- United States

- /

- Healthcare Services

- /

- NasdaqGM:CSTL

Castle Biosciences, Inc.'s (NASDAQ:CSTL) 44% Share Price Surge Not Quite Adding Up

Despite an already strong run, Castle Biosciences, Inc. (NASDAQ:CSTL) shares have been powering on, with a gain of 44% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 2.8% isn't as attractive.

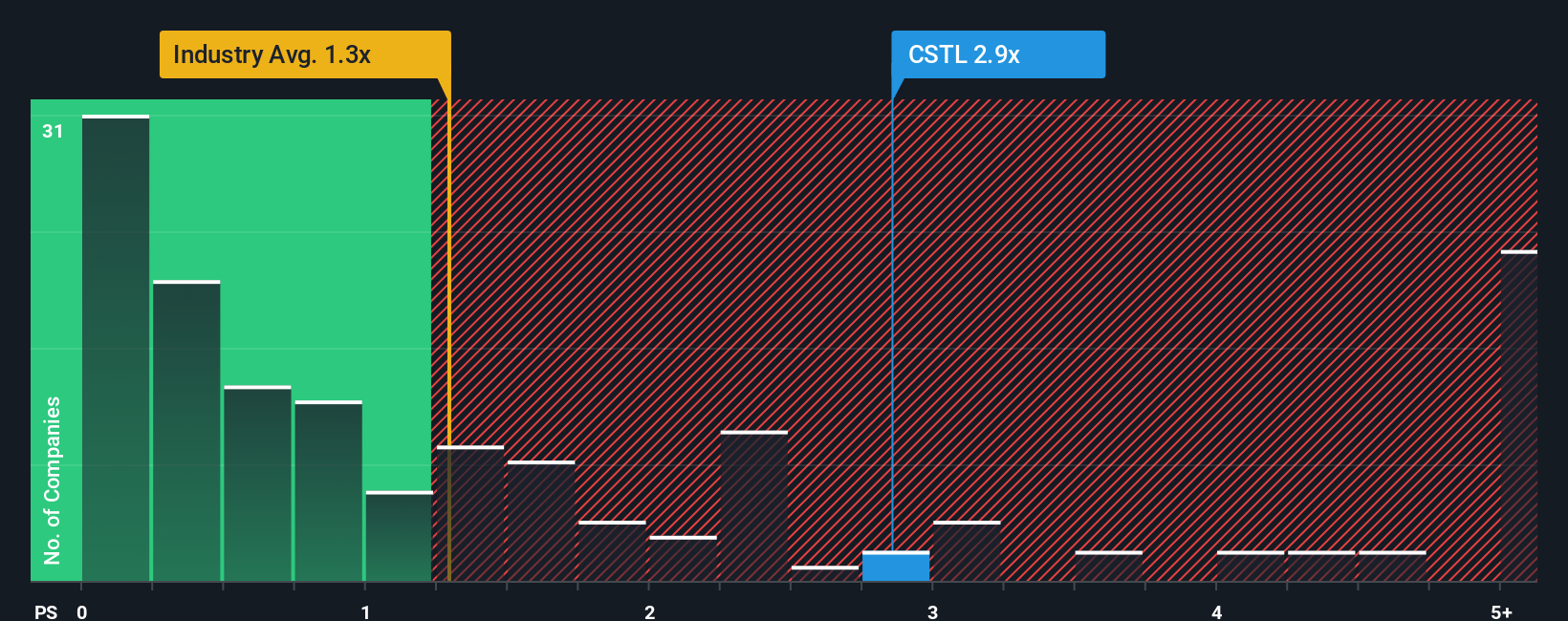

Following the firm bounce in price, given close to half the companies operating in the United States' Healthcare industry have price-to-sales ratios (or "P/S") below 1.3x, you may consider Castle Biosciences as a stock to potentially avoid with its 2.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Castle Biosciences

What Does Castle Biosciences' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Castle Biosciences has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Castle Biosciences.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Castle Biosciences would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 10%. The latest three year period has also seen an excellent 178% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 6.0% per annum as estimated by the seven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 5.4% per year, which is not materially different.

In light of this, it's curious that Castle Biosciences' P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does Castle Biosciences' P/S Mean For Investors?

The large bounce in Castle Biosciences' shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given Castle Biosciences' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

You need to take note of risks, for example - Castle Biosciences has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CSTL

Castle Biosciences

A molecular diagnostics company, provides test solutions for the diagnosis and treatment of dermatologic cancers, Barrett’s esophagus (BE), uveal melanoma, and mental health conditions.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives