- United States

- /

- Medical Equipment

- /

- NasdaqGM:ATRC

Assessing AtriCure (ATRC) Valuation After Milestone First‑in‑Human Results for Its Dual Energy Ablation Platform

Reviewed by Simply Wall St

AtriCure (ATRC) just cleared an important milestone by reporting successful first in human procedures with its dual energy platform that combines Pulsed Field Ablation with Advanced Radiofrequency Ablation in cardiac surgery.

See our latest analysis for AtriCure.

That progress seems to be resonating with investors, with a roughly 34.7% year to date share price return and a 33.3% one year total shareholder return hinting that momentum is rebuilding after weaker multi year performance.

If this kind of medtech innovation is on your radar, it could be a good moment to explore other healthcare names through healthcare stocks and see what else fits your strategy.

Yet with shares still trading below analyst targets despite strong revenue momentum and a deep red bottom line, investors now face a key question: is this a fresh buying opportunity, or is future growth already priced in?

Most Popular Narrative: 18.1% Undervalued

With AtriCure last closing at $40.95 against a narrative fair value of $50, the valuation case leans on aggressive growth and margin improvement assumptions.

Positive volume trends from new product launches, combined with operational efficiencies (evidenced by SG&A and R&D growth below revenue growth), are driving operating leverage, which should improve net margins and profitability as the business continues to scale.

Curious how a loss making medtech earns a premium style valuation? The narrative focuses on rapid revenue compounding, rising margins, and a rich future earnings multiple. Want to see how those ingredients combine into that fair value?

Result: Fair Value of $50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating PFA catheter adoption and European pricing pressure could undermine AtriCure's growth narrative, challenging both revenue expansion and long term margin improvement.

Find out about the key risks to this AtriCure narrative.

Another Angle on Valuation

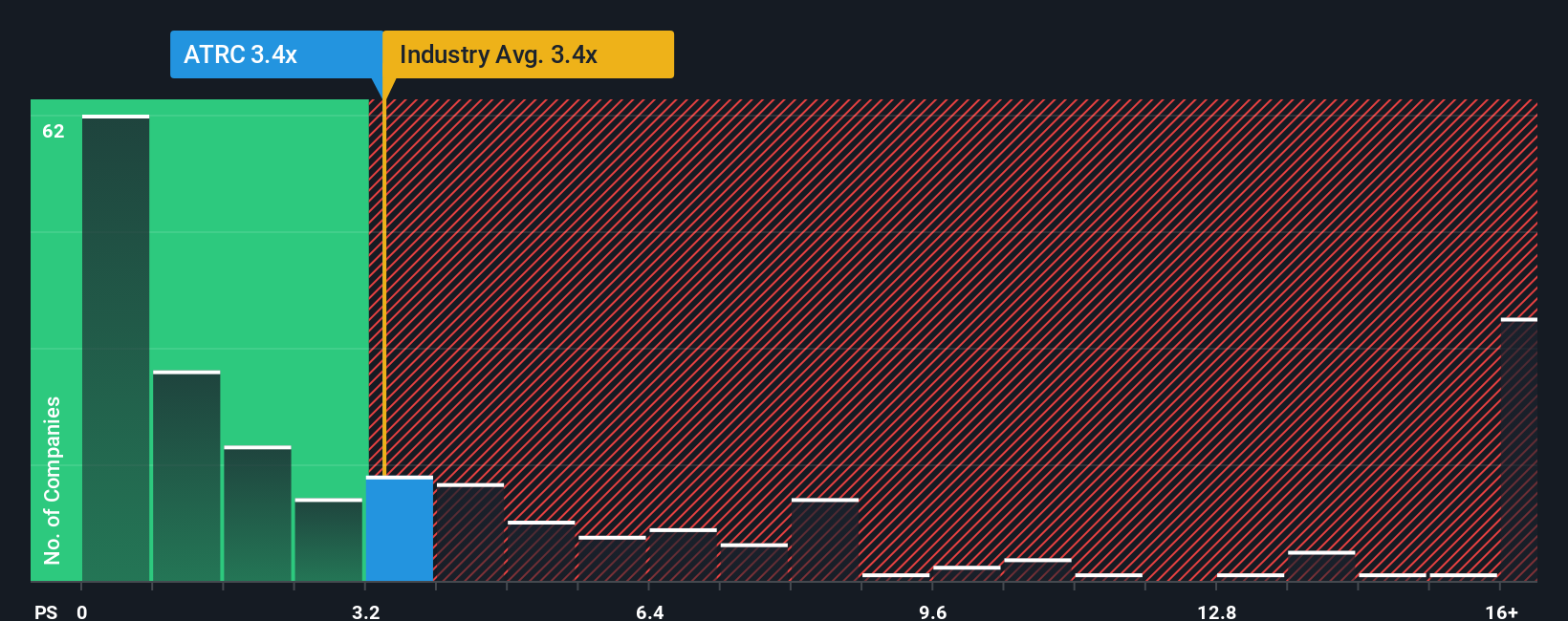

While the narrative fair value suggests AtriCure is 18.1% undervalued, our fair ratio work paints a more cautious picture. On a price to sales of 3.9 times versus a fair ratio of 3.7 times, and 3.1 times for the wider US medical equipment group, the stock screens slightly expensive, not cheap. This raises the question of whether optimism has already crept into today’s price.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AtriCure Narrative

If this perspective does not quite match your own view, you can always dive into the numbers and craft a personalized storyline in just a few minutes, Do it your way.

A great starting point for your AtriCure research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential winners by using the Simply Wall Street Screener to pinpoint opportunities that match your strategy and risk profile.

- Capture early growth potential with these 3633 penny stocks with strong financials that already show solid financial foundations instead of guessing which cheap names might turn around.

- Ride the next wave of innovation by targeting these 24 AI penny stocks positioned at the intersection of software, data, and intelligent automation.

- Strengthen your portfolio’s income stream by focusing on these 12 dividend stocks with yields > 3% that can help offset volatility with reliable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ATRC

AtriCure

Develops, manufactures, and sells devices for surgical ablation of cardiac tissue, exclusion of the left atrial appendage, and temporarily blocking pain by ablating peripheral nerves to medical centers in the United States, the Asia-Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion