- United States

- /

- Food

- /

- NYSEAM:SEB

Seaboard (SEB) Net Margin Jumps to 4%, Challenging Pessimistic Long-Term Narratives

Reviewed by Simply Wall St

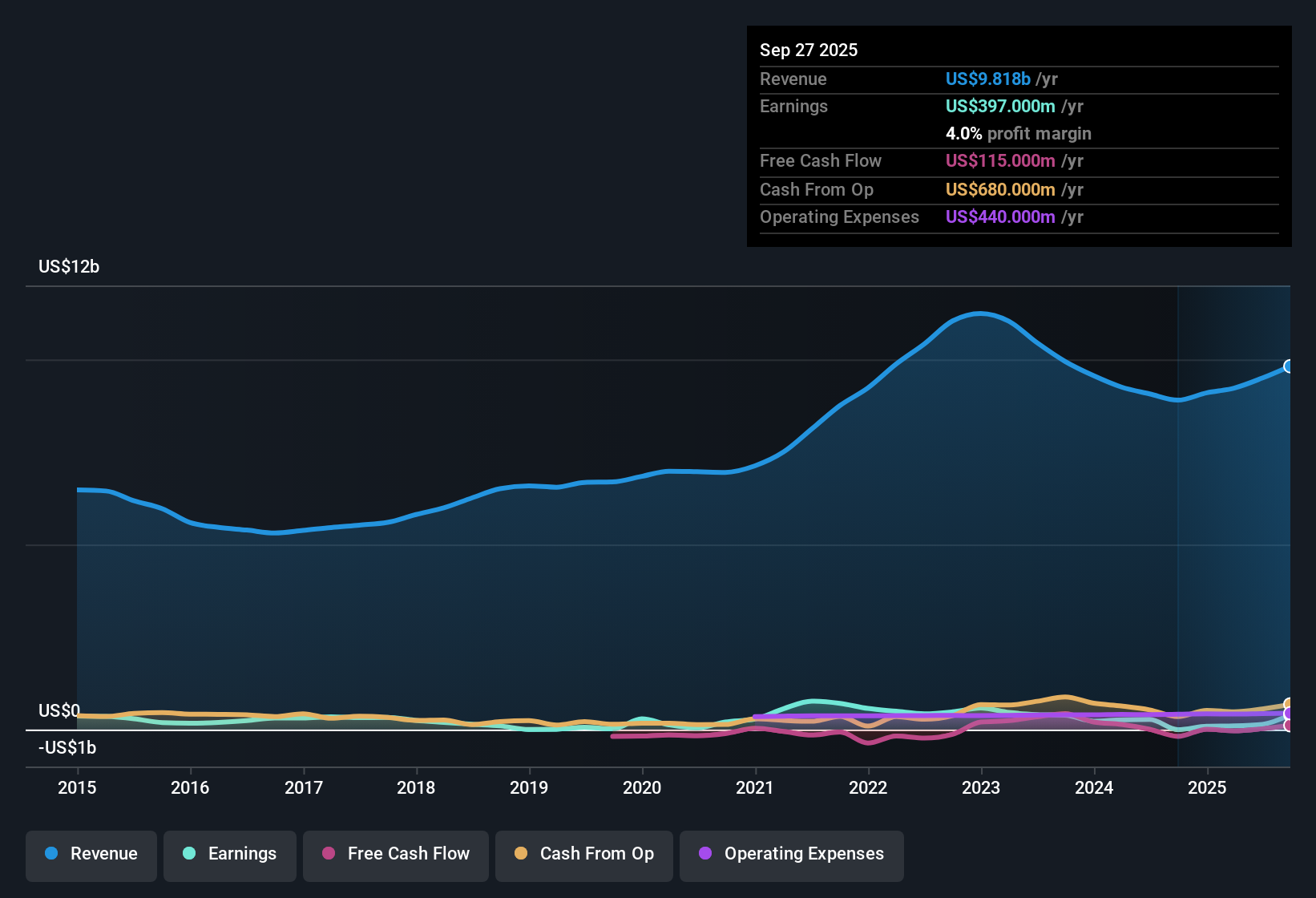

Seaboard (SEB) delivered a remarkable turnaround in its latest results, reporting a net profit margin of 4% versus just 0.01% a year earlier. Earnings growth surged 38,746.2% in the past year after five years of annual declines averaging 21.6%. Investors will find the price-to-earnings ratio of 7.8x notably cheaper than peers. Although shares currently trade at $3,218, above the estimated fair value of $1,434.52, the strong margin improvement and profit acceleration are likely to grab attention this earnings season.

See our full analysis for Seaboard.Next, we’ll see how Seaboard’s latest numbers compare to the narratives circulating among investors. This will reveal which talking points are holding up and which may need rethinking.

Curious how numbers become stories that shape markets? Explore Community Narratives

Five-Year Earnings Decline: Can Recent Surge Last?

- Despite the recent net profit margin rising to 4%, Seaboard’s five-year average annual earnings have declined by 21.6% per year. This marks a sharp contrast to this year’s outsized rebound.

- What stands out is the tension between the dramatic short-term turnaround and the persistent longer-term downtrend in profitability,

- Recent annual earnings growth of 38,746.2% is an outlier compared to the habitual multi-year drop, prompting questions about whether this improvement is the start of a new phase or simply a cyclical upswing.

- Prevailing market analysis notes that while such big reversals look promising to bulls, skeptics are likely to view it as an anomaly until there is evidence that cash flow or sustained business momentum supports the shift.

Profit Multiple Far Below Industry and Peers

- Seaboard’s price-to-earnings ratio is 7.8x, substantially under the peer average of 30.8x and the broader US Food industry’s 18.5x. This suggests value opportunities compared to rivals.

- This large valuation gap drives debate over whether the low multiple truly signals a value opportunity or confidence remains depressed due to years of weak growth,

- The prevailing view is that such a low rating attracts value-focused investors, especially since the business just posted a major profit surge, but longer-term underperformance keeps broader sentiment cautious.

- Bulls may point to the margin rebound and current cheapness as evidence of hidden upside, but critics will note that the market is demanding sustained progress before assigning a higher multiple.

Share Price Well Above DCF Fair Value

- The stock trades at $3,218, well above the estimated DCF fair value of $1,434.52. This spotlights a disconnect between market pricing and valuation models.

- This premium invites scrutiny, especially after a period of rapid profit growth,

- Prevailing market narratives stress that while the business looks attractively valued on earnings multiples, buyers at current market price are assuming a sharp and lasting turnaround, which is considered an aggressive bet given the weak five-year track record.

- Others highlight that upside could quickly fade if next year’s numbers revert to the old downtrend, making it essential for investors to watch for signs of sustained improvement in the core business.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Seaboard's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Seaboard’s dramatic short-term earnings rebound, its five-year history of persistent profits decline and trading above fair value indicate potential volatility.

If you want companies with stronger records of growing earnings and steady results, check out stable growth stocks screener (2120 results) to spot those built for consistency and resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:SEB

Seaboard

Operates in agricultural, energy, and ocean transportation business worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives