- United States

- /

- Medical Equipment

- /

- NasdaqGS:ARAY

Little Excitement Around Accuray Incorporated's (NASDAQ:ARAY) Revenues As Shares Take 28% Pounding

The Accuray Incorporated (NASDAQ:ARAY) share price has fared very poorly over the last month, falling by a substantial 28%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 51% loss during that time.

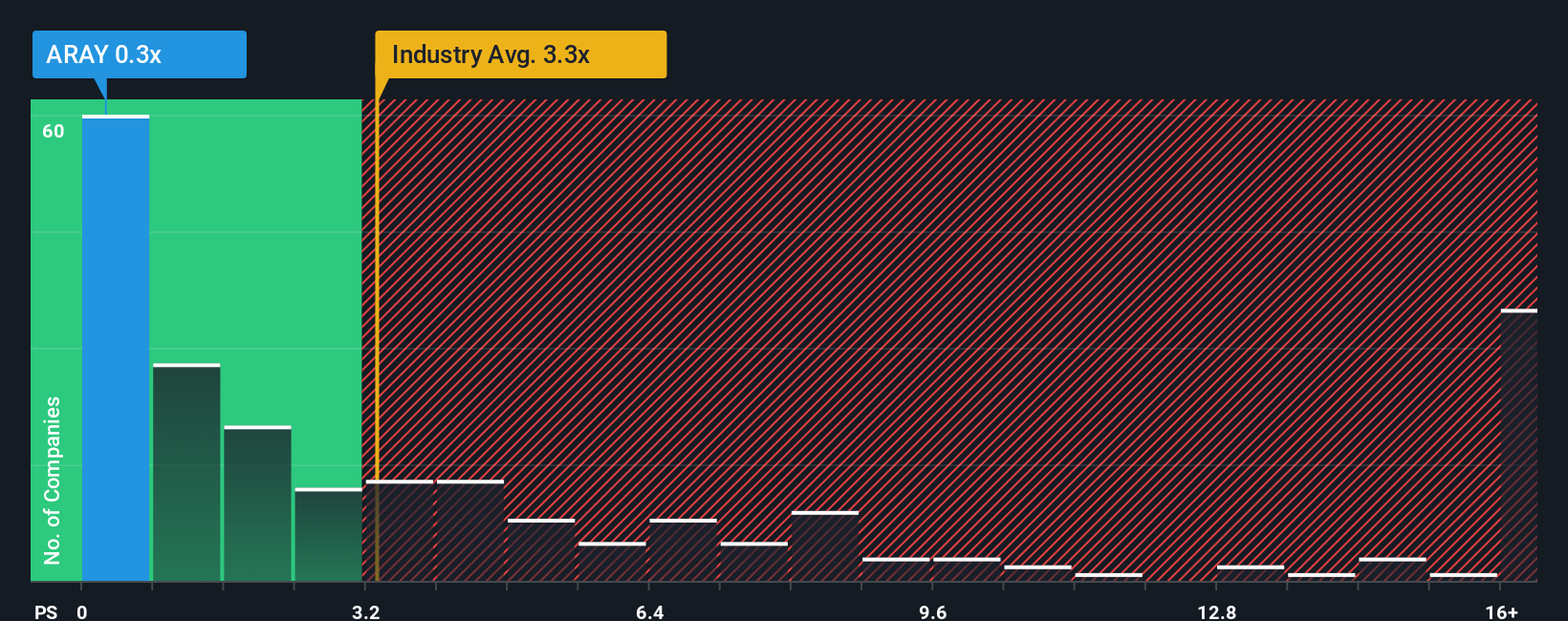

After such a large drop in price, Accuray's price-to-sales (or "P/S") ratio of 0.3x might make it look like a strong buy right now compared to the wider Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 3.3x and even P/S above 9x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Accuray

What Does Accuray's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Accuray has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Accuray will help you uncover what's on the horizon.How Is Accuray's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Accuray's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Regardless, revenue has managed to lift by a handy 7.6% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 4.6% during the coming year according to the dual analysts following the company. That's shaping up to be materially lower than the 60% growth forecast for the broader industry.

With this information, we can see why Accuray is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Shares in Accuray have plummeted and its P/S has followed suit. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Accuray maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Plus, you should also learn about this 1 warning sign we've spotted with Accuray.

If these risks are making you reconsider your opinion on Accuray, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ARAY

Accuray

Engages in the design, development, manufacture, and sale of radiosurgery and radiation therapy systems for the treatment of tumors in the United States, Canada, Latin America, Asia, Australia, New Zealand, Europe, the Middle East, India, Africa, Japan, and China.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026