- United States

- /

- Healthcare Services

- /

- NasdaqCM:ASTH

Astrana Health (ASTH): Assessing If the Recent Decline Signals an Undervalued Opportunity

Reviewed by Simply Wall St

Astrana Health (ASTH) has seen its stock trend downward over the past month, with shares slipping by 33%. This movement comes as investors continue to evaluate the company’s recent performance and its long-term growth prospects.

See our latest analysis for Astrana Health.

While Astrana Health’s share price has struggled lately, the broader story shows momentum has faded over the last year, with a 1-year total shareholder return of -47.24% and year-to-date share price return at -33.14%. Recent volatility suggests investors are weighing both near-term concerns and the company’s longer-term growth picture.

If you’re rethinking your next move after this week’s swings, it could be the perfect time to discover See the full list for free.

With Astrana Health’s share price now trading at a significant discount to analyst targets, the question is whether this downward move signals an undervalued stock or if the market has already factored in its future growth potential.

Most Popular Narrative: 50.9% Undervalued

Astrana Health’s most widely followed narrative sees its fair value nearly double the recent close. This view weighs rapid growth projections alongside structural trends currently changing healthcare.

Sustained investment and rapid integration of proprietary technology platforms and data infrastructure (including AI-driven capabilities) are enabling better cost control, real-time utilization management, and operational leverage. This approach is expected to contribute to further EBITDA margin expansion as scale increases and as new geographies ramp up.

Curious how ambitious tech upgrades and operational overhauls might fuel Astrana’s financial transformation? The growth estimates underpinning this narrative are bold. Analysts are betting on much more than incremental improvements. Only by exploring the full narrative can you uncover the precise forecasts and assumptions shaping its high valuation.

Result: Fair Value of $43.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, major integration challenges and policy shifts in government programs could significantly change Astrana Health’s growth path and affect long-term profitability.

Find out about the key risks to this Astrana Health narrative.

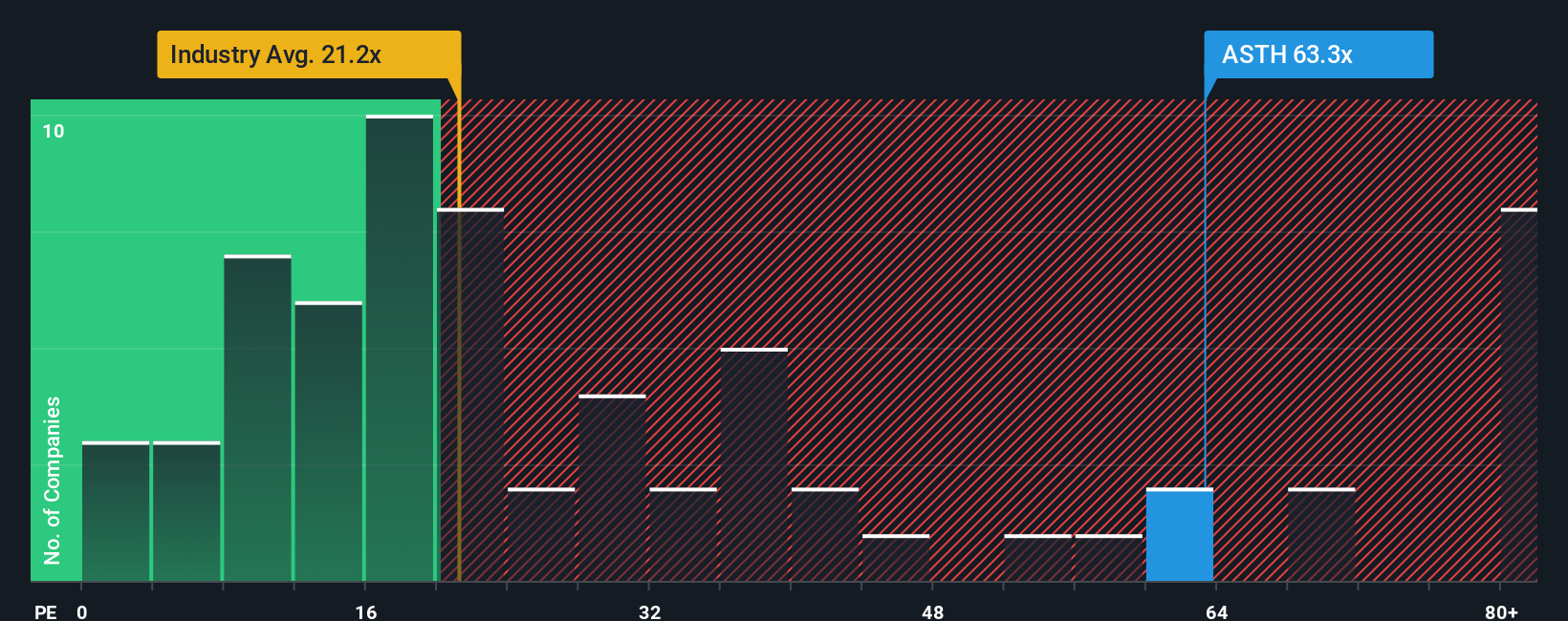

Another View: What Do Price Ratios Say?

While analysts see Astrana Health as undervalued based on future growth, a quick look at its price-to-earnings ratio shows a very different picture. At 113.2x, the stock is much pricier than both peers (57.1x) and the US Healthcare industry average (21.6x). Even the fair ratio for ASTH, calculated by market standards, is much lower at 34.2x. This wide gap could point to big valuation risks if current optimism fades, or does it reflect something the ratios simply miss?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Astrana Health Narrative

If these perspectives don't quite fit your outlook or you want to dig into the details yourself, it only takes a few minutes to build your own narrative with Do it your way.

A great starting point for your Astrana Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let a single stock determine your future returns, especially when untapped opportunities await. Use the Simply Wall Street Screener to target industries and trends that demand attention so you’re always one step ahead of the market.

- Capitalize on cutting-edge breakthroughs shaping artificial intelligence by checking out these 25 AI penny stocks, designed to spotlight companies revolutionizing this field.

- Grow your portfolio’s income and security by uncovering the latest opportunities in these 16 dividend stocks with yields > 3%, offering reliable yields above 3%.

- Catch compelling value plays with these 886 undervalued stocks based on cash flows, which highlights stocks currently trading well below their intrinsic worth based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ASTH

Astrana Health

A healthcare management company, provides medical care services in the United States.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives