- United States

- /

- Medical Equipment

- /

- NasdaqGS:COO

Did Jana Partners’ Push for a Breakup Just Shift Cooper Companies’ (COO) Investment Narrative?

Reviewed by Sasha Jovanovic

- On October 20, 2025, activist investor Jana Partners LLC announced it will pressure The Cooper Companies, Inc. to explore strategic alternatives, including potentially merging its contact lens business with Bausch + Lomb and reviewing its corporate structure.

- Jana Partners contends that Cooper Companies’ two main divisions, contact lenses and women’s health, lack meaningful synergies, which could be affecting the company's ability to maximize shareholder value.

- We'll explore how Jana Partners’ call for a possible business break-up and asset merger could reshape Cooper Companies’ investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Cooper Companies Investment Narrative Recap

To be a shareholder in Cooper Companies today, you need to believe in the long-term value of its dual focus on vision care and women’s health, despite the divisions’ limited integration. The recent move by Jana Partners to push for structural changes presents a potential near-term catalyst if it creates renewed momentum, but also adds uncertainty around the biggest risk: ongoing margin pressure from industry pricing and shifting product demand. Among recent developments, the expanded US$1 billion share buyback announced in September stands out. This action reinforces management’s confidence in cash generation and may help offset share price volatility as the company faces calls for major structural change, supporting shareholder returns even as the strategic review unfolds. However, investors should not overlook the fact that, while management is pursuing operational improvements and buybacks, risks remain if the contact lens segment’s transition to premium products like MyDAY fails to deliver as expected...

Read the full narrative on Cooper Companies (it's free!)

Cooper Companies' narrative projects $4.9 billion revenue and $786.2 million earnings by 2028. This requires 6.4% yearly revenue growth and a $378.4 million earnings increase from $407.8 million.

Uncover how Cooper Companies' forecasts yield a $83.00 fair value, a 19% upside to its current price.

Exploring Other Perspectives

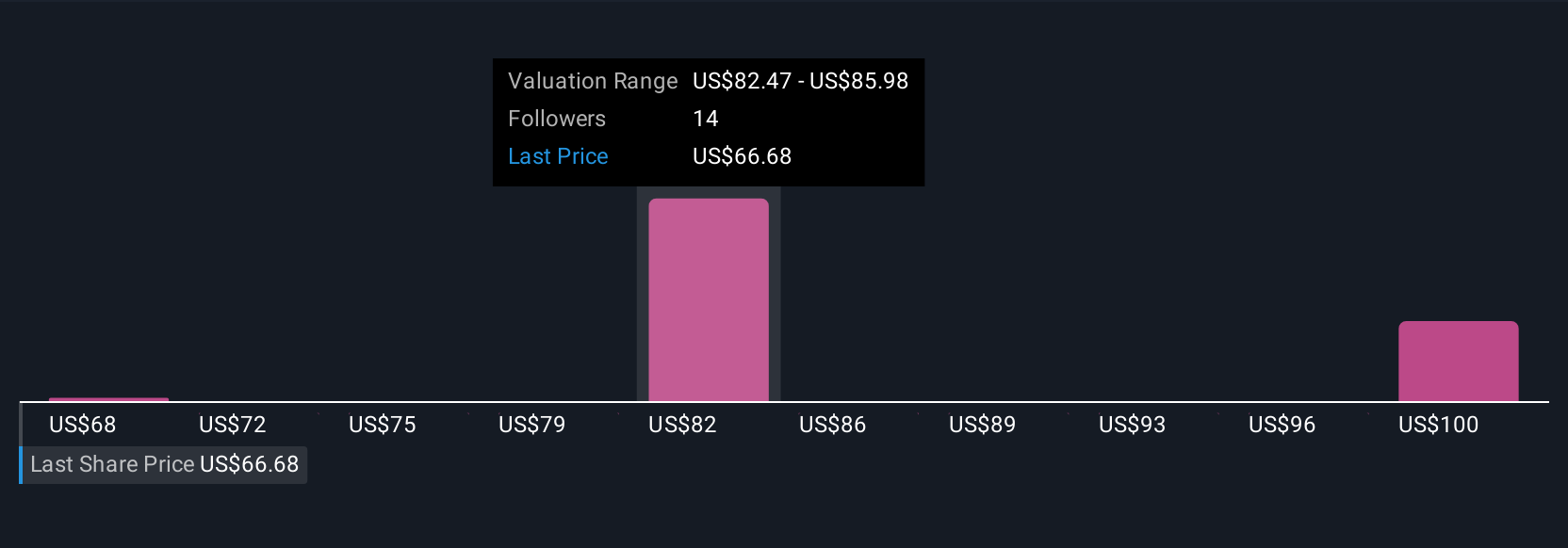

The Simply Wall St Community’s three fair value estimates for Cooper Companies span a wide range, from US$68.44 to US$100.70 per share. While opinions differ, keep in mind that underlying risks around competitive pricing pressure and product transitions may be shaping these divergent views, consider each outlook in context before making your own judgment.

Explore 3 other fair value estimates on Cooper Companies - why the stock might be worth just $68.44!

Build Your Own Cooper Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cooper Companies research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Cooper Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cooper Companies' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COO

Cooper Companies

Develops, manufactures, and markets contact lens wearers.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives