Stock Analysis

- United States

- /

- Medical Equipment

- /

- NasdaqCM:AXGN

Further weakness as AxoGen (NASDAQ:AXGN) drops 16% this week, taking three-year losses to 57%

While not a mind-blowing move, it is good to see that the AxoGen, Inc. (NASDAQ:AXGN) share price has gained 23% in the last three months. Meanwhile over the last three years the stock has dropped hard. In that time, the share price dropped 57%. So it's good to see it climbing back up. The rise has some hopeful, but turnarounds are often precarious.

If the past week is anything to go by, investor sentiment for AxoGen isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for AxoGen

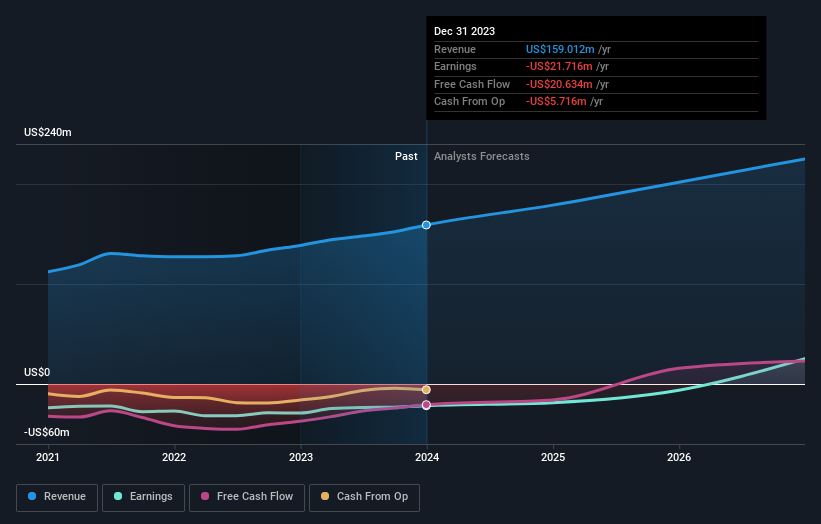

Because AxoGen made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, AxoGen grew revenue at 9.7% per year. That's a pretty good rate of top-line growth. So some shareholders would be frustrated with the compound loss of 16% per year. The market must have had really high expectations to be disappointed with this progress. It would be well worth taking a closer look at the company, to determine growth trends (and balance sheet strength).

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think AxoGen will earn in the future (free profit forecasts).

A Different Perspective

AxoGen shareholders gained a total return of 11% during the year. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 9% per year, over five years. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for AxoGen you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether AxoGen is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AXGN

AxoGen

AxoGen, Inc., together with its subsidiaries, develops and commercializes technologies for peripheral nerve regeneration and repair worldwide.

Undervalued with reasonable growth potential.