight analysts covering Castle Biosciences are now predicting revenues of US$296m in 2024. If met, this would reflect a credible 3.0% improvement in sales compared to the last 12 months. Per-share losses are expected to explode, reaching US$0.60 per share. Yet prior to the latest estimates, the analysts had been forecasting revenues of US$260m and losses of US$1.61 per share in 2024. We can see there's definitely been a change in sentiment in this update, with the analysts administering a sizeable upgrade to this year's revenue estimates, while at the same time reducing their loss estimates.

View our latest analysis for Castle Biosciences

Despite these upgrades, the analysts have not made any major changes to their price target of US$35.38, implying that their latest estimates don't have a long term impact on what they think the stock is worth.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's pretty clear that there is an expectation that Castle Biosciences' revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 6.1% growth on an annualised basis. This is compared to a historical growth rate of 37% over the past five years. Compare this to the 166 other companies in this industry with analyst coverage, which are forecast to grow their revenue at 6.8% per year. So it's pretty clear that, while Castle Biosciences' revenue growth is expected to slow, it's expected to grow roughly in line with the industry.

The Bottom Line

The most important thing here is that analysts reduced their loss per share estimates for this year, reflecting increased optimism around Castle Biosciences' prospects. They also upgraded their revenue forecasts, although the latest estimates suggest that Castle Biosciences will grow in line with the overall market. The lack of change in the price target is puzzling, but with a serious upgrade to this year's earnings expectations, it might be time to take another look at Castle Biosciences.

These earnings upgrades look like a sterling endorsement, but before diving in - you should know that we've spotted 3 potential flags with Castle Biosciences, including dilutive stock issuance over the past year. For more information, you can click through to our platform to learn more about this and the 2 other flags we've identified .

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CSTL

Castle Biosciences

A molecular diagnostics company, provides test solutions for the diagnosis and treatment of dermatologic cancers, Barrett’s esophagus (BE), uveal melanoma, and mental health conditions.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.