- United States

- /

- Medical Equipment

- /

- NasdaqCM:AXGN

Recent 9.2% pullback isn't enough to hurt long-term Axogen (NASDAQ:AXGN) shareholders, they're still up 152% over 1 year

Unfortunately, investing is risky - companies can and do go bankrupt. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Axogen, Inc. (NASDAQ:AXGN) share price has soared 152% in the last 1 year. Most would be very happy with that, especially in just one year! On top of that, the share price is up 15% in about a quarter. But this move may well have been assisted by the reasonably buoyant market (up 13% in 90 days). However, the stock hasn't done so well in the longer term, with the stock only up 4.0% in three years.

While the stock has fallen 9.2% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

View our latest analysis for Axogen

Axogen isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Axogen grew its revenue by 19% last year. That's a fairly respectable growth rate. The revenue growth is decent but the share price had an even better year, gaining 152%. Given that the business has made good progress on the top line, it would be worth taking a look at its path to profitability. But investors need to be wary of how the 'fear of missing out' could influence them to buy without doing thorough research.

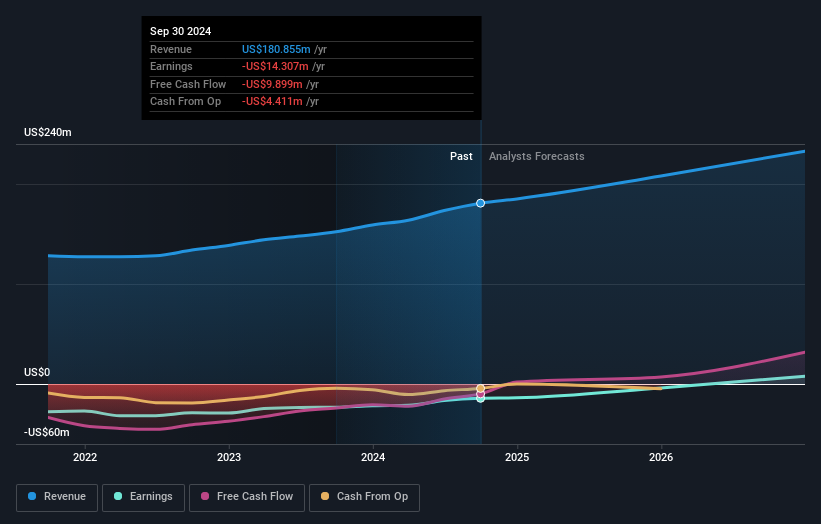

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Axogen's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Axogen has rewarded shareholders with a total shareholder return of 152% in the last twelve months. Notably the five-year annualised TSR loss of 4% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Axogen has 1 warning sign we think you should be aware of.

But note: Axogen may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AXGN

Axogen

Develops and commercializes technologies for peripheral nerve regeneration and repair worldwide.

Very undervalued with reasonable growth potential.