- United States

- /

- Medical Equipment

- /

- NasdaqCM:AXGN

Axogen (AXGN): Valuation Perspective After Profitable Quarter and Raised 2025 Growth Guidance

Reviewed by Simply Wall St

Axogen (AXGN) caught investors’ attention after reporting a swing from net loss to profit in the third quarter and raising its 2025 revenue growth outlook. The company’s updated guidance and results signal growing confidence among management.

See our latest analysis for Axogen.

Momentum in Axogen’s stock has really taken off lately, with a 1-day share price return of 23.1% following the upbeat earnings and raised guidance. That surge builds on solid 30-day and 90-day share price returns of nearly 29% and 70% respectively, along with a strong 54% total shareholder return over the past year. All this suggests optimism is accelerating as investors respond to signs of sustained growth and improving profitability.

If you're looking for other healthcare companies on the move, this is the perfect moment to explore See the full list for free.

Yet with Axogen’s shares surging and guidance raised, the key question for investors is whether enthusiasm has gone too far or if there is still room for upside. This may make it a genuine buying opportunity.

Most Popular Narrative: 10% Undervalued

With Axogen’s narrative fair value calculated at $24.71 and a last close price of $22.25, optimism around the company’s strategic positioning is fueling positive sentiment just as key catalysts come into view.

Broad-based adoption of Axogen's nerve care algorithm across multiple markets (extremities, oral maxillofacial, breast) and exceptional momentum in activating high-potential accounts signal that the addressable market for nerve repair is still substantially underpenetrated. This suggests a long runway for sustained double-digit revenue growth as awareness and adoption rise.

Want a glimpse behind this bullish calculation? Forecasts hinge on bold revenue expansion, operational leverage, and margin transformation. If the growth and earnings expectations land, the narrative’s math could surprise many. Curious which core figures drive the optimism? Find out what sets this fair value apart.

Result: Fair Value of $24.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Axogen’s reliance on a single core product and the possibility of regulatory or reimbursement setbacks could disrupt the current growth story.

Find out about the key risks to this Axogen narrative.

Another View: Market Ratios Throw Shade

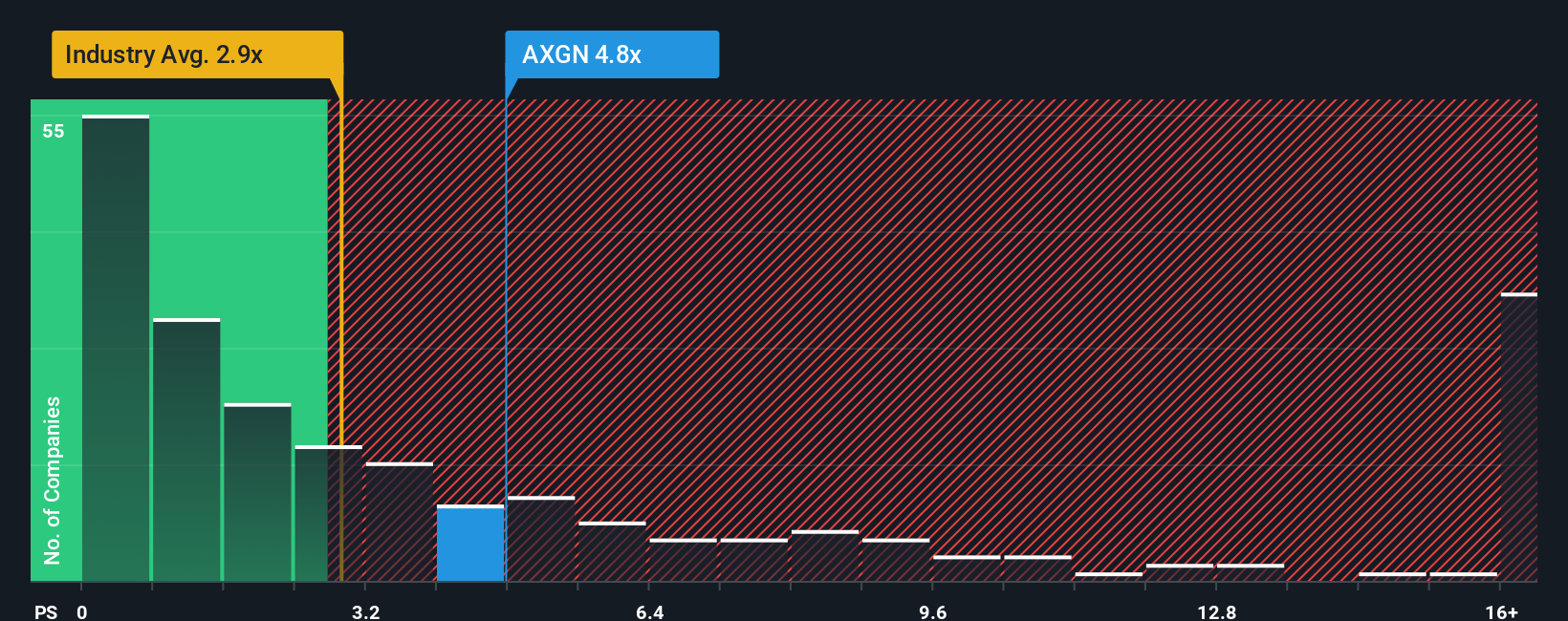

While the narrative points to Axogen being 10% undervalued, the market ratios present a different picture. Axogen’s price-to-sales ratio of 5x stands above both the US Medical Equipment industry average of 3x and the fair ratio of 3.6x. This means shares are trading at a premium, which could limit immediate upside if the market re-rates. Are investors prepared for this valuation risk as growth plays out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Axogen Narrative

If you see things differently, or want to run your own numbers, you can dig into the data and shape a personal view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Axogen.

Looking for more investment ideas?

Don't let great opportunities pass you by. The right stock could change your portfolio, so act now and check out these handpicked ideas from Simply Wall Street’s tools:

- Capture reliable income streams and spot sustainable yields with these 21 dividend stocks with yields > 3% that have consistently paid above 3%.

- Seize growth from transformative trends by scanning these 26 AI penny stocks driving breakthroughs in real-world artificial intelligence.

- Unlock value by reviewing these 854 undervalued stocks based on cash flows trading below their intrinsic cash flow estimates to find compelling bargains before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AXGN

Axogen

Develops and commercializes technologies for peripheral nerve regeneration and repair worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives