- United States

- /

- Healthcare Services

- /

- NasdaqGS:BTSG

How Analyst Upgrades After UBS Conference May Shape BrightSpring Health Services' (BTSG) Investment Outlook

Reviewed by Sasha Jovanovic

- BrightSpring Health Services participated in the UBS Global Healthcare Conference on November 11, 2025, with CFO Jennifer A. Phipps and CEO Jon B. Rousseau presenting at the PGA National Resort Hotel in Palm Beach Gardens, Florida.

- This high-profile engagement was met with a series of positive analyst upgrades from several major institutions, highlighting increased confidence in the company's growth prospects within the healthcare sector.

- To understand how rising analyst confidence might influence BrightSpring Health Services’ outlook, we’ll explore the implications for its investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

BrightSpring Health Services Investment Narrative Recap

To be a shareholder in BrightSpring Health Services, you have to believe in the company’s ability to maintain its rapid specialty pharmacy growth and operational efficiencies while navigating sector risks like labor costs and government reimbursement exposure. Recent analyst upgrades and strong conference performance appear to reinforce enthusiasm for these growth drivers, but do not materially reduce key concerns about margin pressure from staffing costs or elevated leverage, which remains a central short-term risk for the business.

The most relevant recent announcement in this context is BrightSpring’s Q3 2025 earnings, which saw the company swing to year-over-year profitability and deliver substantial revenue growth. While this financial turnaround gives more weight to positive analyst sentiment, the company’s debt load and sensitivity to interest rates remain crucial watchpoints for those tracking upcoming catalysts.

In contrast, investors should be aware that even as analyst confidence climbs, BrightSpring’s significant leverage presents risks if conditions tighten or borrowing costs rise...

Read the full narrative on BrightSpring Health Services (it's free!)

BrightSpring Health Services' outlook anticipates $16.8 billion in revenue and $361.8 million in earnings by 2028. This scenario calls for 10.1% annual revenue growth and an increase in earnings of $314.5 million from the current $47.3 million.

Uncover how BrightSpring Health Services' forecasts yield a $38.25 fair value, a 20% upside to its current price.

Exploring Other Perspectives

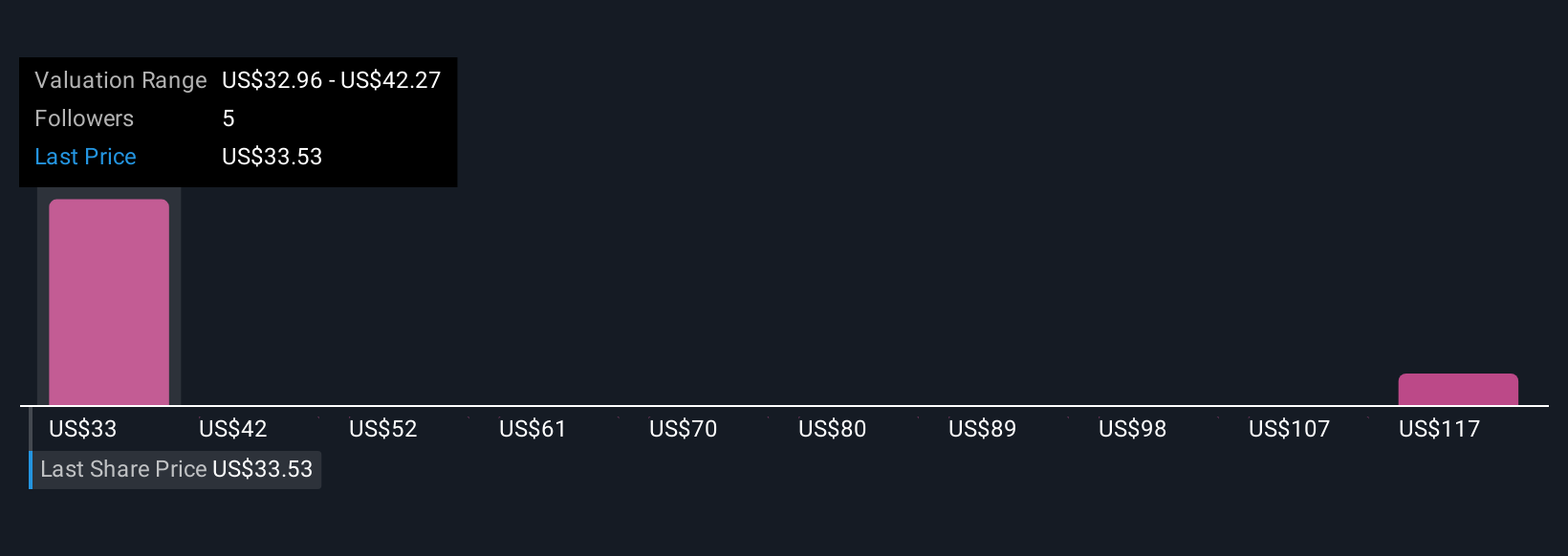

Fair value opinions from the Simply Wall St Community span from US$38.25 to US$128.50 based on two individual estimates. While many see growth potential, remember BrightSpring’s high net debt could affect upside if capital availability shifts, so weigh the full range of investor viewpoints.

Explore 2 other fair value estimates on BrightSpring Health Services - why the stock might be worth just $38.25!

Build Your Own BrightSpring Health Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BrightSpring Health Services research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free BrightSpring Health Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BrightSpring Health Services' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BrightSpring Health Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BTSG

BrightSpring Health Services

Operates as a home and community-based healthcare services platform in the United States.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives