- United States

- /

- Medical Equipment

- /

- NasdaqGS:COO

Assessing Cooper Companies (COO) Valuation as Activist Pressure Sparks Calls for Major Change

Reviewed by Simply Wall St

On November 19, 2025, Cooper Companies (COO) found itself in the spotlight after Browning West LP publicly called for sweeping changes, urging a board shake-up and a strategic refocus toward its vision care division.

See our latest analysis for Cooper Companies.

With shares closing at $75.47 after a strong 6.1% one-day gain, momentum is picking up for Cooper Companies following activist pressure from Browning West. Despite this recent bump, the stock’s one-year total shareholder return sits at -25.1%, reflecting a challenging period for long-term investors even as calls for change fuel optimism about the future direction.

If you’re curious about what other dynamic healthcare companies are making headlines and moving markets, explore new opportunities with our healthcare stocks screener: See the full list for free.

After such a sharp rebound, the key question for investors is whether Cooper Companies’ shares remain undervalued given recent activist developments or if the current price already reflects expectations of stronger future growth.

Most Popular Narrative: 9.1% Undervalued

The narrative consensus places Cooper Companies' fair value at $83 per share, noticeably above its latest close at $75.47. This spread signals ongoing optimism about the company's prospects, even as shares remain well below the highlighted fair value threshold. Here is a major catalyst at the center of that narrative:

Free cash flow is poised to inflect higher as a multi-year capital expenditure cycle winds down following the ramp-up of MyDAY capacity, with management guiding for approximately $2 billion in free cash flow over the next three years. This improved cash generation, tied to strong cost discipline and revenue momentum, will further benefit shareholders via debt reduction and share repurchases.

Want to know the cash engine powering this bullish view? The big factor behind the valuation involves assumptions about how much profit Cooper Companies will turn into cash, and how it plans to return it to shareholders. Is the market really underestimating upcoming buybacks or earnings capacity? Dive in for the real math that drives this fair value target.

Result: Fair Value of $83.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including heightened competitive pricing pressure and unpredictable sales patterns during the transition from Clariti to MyDAY. These factors could limit future upside.

Find out about the key risks to this Cooper Companies narrative.

Another View: Are the Shares Actually Overvalued?

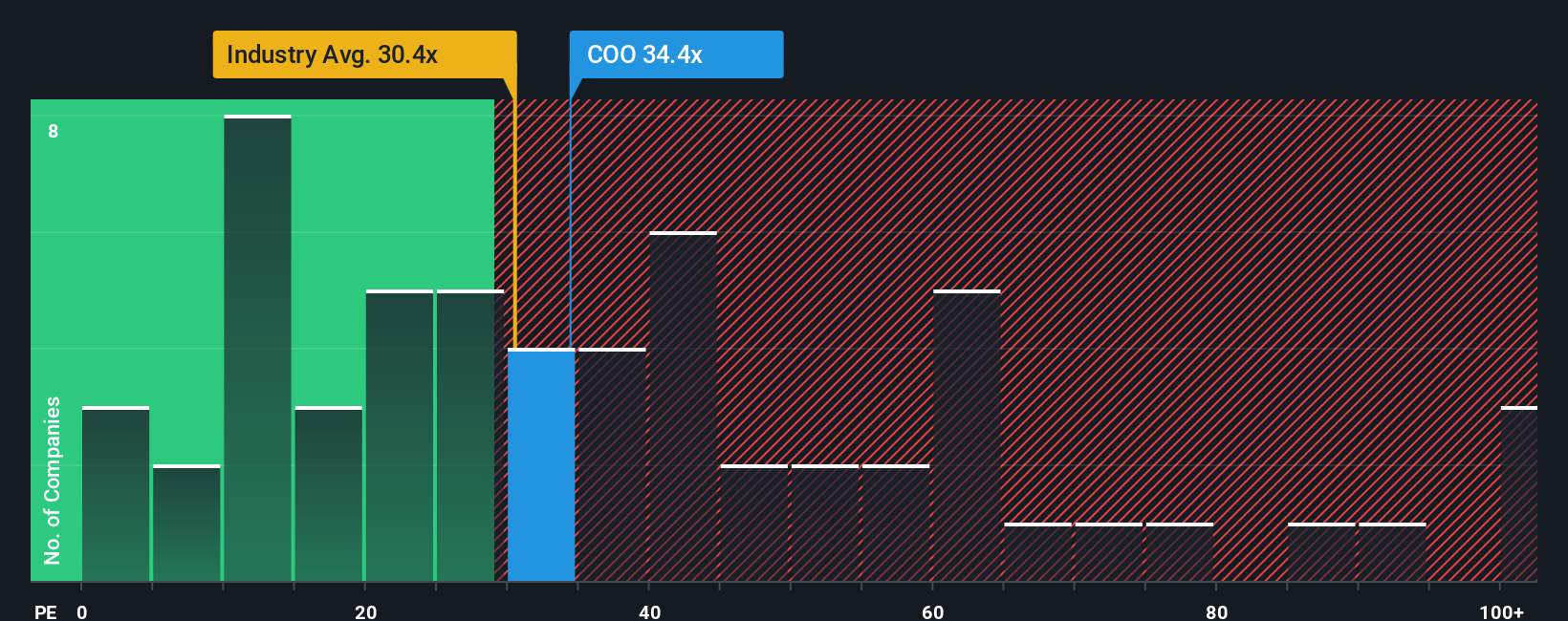

While some see Cooper Companies as undervalued based on fair value estimates, looking at the price-to-earnings ratio tells a different story. The company trades at 36.8 times earnings, which is significantly above both its industry average of 27.4 and the calculated fair ratio of 29.3. This premium suggests investors may be paying too much for future growth, creating valuation risk if future results disappoint. Could bullish assumptions be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cooper Companies Narrative

If you want to take a different angle or dive deeper into the numbers yourself, it only takes a few minutes to shape your own view. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Cooper Companies.

Looking for More Investment Ideas?

Take your investing strategy up a notch and open the door to standout opportunities you won’t want to miss by using these tailored investment screens:

- Capture potential high-yield income with stocks offering reliable payouts by checking out these 17 dividend stocks with yields > 3% for standout dividend opportunities above 3% yield.

- Ride the momentum in artificial intelligence and pinpoint innovative small-caps reshaping the future with these 25 AI penny stocks.

- Target value plays the market may be overlooking right now, and search for promising bargains with these 921 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COO

Cooper Companies

Develops, manufactures, and markets contact lens wearers.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives