- United States

- /

- Healthcare Services

- /

- NasdaqGM:CSTL

Did New Clinical Evidence for DecisionDx-Melanoma Just Shift Castle Biosciences' (CSTL) Investment Narrative?

Reviewed by Sasha Jovanovic

- Castle Biosciences recently announced new data showing that its DecisionDx-Melanoma test can improve sentinel lymph node biopsy decision making and recurrence risk prediction in patients with cutaneous melanoma, with findings presented at the 2nd European Congress on Dermato-Oncology in Paris.

- This research highlights the test’s ability to personalize melanoma management by integrating gene-expression profiling with clinical features, addressing limitations in current risk assessment for SLNB and recurrence.

- We'll explore how the new clinical evidence supporting DecisionDx-Melanoma's value could influence Castle Biosciences' outlook for broader adoption and growth.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Castle Biosciences Investment Narrative Recap

Castle Biosciences’ path to long-term value relies on broad clinical adoption and payer coverage for its molecular diagnostics, particularly DecisionDx-Melanoma. While new data further validating DecisionDx-Melanoma’s clinical utility may aid adoption efforts, the company’s most immediate catalyst remains securing expanded reimbursement, while biggest current risk is the persistent challenge of obtaining and maintaining payer coverage for its core and pipeline tests, the latest findings alone do not fundamentally shift this dynamic in the short term.

Among recent corporate news, Castle’s FDA Breakthrough Device designation for DecisionDx-Melanoma aligns closely with the new clinical data, reinforcing the company’s push for deeper clinical integration of this platform and supporting the primary catalyst of broad-based adoption momentum. Other developments, such as the launch of the atopic dermatitis test or earnings volatility, do not directly affect the near-term adoption or coverage environment for DecisionDx-Melanoma.

Yet, in contrast to promising clinical results, investors should be aware that payer and commercial insurance coverage hurdles persist in ways that...

Read the full narrative on Castle Biosciences (it's free!)

Castle Biosciences' narrative projects $357.5 million revenue and $19.3 million earnings by 2028. This requires 1.1% yearly revenue growth and a $28.8 million earnings increase from the current -$9.5 million.

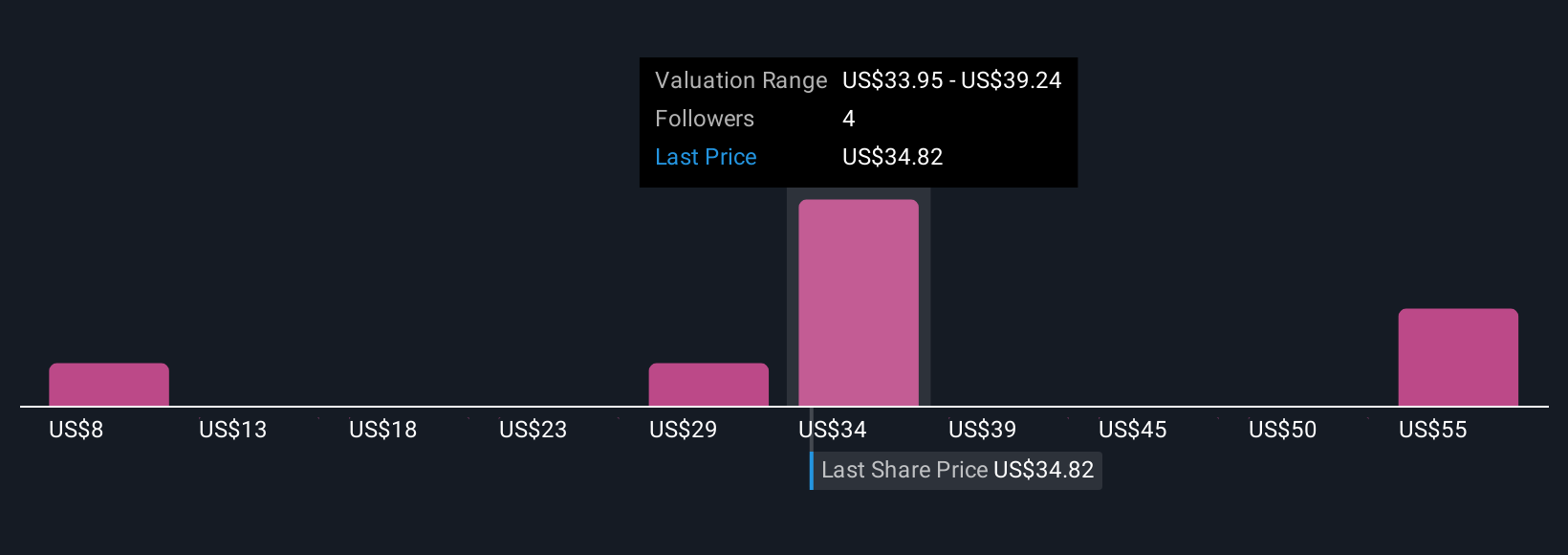

Uncover how Castle Biosciences' forecasts yield a $35.62 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Four valuation estimates from the Simply Wall St Community stretch from US$7.50 to just over US$63.44 per share. As investors debate the significance of new clinical evidence, differences in outlook highlight critical questions around payer coverage and future growth, explore several perspectives to understand how opinions can diverge.

Explore 4 other fair value estimates on Castle Biosciences - why the stock might be worth as much as 83% more than the current price!

Build Your Own Castle Biosciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Castle Biosciences research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Castle Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Castle Biosciences' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CSTL

Castle Biosciences

A molecular diagnostics company, provides test solutions for the diagnosis and treatment of dermatologic cancers, Barrett’s esophagus (BE), uveal melanoma, and mental health conditions.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives