- United States

- /

- Medical Equipment

- /

- NasdaqGS:ALGN

Should Investors Reconsider Align Technology After Invisalign Sales Slump and 40% Share Price Drop?

Reviewed by Bailey Pemberton

If you’ve been following Align Technology’s stock, you know it’s been a bumpy ride lately. Maybe you’re wondering, “Should I hang on, buy more, or head for the exits?” You’re not alone. The stock has seen a lot of ups and downs, and everyone’s looking for a good reason to decide what’s next. Over the past year, shares have slid by more than 43%, and the return since the start of the year is even more daunting at nearly -40%. Even when we zoom out to five years, the price is down over 60%. But wild price swings don’t always mean the story is over for a stock, especially in fast-evolving markets like digital dentistry and orthodontics.

Despite the negative momentum, there are hints that the recent selloff might have made Align look like a bargain. The company now scores a 5 out of 6 on a valuation checklist, which means it appears undervalued by nearly every major measure analysts use to assess a stock’s worth. While the headlines and charts may be painting a gloomy picture right now, there’s more beneath the surface here that’s worth digging into. Next, we’ll break down the different valuation methods and see how Align measures up across the board. And, if you’re the kind of investor who wants more than a checklist, we’ll wrap up with a deeper look at a smarter way to judge if Align is really worth your money.

Why Align Technology is lagging behind its peers

Approach 1: Align Technology Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to today’s dollars. In other words, it looks at what Align Technology is expected to generate in free cash flow going forward, adjusts for the time value of money, and sums it all up to determine what the business might really be worth right now.

For Align Technology, the latest reported Free Cash Flow stands at $571.5 million. Analysts see this number climbing steadily, with projections of $737.3 million by 2026 and $850.3 million by 2027. Simply Wall St extrapolates the growth beyond the usual five-year analyst horizon, resulting in a 2035 forecast of $1.3 billion in annual free cash flow. These estimates reflect the company’s potential as it continues to innovate in digital dentistry and aligner technology.

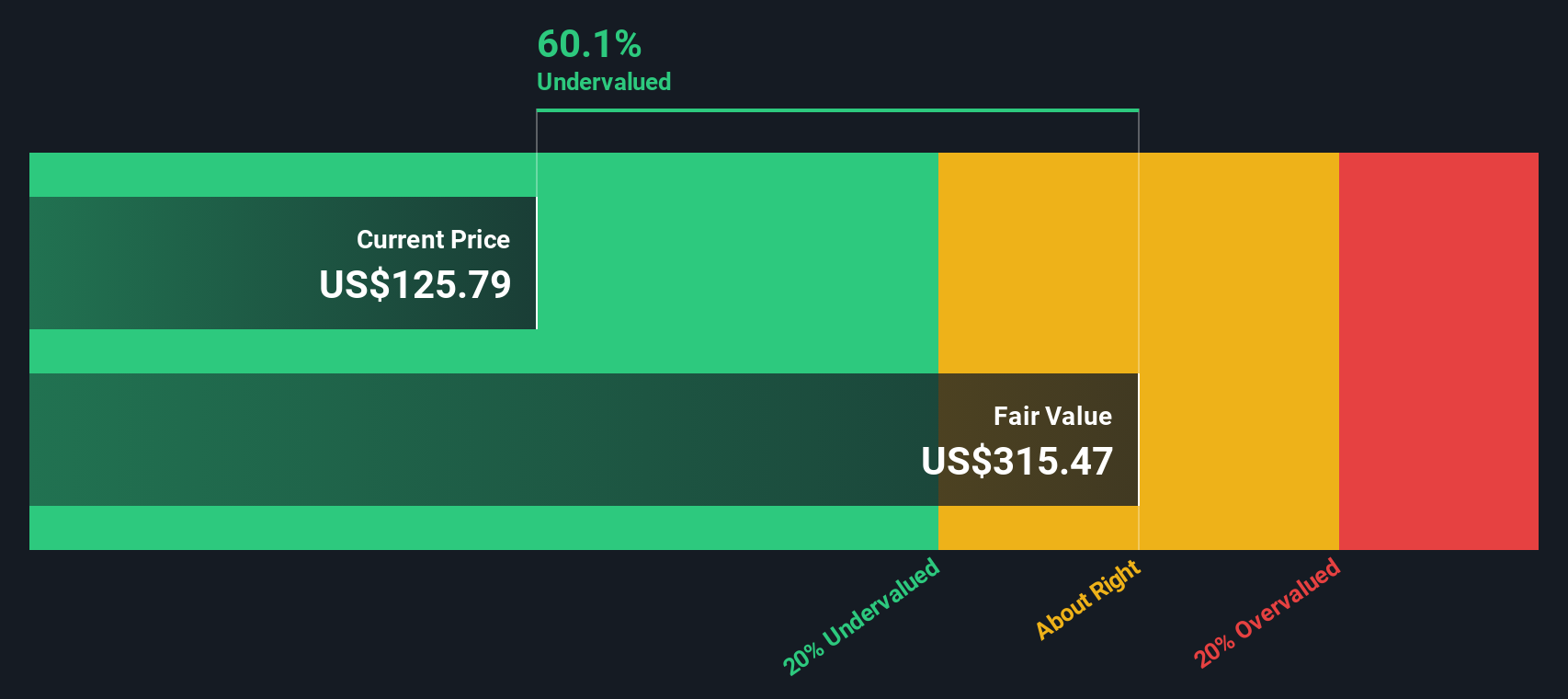

Using the DCF approach, Align Technology’s intrinsic value comes out to $314.58 per share. Compared to where the stock is trading now, this implies it is trading at a 60% discount, suggesting ALIGN may be significantly undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Align Technology is undervalued by 60.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Align Technology Price vs Earnings (PE)

For consistently profitable companies like Align Technology, the Price-to-Earnings (PE) ratio is one of the most popular valuation tools. Investors use the PE ratio to compare what they are paying for each dollar of the company’s earnings, making it especially helpful for businesses with positive and stable profits. Generally, the “right” PE ratio isn’t just a matter of matching the industry or peers. Higher expected growth or lower perceived risk should justify a higher PE, while the opposite is true for riskier or slower-growing companies.

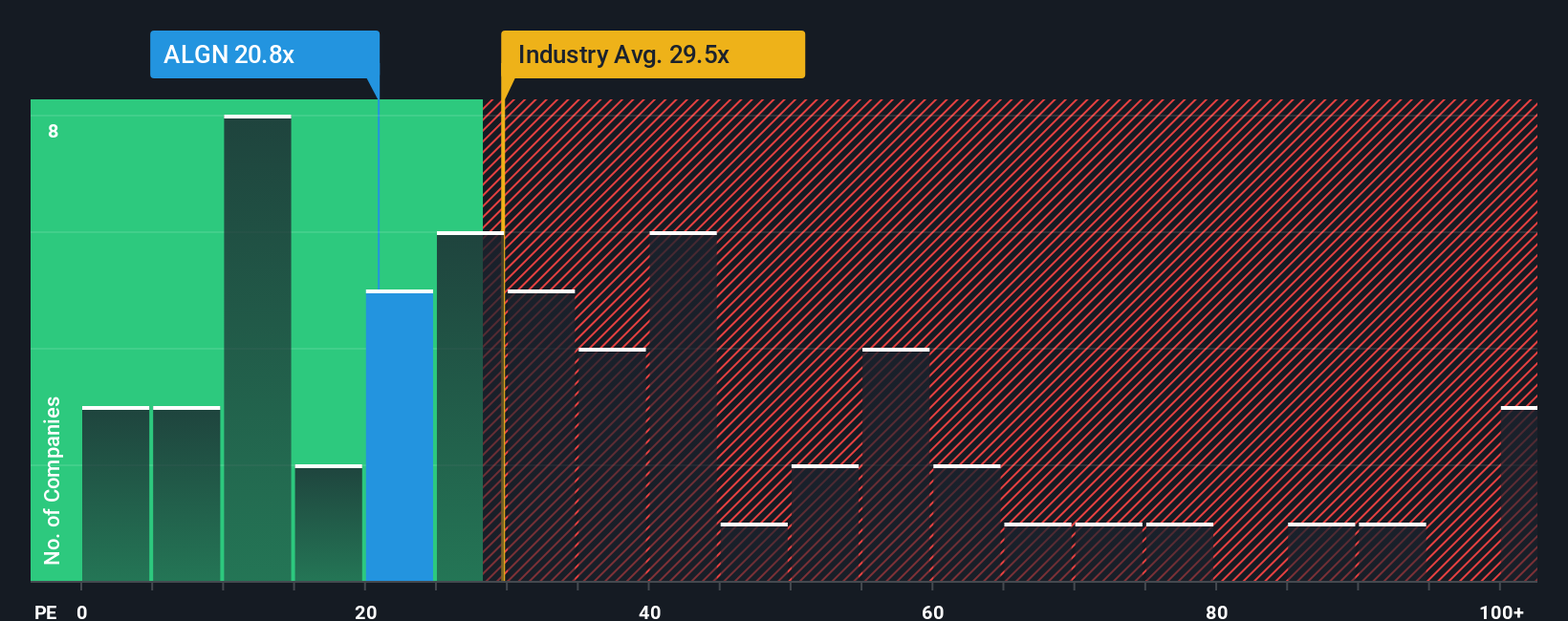

At the moment, Align Technology’s PE ratio is 20.8x, which is well below both the Medical Equipment industry average of 30.1x and the average among its peer group, which sits at 29.6x. These comparisons suggest that Align is trading at a discount, at least by conventional benchmarking standards.

However, Simply Wall St’s “Fair Ratio” metric gives a more nuanced view. By factoring in not just industry averages or peer multiples, but also company-specific elements like earnings growth, profit margins, market capitalization, and risk, the Fair Ratio presents a holistic assessment of what Align's PE should be in this context. For Align, the Fair Ratio calculates to 30.4x, considerably above its current 20.8x.

With Align trading at a PE ratio significantly below the Fair Ratio, this approach suggests the stock is undervalued based on earnings and company characteristics.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Align Technology Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your investment story. It connects your view of Align Technology’s business, industry trends, and competitive positioning with your own assumptions for future revenue, earnings, and margins, ultimately resulting in a personal fair value for the stock.

Narratives empower you to move beyond static ratios by tying your research, conviction, and expectations directly to a financial forecast and valuation. This process is transparent and easy to update as new facts emerge. On Simply Wall St’s Community page (trusted by millions of investors), you can create or explore Narratives that reflect a range of opinions, from highly optimistic to cautious, and see how each user’s forecast leads to a specific fair value for Align.

This approach allows you to compare your Narrative’s fair value with Align’s actual share price, helping you decide when it might be time to buy or sell based on your own logic rather than just headlines or peer averages. Narratives are dynamic. As soon as earnings or news hit, community forecasts and fair values recalculate in real time, giving you a living, breathing investment thesis. For example, some investors expect emerging markets and digital workflow investments to fuel rapid growth, justifying a price target of $220, while others see tougher industry conditions and set their fair value as low as $140.

Do you think there's more to the story for Align Technology? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALGN

Align Technology

Provides Invisalign clear aligners, Vivera retainers, and iTero intraoral scanners and services in the United States, Switzerland, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.