- United States

- /

- Medical Equipment

- /

- NasdaqGM:ATRC

AtriCure (ATRC): Evaluating Valuation Following Strong Earnings and Improved Analyst Sentiment

Reviewed by Simply Wall St

AtriCure (ATRC) shares have drawn fresh attention after the company announced quarterly results that surpassed expectations. Along with recent broker consensus and upbeat institutional sentiment, investors are reevaluating the stock’s prospects in this evolving environment.

See our latest analysis for AtriCure.

AtriCure’s latest quarterly results and upbeat outlook have nudged its share price to $36.12, adding to its 4.5% one-month share price return. Although momentum has picked up this year with an 18.8% year-to-date share price return, its one-year total shareholder return stands at -2.5%, suggesting that investors are still balancing recent growth optimism against earlier challenges.

If fresh momentum in the medtech space has you looking for the next opportunity, it might be a good time to check out the market’s most innovative healthcare stocks. See the full list here: See the full list for free.

With shares rebounding and analyst price targets significantly higher than current levels, the real question is whether AtriCure’s valuation still offers upside for new investors or if the market is already factoring in its future growth.

Most Popular Narrative: 27.8% Undervalued

With the last close at $36.12 and the most widely followed fair value narrative at $50, there is a clear gap that has investors talking. Attention is now on whether AtriCure's accelerating growth and expanding global reach are adequately reflected in the current share price.

Accelerated adoption of innovative minimally invasive devices and successful product launches are driving strong revenue growth, profitability, and operating leverage. Global market expansion, advancing clinical trials, and robust evidence generation are broadening access, supporting payer acceptance, and positioning for sustained long-term growth.

Want to peek behind the curtain of this bullish valuation? The most eye-catching growth projections stem from double-digit revenue gains and a dramatic earnings turnaround. But which financial leap sets this narrative apart from the crowd? Unlock the details fueling this ambitious price target inside the full story.

Result: Fair Value of $50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in the ablation market and ongoing regulatory risks could challenge AtriCure's earnings outlook if these issues are not effectively managed.

Find out about the key risks to this AtriCure narrative.

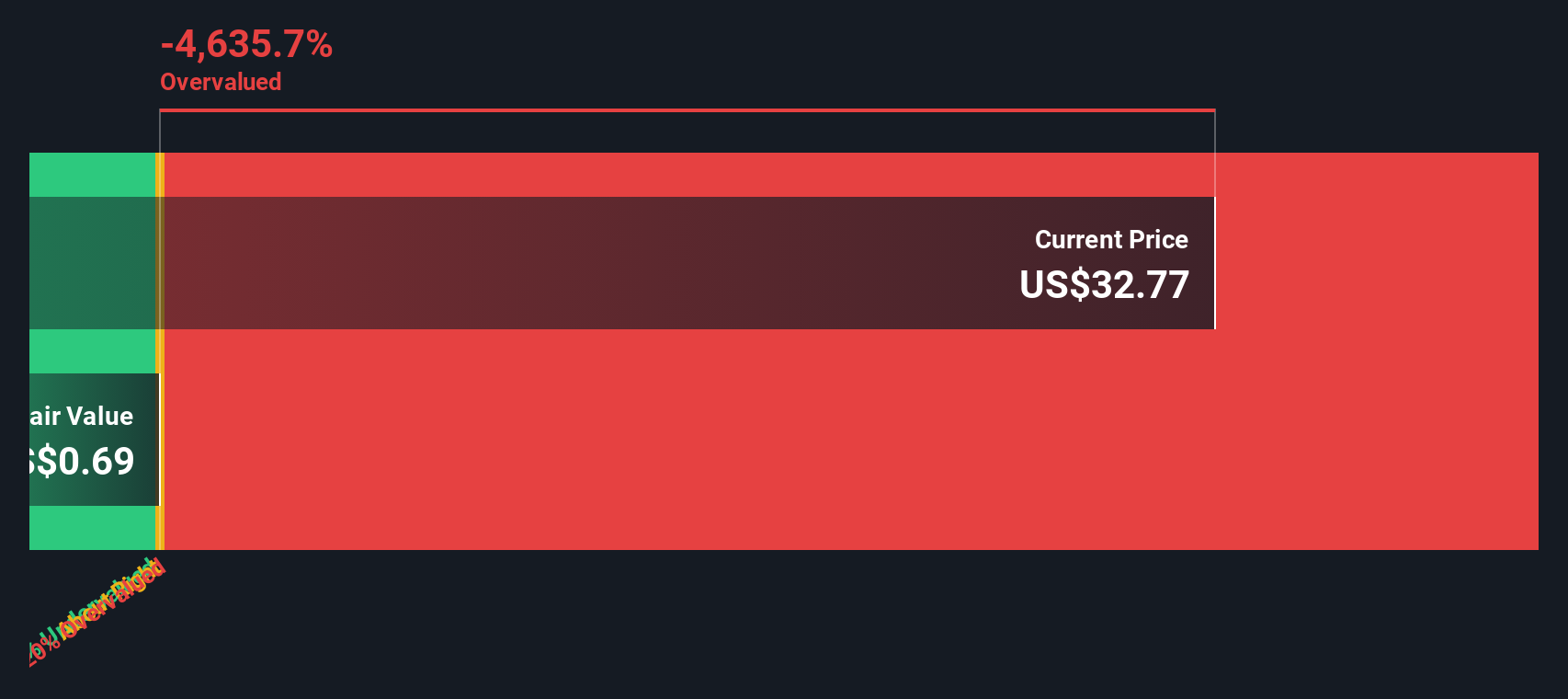

Another View: Discounted Cash Flow Model Raises Questions

While analysts see significant upside based on future earnings growth and price targets, our DCF model tells a far less optimistic story. According to this approach, AtriCure is actually trading well above its estimated fair value. Which method better reflects reality? What matters more in a high-growth medtech market?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AtriCure for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AtriCure Narrative

If you see things differently, or want to draw your own conclusions, you can craft your own take on AtriCure’s outlook in just a few minutes by using Do it your way

A great starting point for your AtriCure research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your search to one opportunity? Position yourself for smarter investing by checking out these standout stock ideas and stay ahead of the trends shaping tomorrow's markets.

- Uncover overlooked value by scanning these 916 undervalued stocks based on cash flows that the market may have missed. These could offer attractive upside potential before the crowd catches on.

- Turbocharge your portfolio with these 25 AI penny stocks focused on artificial intelligence. Rapid innovation in this area could contribute to the next wave of top performers.

- Explore compelling yields and reliable passive income opportunities with these 15 dividend stocks with yields > 3%, an approach well-suited for building a more resilient and rewarding investment mix.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ATRC

AtriCure

Develops, manufactures, and sells devices for surgical ablation of cardiac tissue, exclusion of the left atrial appendage, and temporarily blocking pain by ablating peripheral nerves to medical centers in the United States, the Asia-Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026