- United States

- /

- Healthcare Services

- /

- NasdaqGM:BDSX

Analysts Just Slashed Their Biodesix, Inc. (NASDAQ:BDSX) EPS Numbers

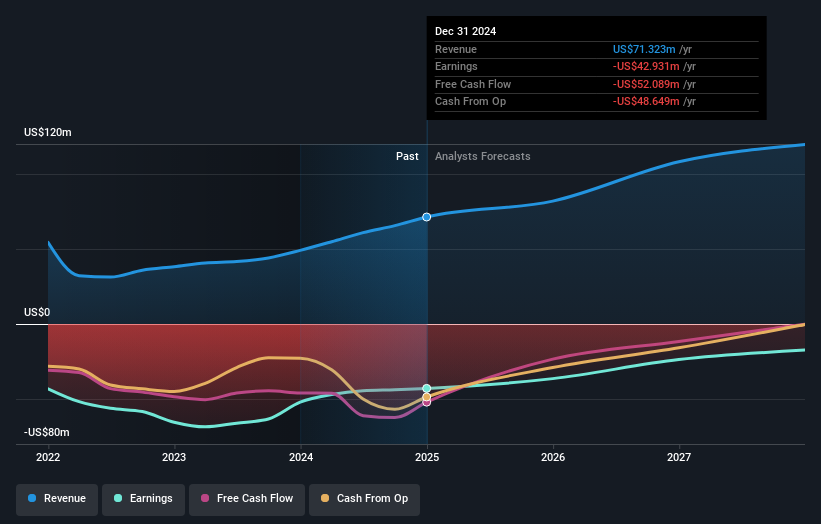

The latest analyst coverage could presage a bad day for Biodesix, Inc. (NASDAQ:BDSX), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Both revenue and earnings per share (EPS) estimates were cut sharply as the analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

After this downgrade, Biodesix's six analysts are now forecasting revenues of US$82m in 2025. This would be a meaningful 15% improvement in sales compared to the last 12 months. Losses are presumed to reduce, shrinking 18% per share from last year to US$0.24. However, before this estimates update, the consensus had been expecting revenues of US$93m and US$0.21 per share in losses. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a serious cut to their revenue forecasts while also expecting losses per share to increase.

View our latest analysis for Biodesix

The consensus price target fell 31% to US$2.00, with the analysts clearly concerned about the company following the weaker revenue and earnings outlook.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. The analysts are definitely expecting Biodesix's growth to accelerate, with the forecast 20% annualised growth to the end of 2025 ranking favourably alongside historical growth of 11% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 6.9% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Biodesix is expected to grow much faster than its industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at Biodesix. Unfortunately, analysts also downgraded their revenue estimates, although our data indicates revenues are expected to perform better than the wider market. After such a stark change in sentiment from analysts, we'd understand if readers now felt a bit wary of Biodesix.

That said, the analysts might have good reason to be negative on Biodesix, given dilutive stock issuance over the past year. For more information, you can click here to discover this and the 4 other concerns we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Biodesix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:BDSX

Very undervalued slight.

Similar Companies

Market Insights

Community Narratives