- United States

- /

- Medical Equipment

- /

- NasdaqGS:CSII

Cardiovascular Systems (NASDAQ:CSII) Shareholders Have Enjoyed A Whopping 399% Share Price Gain

Long term investing can be life changing when you buy and hold the truly great businesses. And highest quality companies can see their share prices grow by huge amounts. For example, the Cardiovascular Systems, Inc. (NASDAQ:CSII) share price is up a whopping 399% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. Also pleasing for shareholders was the 19% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 15% in 90 days).

See our latest analysis for Cardiovascular Systems

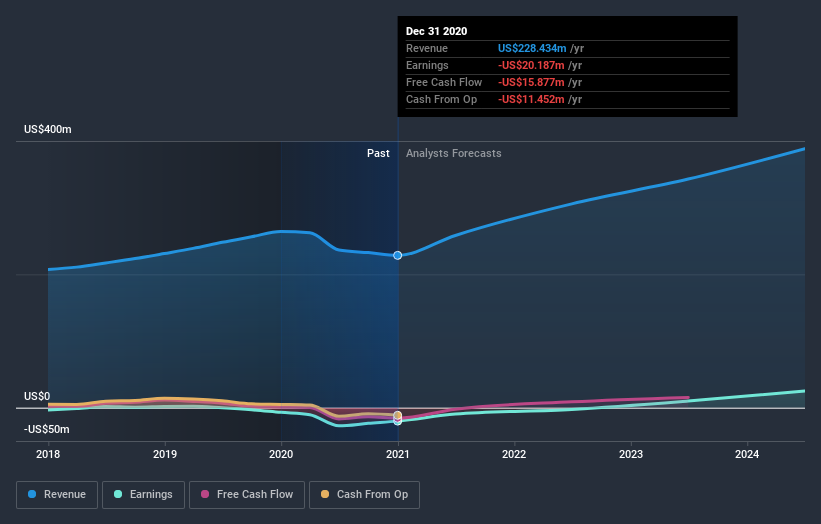

Given that Cardiovascular Systems didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Cardiovascular Systems saw its revenue grow at 7.4% per year. That's a fairly respectable growth rate. Arguably it's more than reflected in the very strong share price gain of 38% a year over a half a decade. We usually like strong growth stocks but it does seem the market already appreciates this one quite well!

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Cardiovascular Systems shareholders are up 2.2% for the year. But that was short of the market average. On the bright side, the longer term returns (running at about 38% a year, over half a decade) look better. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with Cardiovascular Systems .

Cardiovascular Systems is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Cardiovascular Systems or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:CSII

Cardiovascular Systems

Cardiovascular Systems, Inc., a medical technology company, develops and commercializes solutions to treat peripheral and coronary artery diseases in the United States and internationally.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives