- United States

- /

- Healthcare Services

- /

- NasdaqGS:AVAH

Does Upward Earnings Revisions Strengthen the Long-Term Value Case for Aveanna Healthcare Holdings (AVAH)?

Reviewed by Sasha Jovanovic

- In early October 2025, analyst research highlighted Aveanna Healthcare Holdings for its strong momentum and substantial upward revisions in earnings estimates, resulting in a high analyst rating and favorable outlook for future earnings performance.

- This recognition underscores a growing consensus regarding Aveanna's capacity to translate solid operating trends and improved earnings prospects into long-term value within the home healthcare sector.

- We'll look at how these upward earnings estimate revisions and improved momentum shape Aveanna Healthcare's current investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Aveanna Healthcare Holdings Investment Narrative Recap

To be a shareholder in Aveanna Healthcare Holdings today, you need to believe in the sustained demand for home-based care and Aveanna’s ability to execute amid industry headwinds. The recent analyst recognition for strong momentum and substantial upward revisions in earnings estimates supports an optimistic, short-term earnings outlook, though it does not significantly change the biggest near-term risk, dependency on Medicaid and Medicare reimbursement rates, particularly ahead of proposed Medicare home health cuts in 2026.

Among recent announcements, Aveanna’s August 2025 guidance update, raising full-year revenue expectations to over US$2.3 billion after notable quarterly sales and earnings growth, stands out as directly tying to the story of improving earnings momentum. This underpins the positive outlook cited by analysts, with higher guidance highlighting potential short-term catalysts, although longer-term risks related to federal reimbursement policies remain top of mind.

However, it’s important to recognize that this positive momentum cannot fully offset uncertainties around upcoming Medicare rate decisions, investors should be aware that...

Read the full narrative on Aveanna Healthcare Holdings (it's free!)

Aveanna Healthcare Holdings’ outlook anticipates $2.7 billion in revenue and $156.7 million in earnings by 2028. This scenario is based on a 7.2% annual revenue growth rate and an increase in earnings of $138.1 million from the current $18.6 million.

Uncover how Aveanna Healthcare Holdings' forecasts yield a $8.81 fair value, in line with its current price.

Exploring Other Perspectives

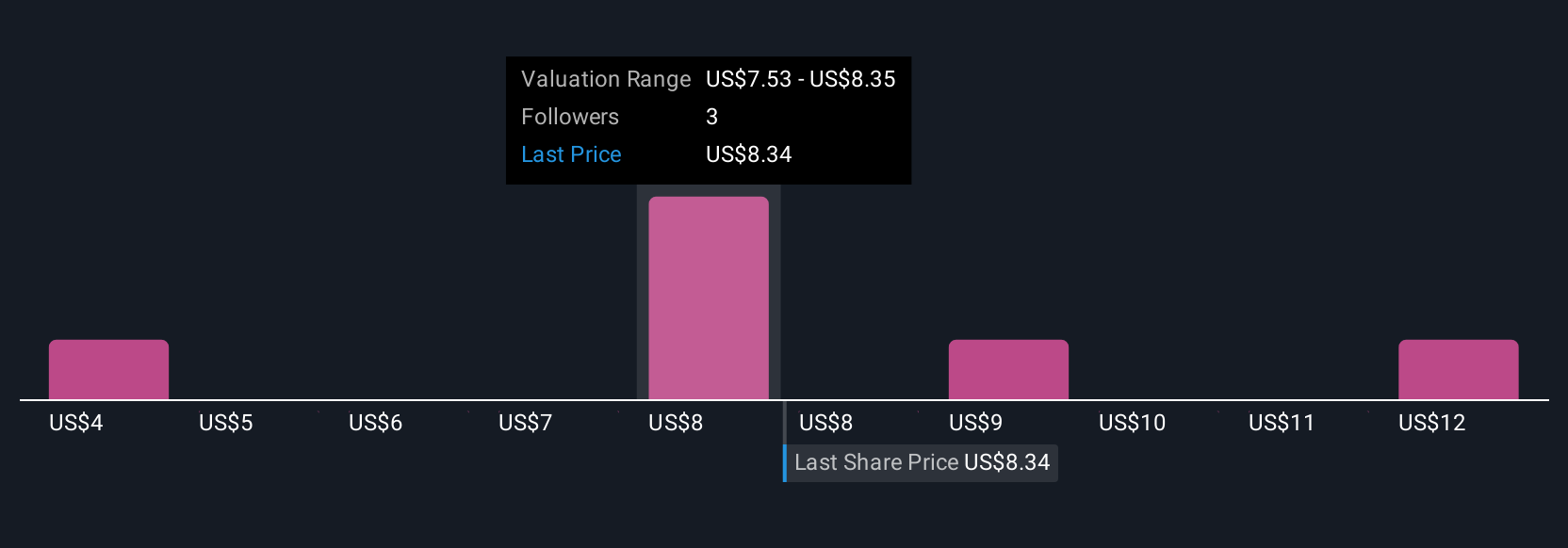

Fair value estimates from four Simply Wall St Community members range from US$4.29 to US$12.40 per share, reflecting wide differences in expectations. Against this backdrop, upcoming decisions on government reimbursement rates could be a decisive factor for Aveanna’s growth prospects, illustrating why it pays to consider multiple viewpoints.

Explore 4 other fair value estimates on Aveanna Healthcare Holdings - why the stock might be worth less than half the current price!

Build Your Own Aveanna Healthcare Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aveanna Healthcare Holdings research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Aveanna Healthcare Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aveanna Healthcare Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVAH

Aveanna Healthcare Holdings

A diversified home care platform company, provides pediatric and adult healthcare services in the United States.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives