- United States

- /

- Healthcare Services

- /

- NasdaqGS:ADUS

Addus HomeCare (ADUS) Valuation in Focus Following Q2 Beat, Analyst Upgrades, and New Leadership Appointment

Reviewed by Simply Wall St

Addus HomeCare (ADUS) has captured investors’ attention this month after a series of consequential news events. Following an upbeat Q2 report, the company’s leadership welcomed Heather Dixon as its new President and Chief Operating Officer. In addition, two prominent firms, Barclays and TD Cowen, raised their assessments of the stock, indicating an increased level of market optimism. At the same time, Chairman and CEO Dirk Allison sold 25,000 shares, signaling significant insider selling and raising questions about sentiment among management.

These recent announcements have occurred alongside intriguing trading dynamics for Addus HomeCare. After a challenging stretch in which shares fell over 11% in the past year, momentum appears to be shifting, with a 7% climb in the past month and additional gains year-to-date. The company also posted strong annual revenue and net income growth, at over 9% and 16% respectively, which may be contributing to renewed investor interest despite continued uncertainty in the broader healthcare sector this year.

With new leadership, increased analyst confidence, and fresh upward momentum, the central question is whether Addus HomeCare is undervalued today or if the market has already fully factored in its future growth. Is this a compelling entry point, or has optimism already been reflected in the stock price?

Most Popular Narrative: 23% Undervalued

According to the narrative by DanielGC, Addus HomeCare is calculated to be trading at a notable discount to its estimated fair value, reflecting potential upside for patient investors who can withstand some uncertainty in the healthcare space.

The company's business model is resilient and defensive against cyclical downturns, making it a safe haven in times of economic uncertainty. Valuation premiums reflect a superior business model and significant long-term growth prospects, but also imply limited margin of safety for investors.

Can a disciplined growth engine, stable margins, and an eye for selective acquisitions justify such an optimistic valuation? There is a catch that could change everything. Want to decode the financial growth formula and the exact leverage points pushing this premium pricing? Find out the key assumptions that fuel this compelling valuation outlook. Read on to see what market forces could make or break the upside.

Result: Fair Value of $154.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent labor shortages or unexpected government reimbursement cuts could quickly undermine Addus HomeCare’s growth thesis and investor confidence.

Find out about the key risks to this Addus HomeCare narrative.Another View: Price Ratio Tells a Different Story

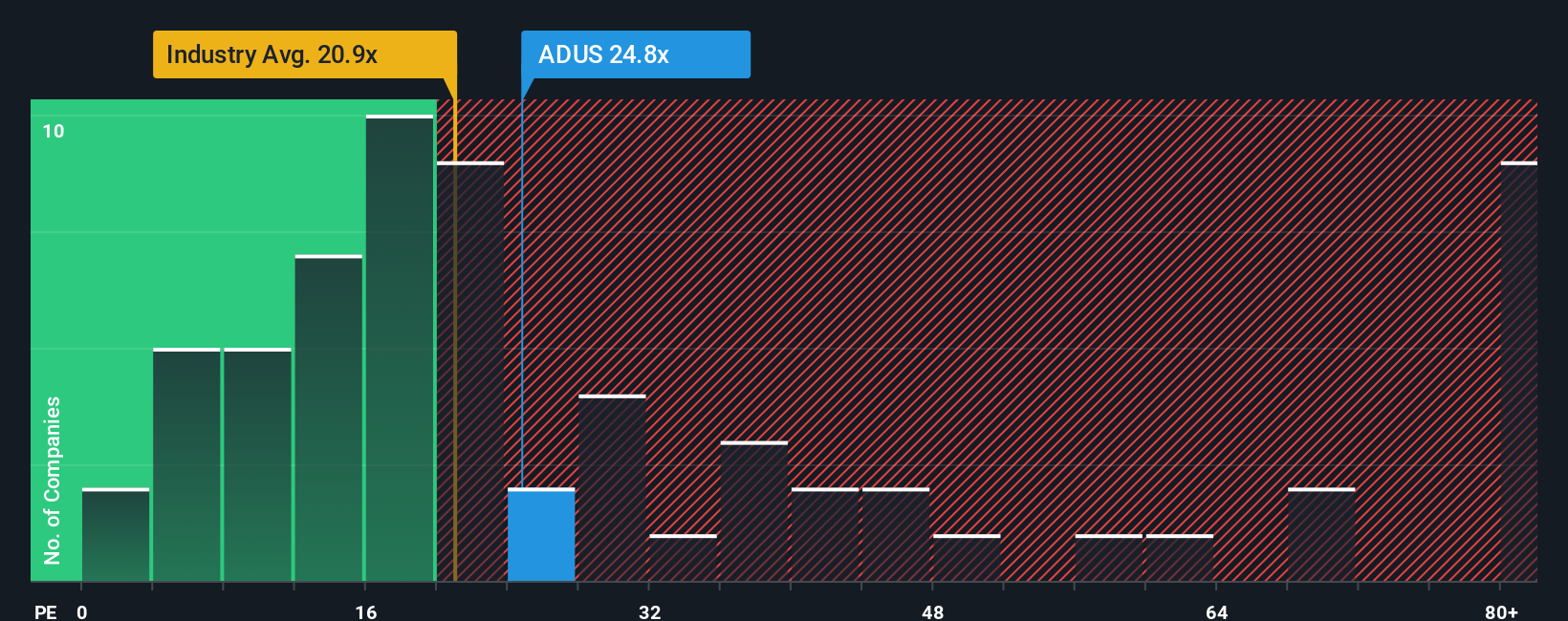

While one method points to Addus HomeCare being undervalued, comparing its pricing to similar companies in the industry suggests it may be more expensive. Could the stock’s recent strength already reflect future optimism, or is there still potential for growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Addus HomeCare Narrative

If the above perspectives don’t quite fit your interpretation, you’re welcome to dive into the numbers and assemble a narrative of your own in just a few minutes. do it your way.

A great starting point for your Addus HomeCare research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Investment Opportunities?

Accelerate your investing edge by branching out beyond just one stock. The market is brimming with exceptional opportunities, and you deserve to know about the most promising trends before everyone else. Seize the chance to get ahead of the crowd with these compelling investment angles:

- Unlock consistent income by following up on the strongest dividend stocks with yields above 3% using the smart filter here: dividend stocks with yields > 3%.

- Ride the innovation wave by tracking healthcare companies harnessing the power of artificial intelligence to revolutionize patient care and medical breakthroughs with this shortcut: healthcare AI stocks.

- Spot emerging value by targeting penny stocks with robust financials, primed for potential big moves, with this targeted list: penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADUS

Addus HomeCare

Provides personal care services to elderly, chronically ill, disabled persons, and individuals who are at risk of hospitalization or institutionalization in the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives