- United States

- /

- Healthcare Services

- /

- NasdaqGS:AVAH

Is Aveanna’s (AVAH) Strong Q3 Revenue and Equity Raise Shifting Its Growth Outlook?

Reviewed by Sasha Jovanovic

- In October 2025, Aveanna Healthcare Holdings announced preliminary third-quarter results showing expected revenue of approximately US$616 million to US$624 million and net income of about US$11 million to US$15 million, along with the completion of a US$90 million follow-on equity offering and impairment guidance of US$350,000 to US$500,000.

- These developments highlight sustained operational growth while providing new capital for expansion, even as the company addresses asset impairments in the quarter.

- Next, we'll assess how Aveanna's strong quarterly results and capital infusion may influence its investment narrative and growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Aveanna Healthcare Holdings Investment Narrative Recap

For anyone considering Aveanna Healthcare Holdings, the core belief centers on sustained expansion in home-based healthcare, buoyed by increasing patient demand and demographic tailwinds. The most recent quarterly guidance, calling for revenue of about US$616 million to US$624 million and net income up to US$15 million, shows strong top-line growth but does not materially alter the primary risk: continued exposure to wage pressures and reimbursement volatility, especially with looming Medicare changes. The completion of a US$90 million follow-on equity offering is particularly relevant for near-term catalysts, as it secures fresh capital to support operational initiatives and future growth plans at a time when robust demand and margin improvements are front of mind. Yet, these promising signals are tempered by the ongoing challenge of persistent wage inflation and tight labor conditions that investors should be aware of...

Read the full narrative on Aveanna Healthcare Holdings (it's free!)

Aveanna Healthcare Holdings is projected to achieve $2.7 billion in revenue and $156.7 million in earnings by 2028. This outlook calls for a 7.2% annual revenue growth rate and an increase in earnings of $138.1 million from the current $18.6 million.

Uncover how Aveanna Healthcare Holdings' forecasts yield a $9.22 fair value, a 6% downside to its current price.

Exploring Other Perspectives

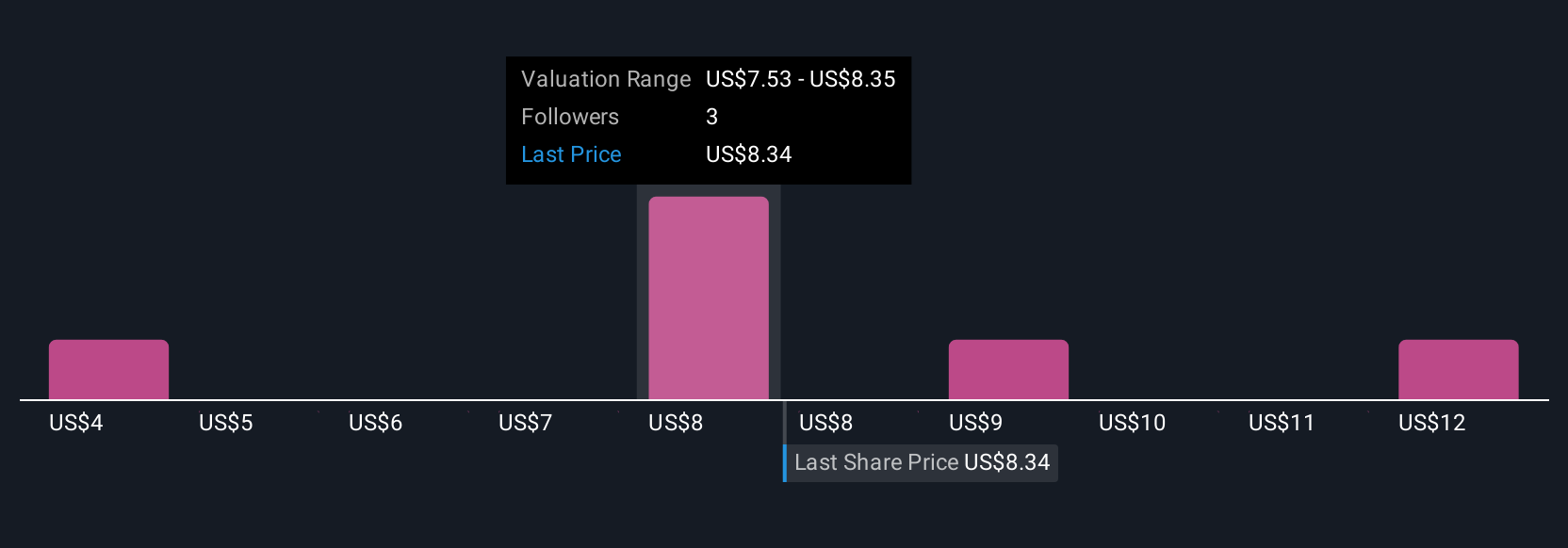

Four community members on Simply Wall St value Aveanna between US$4.29 and US$12.40 per share. With this wide range, it is important to consider both individual perspectives and how wage inflation could influence Aveanna’s financial flexibility going forward.

Explore 4 other fair value estimates on Aveanna Healthcare Holdings - why the stock might be worth less than half the current price!

Build Your Own Aveanna Healthcare Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aveanna Healthcare Holdings research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Aveanna Healthcare Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aveanna Healthcare Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVAH

Aveanna Healthcare Holdings

A diversified home care platform company, provides pediatric and adult healthcare services in the United States.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives