- United States

- /

- Medical Equipment

- /

- NasdaqCM:CLPT

ClearPoint Neuro (CLPT): Assessing Valuation Ahead of Anticipated Quarterly Earnings and Positive Analyst Outlook

Reviewed by Simply Wall St

ClearPoint Neuro (CLPT) is drawing investor focus as the company prepares to announce its quarterly earnings for the period ending September 30, 2025. Anticipation is high for increased revenue, even though a loss per share is projected.

See our latest analysis for ClearPoint Neuro.

Momentum around ClearPoint Neuro has taken investors on a ride lately, with the latest share price at $16.98. While the stock soared an impressive 55% over the past 90 days, recent weeks brought a sharp reversal, as seen in the 29% drop over the past week and a 36% decline for the month. Still, patient shareholders have enjoyed a 26.9% one-year total return, and the long-term trend remains robust, with a 114% total return over five years. This is evidence that volatility is nothing new for this name.

If you’re curious about other high-potential names in the healthcare space, now is a perfect moment to uncover fresh opportunities with our See the full list for free.

With analyst targets placing ClearPoint Neuro’s value far above its current price, investors must ask themselves whether the recent pullback is a compelling entry point or if the market has already factored in the company’s future growth.

Most Popular Narrative: 41.4% Undervalued

With ClearPoint Neuro closing at $16.98, the most-followed narrative pegs its fair value at $29, suggesting a substantial upside from current levels. The argument supporting this view focuses on rapid adoption, partnering momentum, and several powerful growth drivers that are expected to play out in the coming years.

Increasing adoption of precision medicine and minimally invasive neurosurgical procedures is accelerating uptake of MRI and CT-guided technologies like ClearPoint's platform. Recent positive feedback and rapid deployment of new products such as 3.0 navigation are likely to boost installed base growth and procedure-driven consumable sales, supporting recurring revenue and gross margin expansion.

Want to peek behind the curtain and uncover what’s driving this bullish target? The magic lies in bold revenue expansion, major shifts in profitability, and a valuation multiple that will surprise even seasoned investors. Dive in and see what key assumptions underpin this eye-catching narrative.

Result: Fair Value of $29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a few early-stage partners and ongoing high expenses could limit revenue stability and delay ClearPoint Neuro’s path to profitability.

Find out about the key risks to this ClearPoint Neuro narrative.

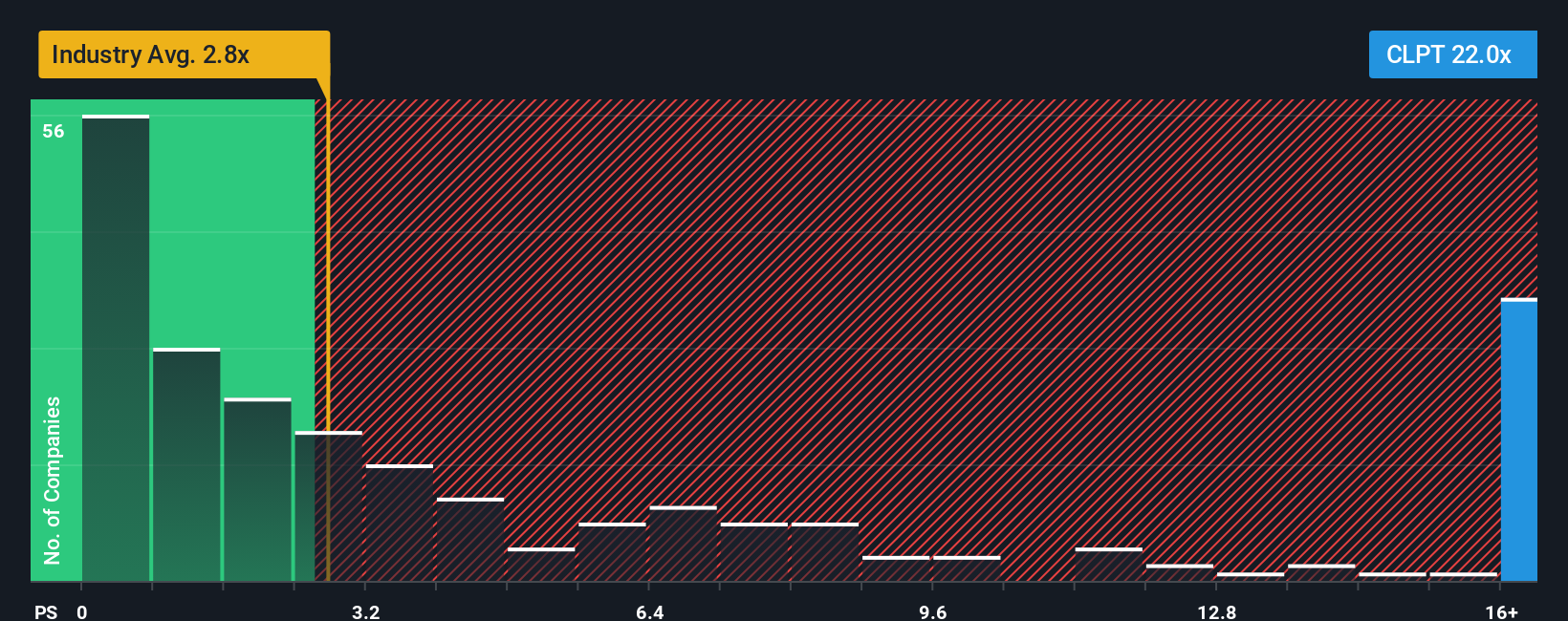

Another View: Market Multiples Raise a Red Flag

While analyst projections suggest ClearPoint Neuro is undervalued, a look at the company’s current price-to-sales ratio tells a different story. At 14.4x, this is far above both the US Medical Equipment sector average (2.9x), the peer average (3.8x), and the fair ratio of 3.4x. This suggests the stock is trading at a significant premium, increasing valuation risk if future growth does not materialize as hoped. Are optimism and future growth fully justified at these levels, or could reality fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ClearPoint Neuro Narrative

If you see things differently or want to dig deeper on your own, you can quickly assemble your own take on ClearPoint Neuro’s story in just a few minutes. Do it your way

A great starting point for your ClearPoint Neuro research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

You don’t want to miss out on other top opportunities. Expand your search and spot your next potential winner with the Simply Wall Street Screener.

- Snap up hidden bargains poised for a rebound by using these 842 undervalued stocks based on cash flows and sidestep overpriced risks.

- Earn steady income and bolster your portfolio with reliable payers through these 20 dividend stocks with yields > 3% featuring robust yields.

- Ride the wave of innovation and mega-trends in medicine with cutting-edge picks in these 33 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CLPT

ClearPoint Neuro

Operates as a medical device company primarily in the United States.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives