- United States

- /

- Healthcare Services

- /

- NasdaqGS:BTSG

BrightSpring Health Services (BTSG): Revisiting Valuation After Multiple Analyst Upgrades and Raised Outlooks

Reviewed by Simply Wall St

BrightSpring Health Services (BTSG) has attracted increased attention after Wells Fargo raised its outlook, following a string of upward revisions from major banks in recent weeks. These moves highlight growing market confidence around the company’s prospects.

See our latest analysis for BrightSpring Health Services.

Momentum has been hard to ignore lately, with BrightSpring’s 30-day share price return of 14.1% and a huge 94.1% year-to-date gain. Recent upbeat analyst views and upcoming conference appearances seem to be fueling optimism, signaling that investors are recognizing both the company’s growth potential and an improving perception of risk. Over the short and long term, BrightSpring has clearly outperformed, as shown by its 1-year total shareholder return of 71.1% and persistent positive sentiment building around the stock.

Curious what other healthcare standouts are on the move? Discover fresh opportunities in the sector with our latest picks in See the full list for free.

But with BrightSpring’s stellar run in recent months and multiple analyst upgrades, the question for investors is whether the stock remains undervalued or if expectations for future growth are already fully reflected in the current price.

Most Popular Narrative: 12.1% Undervalued

Compared to its recent closing price, the narrative sees fair value meaningfully higher for BrightSpring Health Services, pointing to upside potential. This gap is driven by powerful assumptions about future growth and profitability, setting the foundation for a bullish case that investors are watching closely.

Ongoing investments in integrated service delivery, technology, procurement, and automation are enabling enhanced operating efficiencies and cross-selling. These are expected to deliver sustained improvements in net margins and EBITDA through 2026 and beyond.

Want to understand what's truly behind this valuation? This story is built on major efficiency gains and a profitability leap that could reshape BrightSpring’s future. Ready to see which ambitious growth and margin targets underpin the price estimate? Check the full narrative and discover the details fueling this optimistic outlook.

Result: Fair Value of $38.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, labor shortages or shifts in government reimbursement could challenge margins and growth, quickly testing the bullish narrative around BrightSpring’s outlook.

Find out about the key risks to this BrightSpring Health Services narrative.

Another View: The Multiples Dilemma

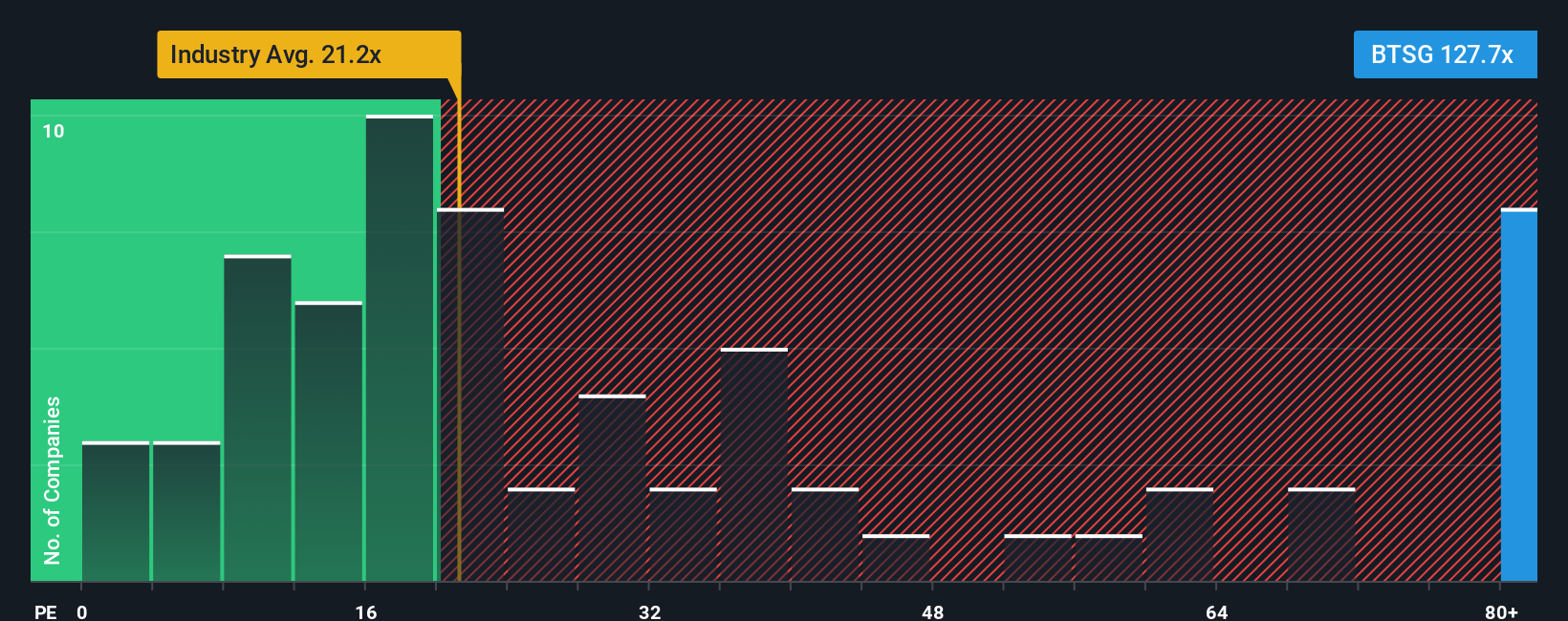

While the narrative points to meaningful upside, BrightSpring’s current price-to-earnings ratio is 63x. This figure significantly exceeds both the peer average of 23.4x and the healthcare sector average of 21.9x. According to regression estimates, the fair ratio is much lower at 38.4x. This suggests that the market could quickly reassess its optimism if growth slows, or maintain the premium if results continue to improve. Will investors continue to drive the stock higher, or is it time for caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BrightSpring Health Services Narrative

If you want a different angle or are curious to see how your own view stacks up, you can dig into the numbers and craft a personal outlook in just a few minutes. Do it your way

A great starting point for your BrightSpring Health Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let your research stop here. Seize your next opportunity by harnessing powerful stock screeners to uncover fresh growth, profit, and technology breakthroughs.

- Tap into tomorrow’s financial breakthroughs and see which names are set to transform finance by tracking these 82 cryptocurrency and blockchain stocks before they hit the mainstream.

- Secure potential high-yield payouts by targeting these 14 dividend stocks with yields > 3% offering reliable and attractive income streams above 3%.

- Catch the momentum in artificial intelligence by scouting these 27 AI penny stocks that are pioneering the next wave of innovation in this game-changing sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BrightSpring Health Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BTSG

BrightSpring Health Services

Operates as a home and community-based healthcare services platform in the United States.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives