- United States

- /

- Healthtech

- /

- NasdaqGS:TBRG

These 4 Measures Indicate That Computer Programs and Systems (NASDAQ:CPSI) Is Using Debt Reasonably Well

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Computer Programs and Systems, Inc. (NASDAQ:CPSI) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Computer Programs and Systems

How Much Debt Does Computer Programs and Systems Carry?

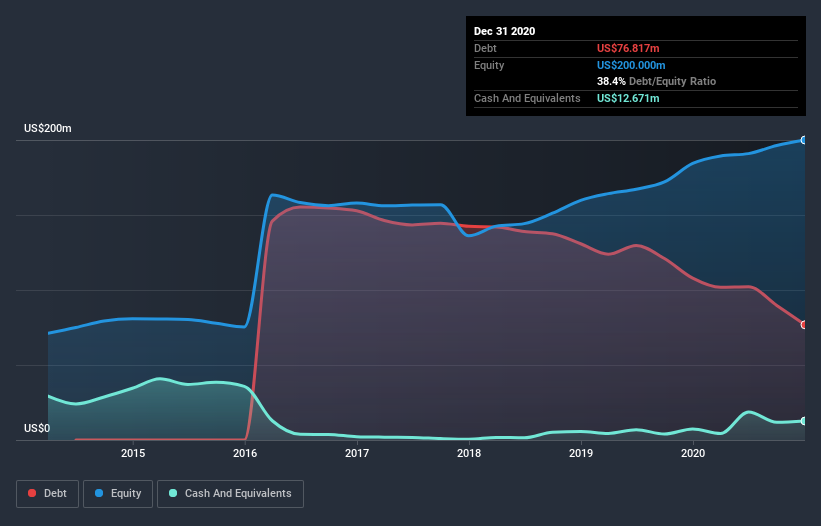

You can click the graphic below for the historical numbers, but it shows that Computer Programs and Systems had US$76.8m of debt in December 2020, down from US$107.9m, one year before. However, it does have US$12.7m in cash offsetting this, leading to net debt of about US$64.1m.

A Look At Computer Programs and Systems' Liabilities

We can see from the most recent balance sheet that Computer Programs and Systems had liabilities of US$37.4m falling due within a year, and liabilities of US$88.8m due beyond that. On the other hand, it had cash of US$12.7m and US$43.2m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$70.4m.

Of course, Computer Programs and Systems has a market capitalization of US$432.6m, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Computer Programs and Systems has net debt worth 1.9 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 5.9 times the interest expense. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. The bad news is that Computer Programs and Systems saw its EBIT decline by 16% over the last year. If that sort of decline is not arrested, then the managing its debt will be harder than selling broccoli flavoured ice-cream for a premium. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Computer Programs and Systems's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Happily for any shareholders, Computer Programs and Systems actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

On our analysis Computer Programs and Systems's conversion of EBIT to free cash flow should signal that it won't have too much trouble with its debt. However, our other observations weren't so heartening. In particular, EBIT growth rate gives us cold feet. It's also worth noting that Computer Programs and Systems is in the Healthcare Services industry, which is often considered to be quite defensive. When we consider all the elements mentioned above, it seems to us that Computer Programs and Systems is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. We'd be motivated to research the stock further if we found out that Computer Programs and Systems insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Computer Programs and Systems, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TruBridge might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:TBRG

TruBridge

Provides healthcare solutions and services for community hospitals, clinics, and other healthcare systems in the United States and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Qantas: A Stronger Post-COVID Airline with Sustainable Earnings Power

My view on CSL Limited is positive. It’s a high-quality growth stock with strong barriers to entry through its global plasma network.

Nu holdings will continue to disrupt the South American banking market

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion