- United States

- /

- Healthcare Services

- /

- NasdaqGS:BTSG

BrightSpring Health Services (BTSG): Evaluating Valuation After Q3 Profit Turnaround and Upgraded 2025 Outlook

Reviewed by Simply Wall St

BrightSpring Health Services (BTSG) grabbed attention with its third-quarter results, showing a sharp turnaround in financial performance. The company posted a return to profitability and raised its outlook for 2025, which suggests confidence in continued growth.

See our latest analysis for BrightSpring Health Services.

After a remarkable earnings turnaround and new index inclusions this month, BrightSpring Health Services is gathering fresh market attention. The momentum is underscored by a 22% share price return over the last month and an eye-catching 112% total shareholder return for the year. These are clear signs that investor sentiment is on the upswing as the company executes on growth promises.

If you're interested in what other healthcare names are building similar momentum, exploring See the full list for free. could uncover some compelling opportunities right now.

With shares climbing rapidly, but the latest closing price now just above most analyst targets, investors may be wondering if there is still room for upside or if the market has already factored in all of BrightSpring's anticipated growth.

Most Popular Narrative: 2% Overvalued

BrightSpring Health Services is now trading just above the collective fair value estimated by the most widely followed narrative, despite its rapid recent gains. This price suggests the market may be getting ahead of the company’s future projections and leaves little room for missteps in execution.

Ongoing investments in integrated service delivery, technology, procurement, and automation are enabling enhanced operating efficiencies and cross-selling. These efforts are expected to deliver sustained improvements in net margins and EBITDA through 2026 and beyond.

Curious what’s fueling analyst optimism? The narrative’s forecast hinges on big improvements in profitability and major efficiency gains. But the real twist is that the projected margin leap and future company multiple are not what you’d expect for a health services newcomer. The full story reveals the assumptions and tension beneath this ambitious fair value target.

Result: Fair Value of $32.96 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing labor shortages and rising regulatory scrutiny could quickly challenge BrightSpring's optimistic margin outlook and could disrupt its current growth trajectory.

Find out about the key risks to this BrightSpring Health Services narrative.

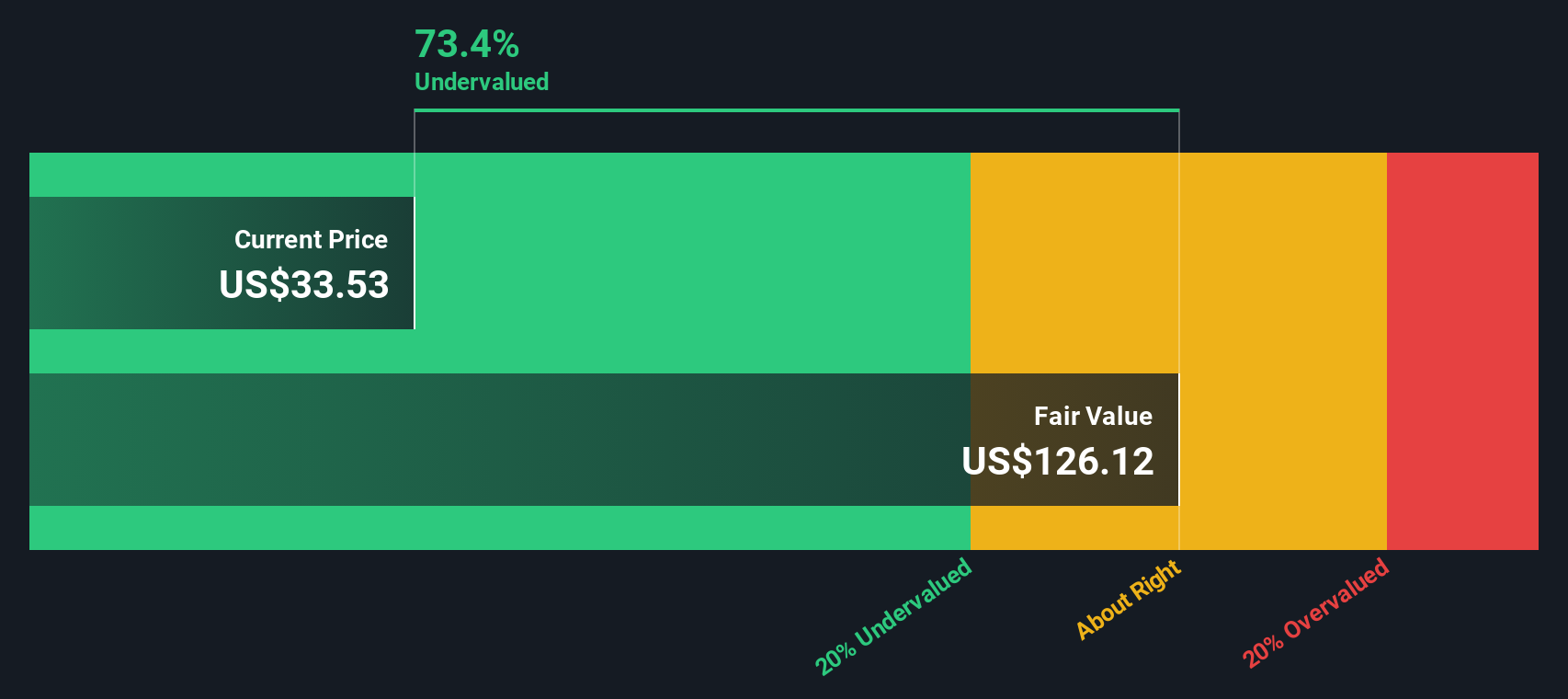

Another View: DCF Tells a Different Story

Looking at things through the lens of the SWS DCF model, the picture changes dramatically. This model suggests BrightSpring Health Services is trading well below its underlying value, which hints at a significant undervaluation even when compared to the current share price and conventional analyst metrics. Does this gap point to an opportunity that everyone else is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BrightSpring Health Services for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BrightSpring Health Services Narrative

If you want to dive deeper into the numbers or craft your own perspective on BrightSpring Health Services, building a custom narrative is quick and easy. You can do it in just a few minutes with Do it your way.

A great starting point for your BrightSpring Health Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't let potential winners slip through your fingers. Expand your portfolio horizons in moments by tapping into investment themes most are missing right now.

- Capitalize on rapidly emerging tech by checking out these 27 AI penny stocks, which are setting new standards in artificial intelligence innovation and growth.

- Lock in steady income with these 17 dividend stocks with yields > 3%, where financially strong companies offer yields above 3% for income-focused investors.

- Position yourself ahead of the curve with these 28 quantum computing stocks, highlighting firms pioneering breakthroughs in quantum computing and reshaping the digital landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BrightSpring Health Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BTSG

BrightSpring Health Services

Operates as a home and community-based healthcare services platform in the United States.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives