- United States

- /

- Healthcare Services

- /

- NasdaqGS:CRVL

CorVel (CRVL) Profit Margin Surge Reinforces Bullish Narratives Despite Valuation Concerns

Reviewed by Simply Wall St

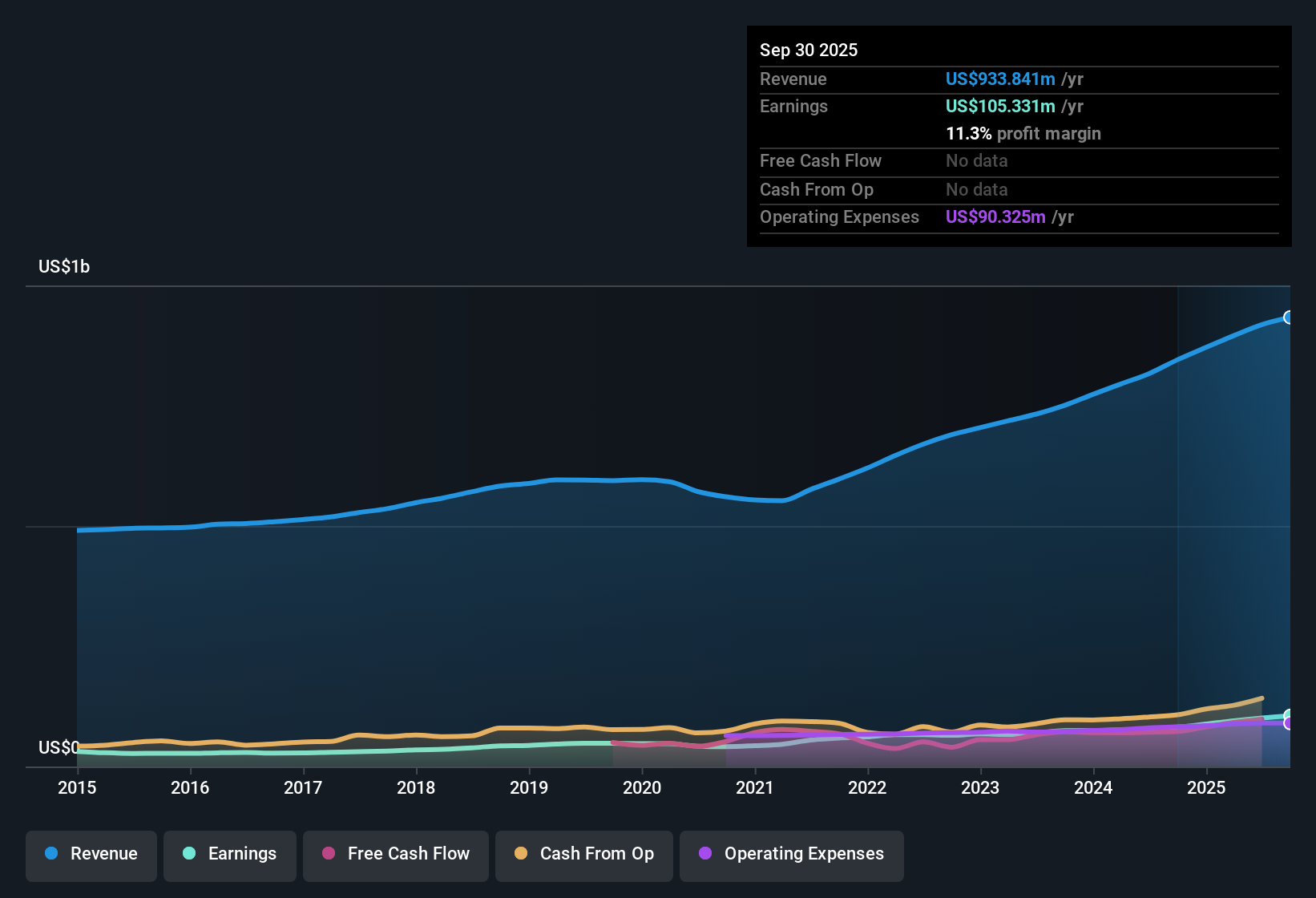

CorVel (CRVL) delivered high quality results in its latest earnings release, reporting a net profit margin of 11.3% compared to 9.6% last year. Over the past year, earnings growth accelerated to 29.2% against a five-year average of 15.3%. This reflects notable momentum and improved profitability that stands out in the company’s recent performance. Investors may see the combination of margin expansion and rapid earnings growth as a strong positive, even as valuation ratios suggest the shares are trading on the higher side compared to industry norms.

See our full analysis for CorVel.Next, we’ll break down how these headline figures compare to the most prevalent narratives in the market, highlighting where the consensus holds and where the numbers spark debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Surge Outpaces Five-Year Average

- CorVel’s net profit margin reached 11.3%, improving substantially from 9.6% last year and outperforming its five-year annual profit growth rate of 15.3%.

- The rapid acceleration in profit margin heavily supports the bullish case for robust operational efficiency. The filing confirms gains have not only persisted but gained pace in the last year.

- Analysts note this margin expansion shows recent management initiatives are translating into real bottom-line results, going beyond the steady but slower five-year trend.

- While bulls may have anticipated continued improvement, the shift to double-digit margins has outpaced historical averages and indicates structural enhancements rather than a typical growth cycle.

Valuation Remains Well Above DCF Fair Value

- CorVel trades at a share price of $76.06, noticeably higher than its DCF fair value of $60.52, and commands a price-to-earnings ratio of 37.1x. This ratio, though below the peer average of 42.8x, is still significantly above the broader US Healthcare industry average of 20.7x.

- The prevailing market view highlights that while profitability and growth metrics excite investors, the current share price implies the stock is pricing in ongoing outperformance beyond recent strong results.

- This premium could deter value-focused investors who weigh fair value more heavily, especially given the 25% elevation of the stock price relative to DCF fair value.

- However, the fact that CorVel’s price multiple is still lower than peers may be leveraged in bullish narratives, suggesting continued upside in a favorable industry environment.

Sustained Growth Supports the Upside Thesis

- Earnings growth accelerated to 29.2% over the past year, well ahead of the five-year compound annual rate of 15.3%, signaling that recent performance is outpacing long-term trends.

- The current momentum reinforces the view that CorVel’s focus on efficiency and scale is driving meaningful improvements, with little evidence of risk undermining this trajectory.

- The steady profit and revenue improvement referenced in risks and rewards data challenges any concerns that growth momentum might soon slow or revert to lower levels.

- With only a single minor risk identified in the filings and no major flagged concerns, investors have additional confidence that sustained gains are rooted in durable business changes.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on CorVel's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust growth and expanding profit margins, CorVel’s shares remain well above fair value. This raises concerns for investors focused on valuation and downside risk.

If a premium price gives you pause, use our these 844 undervalued stocks based on cash flows to target companies that the market is undervaluing right now and spot your next compelling idea.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRVL

CorVel

Provides workers’ compensation, general and auto liability, and hospital bill auditing and payment integrity solutions.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives