- United States

- /

- Biotech

- /

- NasdaqGM:NAMS

November 2025's Select Stocks That May Be Priced Below Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of mixed performance, with major indices like the S&P 500 and Nasdaq showing slight declines following an early-week rally, investors are closely monitoring developments such as the potential end to the government shutdown. In this environment, identifying stocks that may be undervalued becomes crucial for investors seeking opportunities amid fluctuating tech stock performances and broader market shifts.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Old National Bancorp (ONB) | $21.03 | $41.03 | 48.7% |

| Nicolet Bankshares (NIC) | $125.39 | $242.17 | 48.2% |

| Huntington Bancshares (HBAN) | $15.81 | $31.03 | 49.1% |

| Genius Sports (GENI) | $10.40 | $20.64 | 49.6% |

| First Busey (BUSE) | $22.92 | $45.34 | 49.4% |

| Fifth Third Bancorp (FITB) | $43.13 | $83.26 | 48.2% |

| CNB Financial (CCNE) | $24.89 | $49.42 | 49.6% |

| Caris Life Sciences (CAI) | $24.80 | $47.93 | 48.3% |

| Byrna Technologies (BYRN) | $18.26 | $35.57 | 48.7% |

| AbbVie (ABBV) | $218.71 | $434.42 | 49.7% |

Let's review some notable picks from our screened stocks.

NewAmsterdam Pharma (NAMS)

Overview: NewAmsterdam Pharma Company N.V. is a late-stage biopharmaceutical company focused on developing therapies for metabolic diseases, with a market cap of $4.14 billion.

Operations: NewAmsterdam Pharma's revenue segments are not specified in the available information.

Estimated Discount To Fair Value: 43.5%

NewAmsterdam Pharma appears undervalued based on discounted cash flow analysis, trading at US$38.97, significantly below the estimated fair value of US$69.01. Despite a challenging financial quarter with a net loss of US$72.01 million, the company's revenue is projected to grow 61.4% annually, outpacing market averages and indicating potential future profitability within three years. However, recent insider selling could be a concern for investors assessing confidence in management's strategic direction.

- Our comprehensive growth report raises the possibility that NewAmsterdam Pharma is poised for substantial financial growth.

- Get an in-depth perspective on NewAmsterdam Pharma's balance sheet by reading our health report here.

Alphatec Holdings (ATEC)

Overview: Alphatec Holdings, Inc. is a medical technology company that focuses on designing and developing technologies for the surgical treatment of spinal disorders, with a market cap of approximately $2.94 billion.

Operations: The company's revenue primarily comes from its Medical Products segment, which generated $728.02 million.

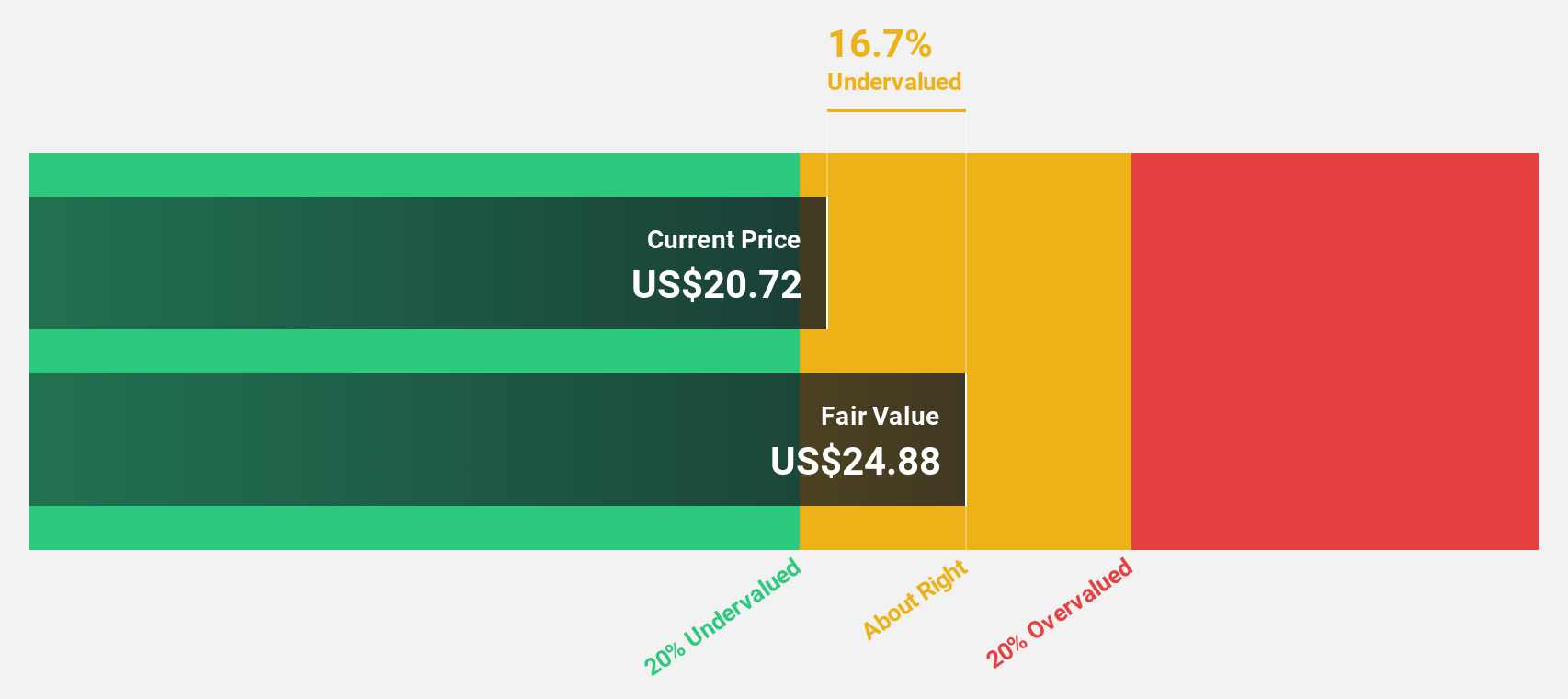

Estimated Discount To Fair Value: 18.7%

Alphatec Holdings, trading at US$20.24, is undervalued relative to its estimated fair value of US$24.89. The company anticipates revenue growth of 14.1% annually, surpassing the broader market's pace and projecting profitability within three years. Despite a third-quarter net loss of US$28.58 million, improved guidance for the fiscal year reflects confidence in strategic execution. However, significant insider selling recently might raise questions about internal sentiment toward future prospects.

- Our expertly prepared growth report on Alphatec Holdings implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Alphatec Holdings here with our thorough financial health report.

Pattern Group (PTRN)

Overview: Pattern Group Inc. accelerates various brands on ecommerce marketplaces using proprietary technology and AI, with a market cap of $3.12 billion.

Operations: Pattern Group Inc. generates revenue through its operations in ecommerce marketplaces, leveraging advanced technology and artificial intelligence to enhance brand performance.

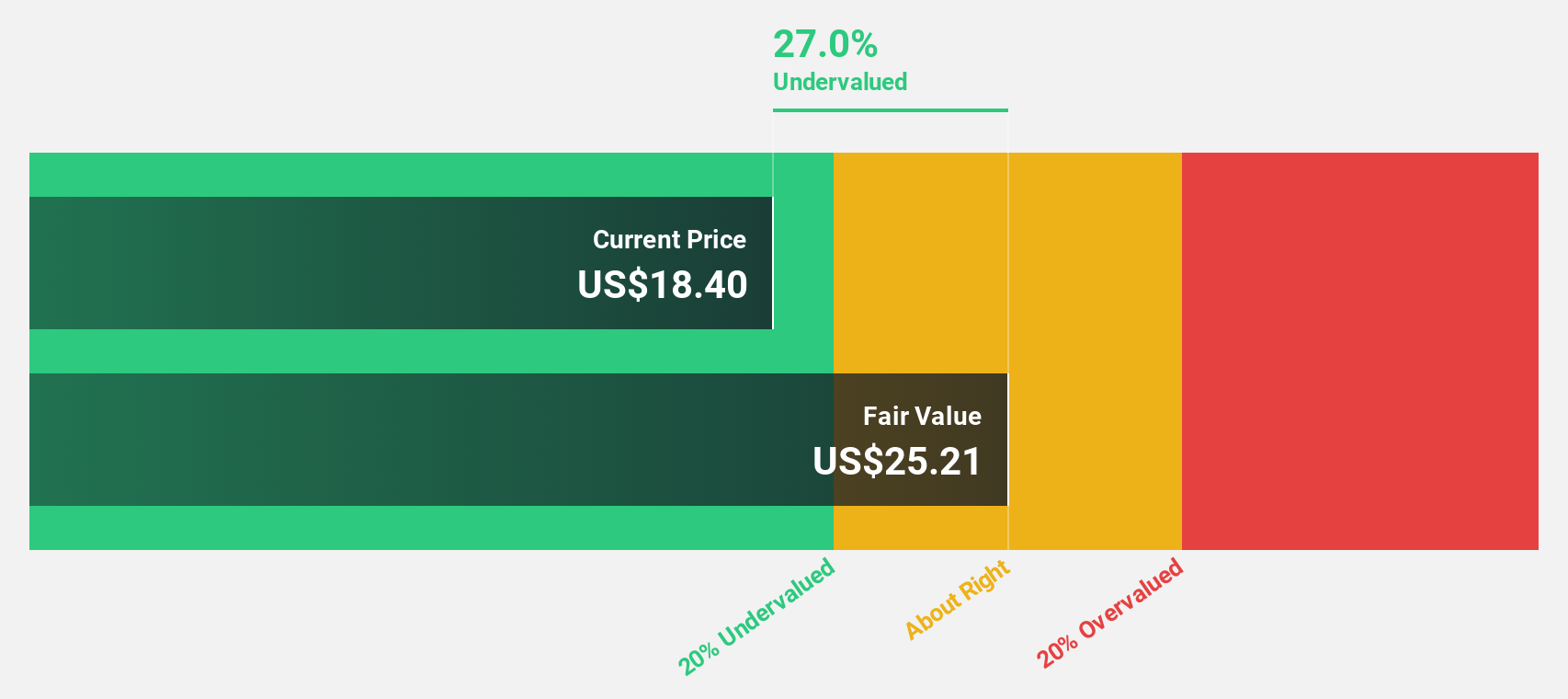

Estimated Discount To Fair Value: 29.8%

Pattern Group, trading at US$17.7, is undervalued compared to its estimated fair value of US$25.21. Despite a third-quarter net loss of US$59.06 million, revenue grew significantly to US$639.66 million from the previous year and is expected to continue growing faster than the market average at 19.2% annually. The company anticipates fourth-quarter revenues between US$680 million and US$700 million, reflecting strong growth potential despite recent volatility in share price post-IPO.

- The growth report we've compiled suggests that Pattern Group's future prospects could be on the up.

- Click here to discover the nuances of Pattern Group with our detailed financial health report.

Turning Ideas Into Actions

- Click here to access our complete index of 180 Undervalued US Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewAmsterdam Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NAMS

NewAmsterdam Pharma

A late-stage biopharmaceutical company, develops therapies to enhance patient care in populations with metabolic disease.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives