- United States

- /

- Healthcare Services

- /

- NasdaqGM:CSTL

Castle Biosciences (CSTL) Margin Miss Reinforces Concerns Over Unprofitable Growth and Sector Lag

Reviewed by Simply Wall St

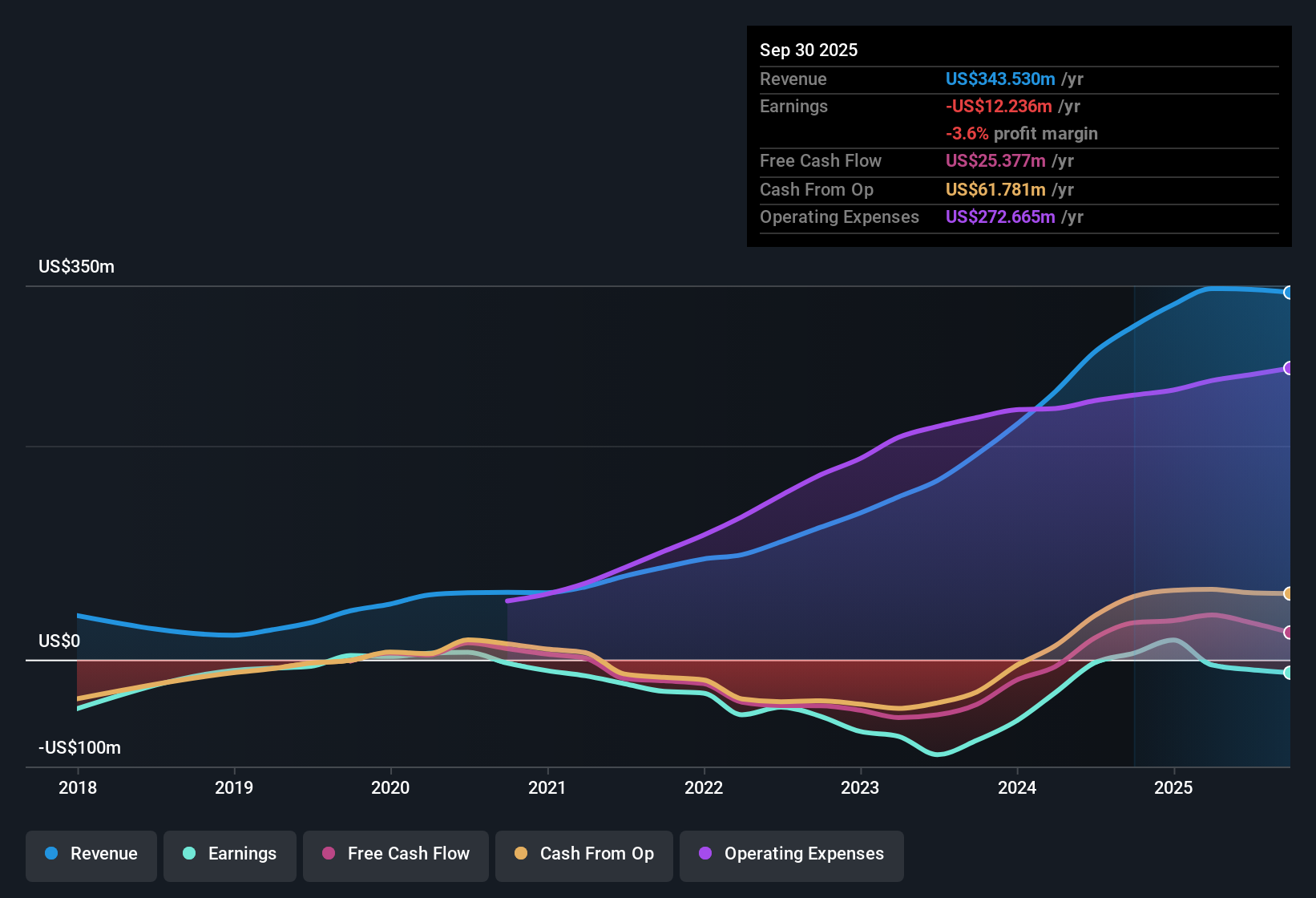

Castle Biosciences (CSTL) continues to operate at a loss, with recent filings confirming the company has yet to achieve net profit margin improvement over the past year and is still generating negative earnings. Despite reducing its annual losses at a rate of 9.6% per year over the last five years, it remains on a slower growth path. Forecasted revenue is expected to rise 6.5% per year, lagging behind the broader US market’s 10.5% annual growth rate. With profitability still out of reach in the near term, investors are watching ongoing operating losses and sector comparisons closely to gauge the company’s progress.

See our full analysis for Castle Biosciences.Next, we’ll see how these earnings results compare to the prevailing market narratives. Some expectations may hold up, while others could be challenged by the latest data.

See what the community is saying about Castle Biosciences

Margins Remain Negative as Cost Pressures Persist

- Castle Biosciences has not achieved any improvement in net profit margin over the last year, remaining in negative territory as confirmed by recent filings.

- Consensus narrative notes that while there are ongoing efforts such as investments in clinical evidence and expansion of test offerings, persistent negative margins and concentrated revenue sources raise questions about the path to durable earnings.

- Bears argue that competitive threats and rising expenses may keep profitability out of reach, even as new markets are targeted.

- Consensus also acknowledges that heavy reimbursement risks remain and suggests that the company's expenses could continue to outpace revenue growth if new payer policies do not materialize as hoped.

Growth Lags US Market Despite Pipeline Expansion

- Castle's forecast annual revenue growth of 6.5% trails the broader US market's expected 10.5% rate, highlighting slower top-line momentum.

- According to analysts' consensus view, expansion into novel test areas like gastrointestinal diagnostics is designed to diversify revenue and drive adoption, but immediate revenue improvements have not matched sector trends.

- Consensus view suggests that while pipelines and new sales initiatives create long-term growth potential, short-term revenue may remain below the industry average if adoption or reimbursement does not meaningfully accelerate.

- It is noteworthy that clinical evidence and physician education gains, which are typically catalysts for rapid test utilization, have yet to fully close the growth gap with market peers.

Valuation Discount Comes With Ongoing Risks

- Castle Biosciences trades below the DCF fair value of $60.95, but remains expensive relative to peers based on price-to-sales, and continues to generate negative earnings with no path to profitability in the next three years.

- Analysts' consensus view highlights a valuation tension: the current share price of $31.63 sits well below the analyst price target of $36.50, presenting a 15.4% implied upside. However, the company would need to improve margins substantially and trade at a future PE of 72.0x by 2028 to justify this target.

- Consensus also points out that increasing competition and razor-thin or negative margins challenge the notion that Castle’s discount is a straightforward buying opportunity.

- This gap between fair value models and peer multiples reinforces why many investors are keeping Castle on a watch list rather than jumping in at current levels.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Castle Biosciences on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the latest numbers? Share your perspective and craft your own narrative in just a few minutes using Do it your way.

A great starting point for your Castle Biosciences research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Castle Biosciences continues to struggle with persistent negative margins, sluggish revenue growth, and ongoing questions about the sustainability of its earnings path.

If steady results are a priority, use our stable growth stocks screener (2077 results) to find companies that consistently deliver solid revenue and earnings growth, which may help avoid the volatility seen here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CSTL

Castle Biosciences

A molecular diagnostics company, provides test solutions for the diagnosis and treatment of dermatologic cancers, Barrett’s esophagus (BE), uveal melanoma, and mental health conditions.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives