- United States

- /

- Healthcare Services

- /

- NasdaqGS:BTSG

Why BrightSpring Health Services (BTSG) Is Up 12.8% After Major Shareholder Exit and Buyback Plan

Reviewed by Sasha Jovanovic

- Earlier this week, BrightSpring Health Services announced strong third-quarter results, highlighting revenues of US$3.33 billion and a significant swing to net income, alongside the completion of a secondary offering by major shareholders who sold 15 million shares with no proceeds to the company itself.

- An interesting aspect is that the company paired this shareholder exit with an increased full-year revenue outlook and a concurrent plan to repurchase up to US$50 million of stock, signaling underlying confidence in operational performance.

- With large shareholders reducing their stake just as robust financial results and guidance were released, we’ll explore what this means for BrightSpring’s investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

BrightSpring Health Services Investment Narrative Recap

To support BrightSpring Health Services as a shareholder, an investor needs to believe the company can capture growing demand for specialty pharmacy and home-based care while managing sector-wide cost and labor headwinds. The recent secondary offering by major shareholders does not appear to materially affect the company’s near-term catalyst: robust topline growth and margin expansion, supported by strong quarterly results and upgraded guidance. The most urgent risk remains BrightSpring’s high leverage, which could limit strategic flexibility if financing conditions tighten.

Among the recent announcements, the company’s decision to raise its 2025 revenue outlook stands out, reflecting management's confidence in underlying demand and performance, even as key shareholders reduce their stake. This upgraded forecast highlights revenue momentum as a fundamental catalyst underpinning the short-term investment case, potentially offsetting fears linked to equity sales by insiders and private equity holders.

But while growth prospects look solid, investors should be aware that high debt levels may become a pressing concern if...

Read the full narrative on BrightSpring Health Services (it's free!)

BrightSpring Health Services is projected to reach $16.8 billion in revenue and $361.8 million in earnings by 2028. This outlook assumes 10.1% annual revenue growth and an increase in earnings of $314.5 million from the current $47.3 million.

Uncover how BrightSpring Health Services' forecasts yield a $32.96 fair value, in line with its current price.

Exploring Other Perspectives

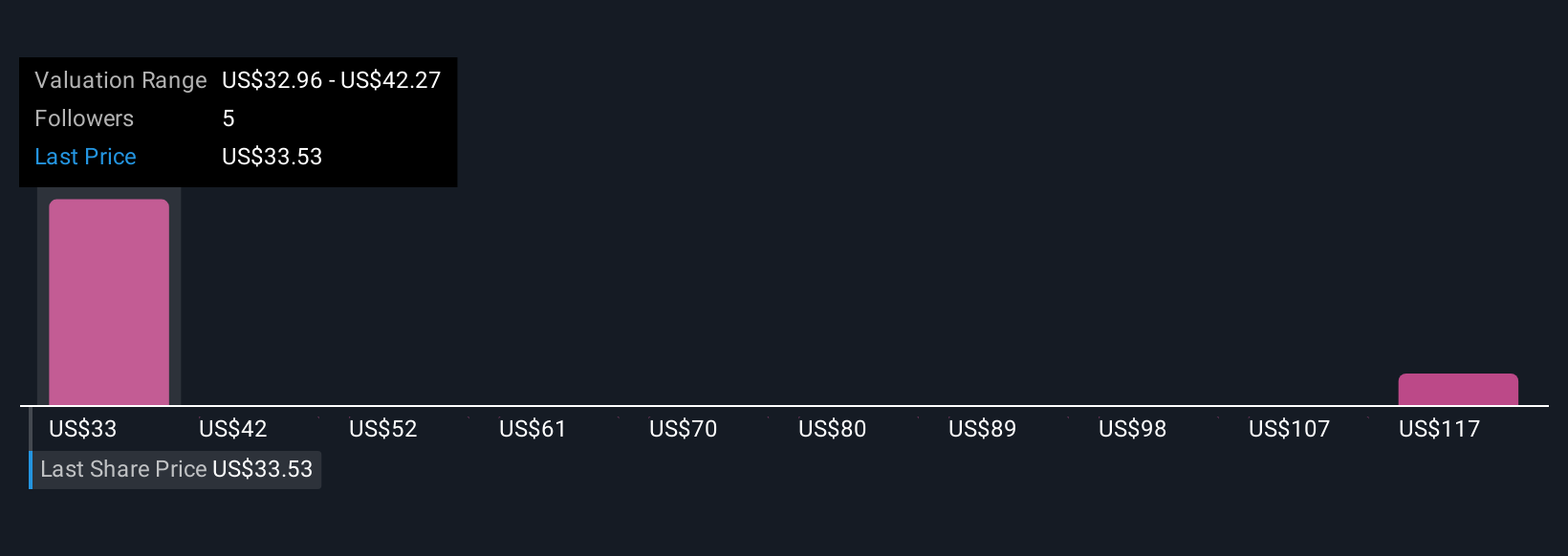

Fair value estimates from the Simply Wall St Community span from US$32.96 to US$126.12, based on three different analyses. As new catalysts boost revenue expectations, risk from substantial leverage could shape how future returns unfold, so check out a range of views before deciding.

Explore 3 other fair value estimates on BrightSpring Health Services - why the stock might be worth just $32.96!

Build Your Own BrightSpring Health Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BrightSpring Health Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free BrightSpring Health Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BrightSpring Health Services' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BrightSpring Health Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BTSG

BrightSpring Health Services

Operates as a home and community-based healthcare services platform in the United States.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives