- United States

- /

- Medical Equipment

- /

- NasdaqCM:AXGN

Even With A 28% Surge, Cautious Investors Are Not Rewarding AxoGen, Inc.'s (NASDAQ:AXGN) Performance Completely

Despite an already strong run, AxoGen, Inc. (NASDAQ:AXGN) shares have been powering on, with a gain of 28% in the last thirty days. The annual gain comes to 153% following the latest surge, making investors sit up and take notice.

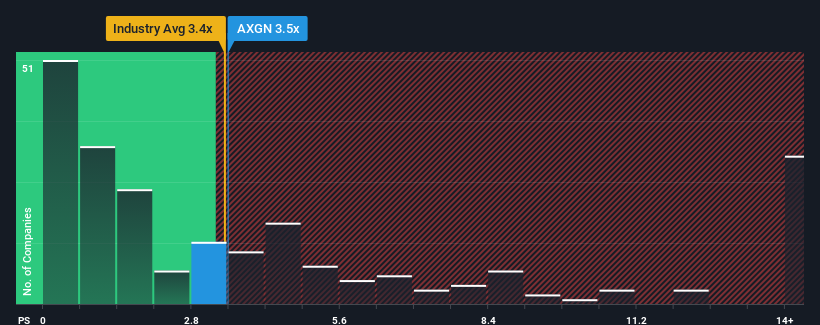

Even after such a large jump in price, it's still not a stretch to say that AxoGen's price-to-sales (or "P/S") ratio of 3.5x right now seems quite "middle-of-the-road" compared to the Medical Equipment industry in the United States, where the median P/S ratio is around 3.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for AxoGen

What Does AxoGen's Recent Performance Look Like?

Recent times have been advantageous for AxoGen as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AxoGen.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like AxoGen's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 17% last year. Pleasingly, revenue has also lifted 33% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 13% per year during the coming three years according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 9.2% per annum, which is noticeably less attractive.

With this in consideration, we find it intriguing that AxoGen's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Its shares have lifted substantially and now AxoGen's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, AxoGen's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 1 warning sign for AxoGen you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AXGN

Axogen

Develops and commercializes technologies for peripheral nerve regeneration and repair worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives