- United States

- /

- Healthtech

- /

- NasdaqGS:TBRG

Computer Programs and Systems (NASDAQ:CPSI) Might Be Having Difficulty Using Its Capital Effectively

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Although, when we looked at Computer Programs and Systems (NASDAQ:CPSI), it didn't seem to tick all of these boxes.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Computer Programs and Systems:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0092 = US$3.4m ÷ (US$430m - US$55m) (Based on the trailing twelve months to September 2023).

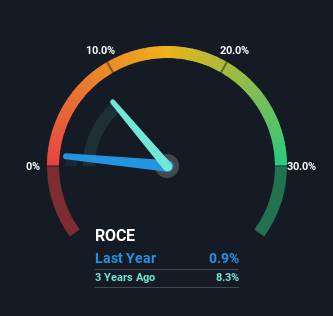

Thus, Computer Programs and Systems has an ROCE of 0.9%. Ultimately, that's a low return and it under-performs the Healthcare Services industry average of 5.0%.

View our latest analysis for Computer Programs and Systems

Above you can see how the current ROCE for Computer Programs and Systems compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Computer Programs and Systems .

How Are Returns Trending?

When we looked at the ROCE trend at Computer Programs and Systems, we didn't gain much confidence. Over the last five years, returns on capital have decreased to 0.9% from 8.7% five years ago. Meanwhile, the business is utilizing more capital but this hasn't moved the needle much in terms of sales in the past 12 months, so this could reflect longer term investments. It may take some time before the company starts to see any change in earnings from these investments.

What We Can Learn From Computer Programs and Systems' ROCE

In summary, Computer Programs and Systems is reinvesting funds back into the business for growth but unfortunately it looks like sales haven't increased much just yet. It seems that investors have little hope of these trends getting any better and that may have partly contributed to the stock collapsing 72% in the last five years. In any case, the stock doesn't have these traits of a multi-bagger discussed above, so if that's what you're looking for, we think you'd have more luck elsewhere.

One more thing, we've spotted 1 warning sign facing Computer Programs and Systems that you might find interesting.

While Computer Programs and Systems isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if TruBridge might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TBRG

TruBridge

Provides healthcare solutions and services for community hospitals, clinics, and other healthcare systems in the United States and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Czechoslovak Group - is it really so hot?

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion